A US slowdown Federal Reserve launched its most aggressive monetary tightening in decades

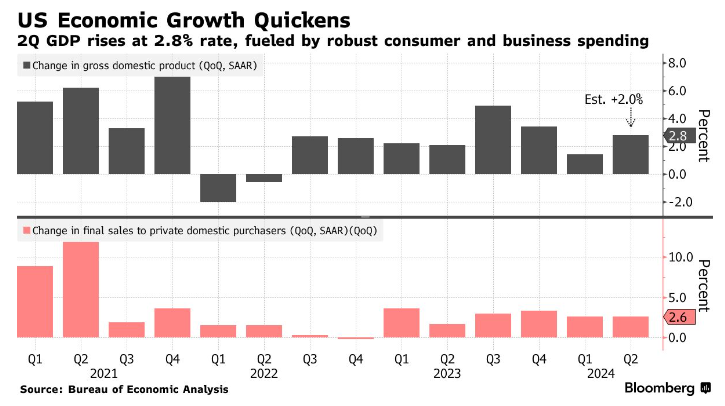

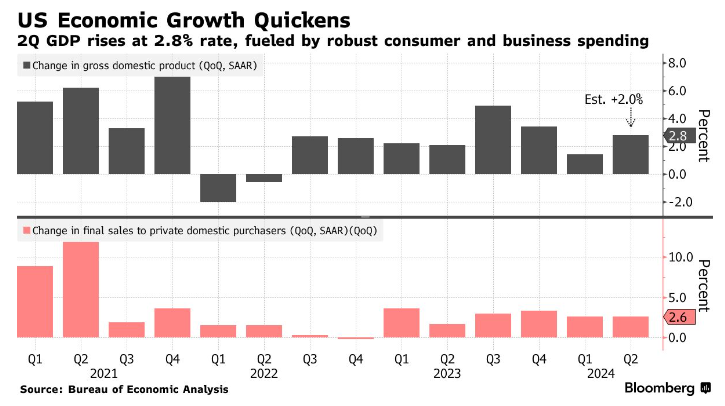

Just over two years after the Federal Reserve launched its most aggressive monetary tightening in decades, the US economy just clocked a growth rate that's essentially a full percentage point above its longer-term trend.

The 2.8% GDP gain in the second quarter trounced economists' median forecast for 2%, and marked an acceleration from the 1.4% posted for the first three months of this year. The biggest driver: personal spending, as consumers shelled out for new cars and furniture.

Coming after a particular nervy day for investors on Wall Street, Thursday's report declared the economy to be doing just fine.

But there's more to the story.

Looking under the hood, economists are starting to ask whether conditions are really as good as the data suggests — given the warning signals that leading indicators have been sending for months, as this newsletter flagged earlier this week.

The labor market has been cooling, with the jobless rate rising.

Real estate is trapped by high borrowing costs, as the drop in June new home sales showcased Wednesday.

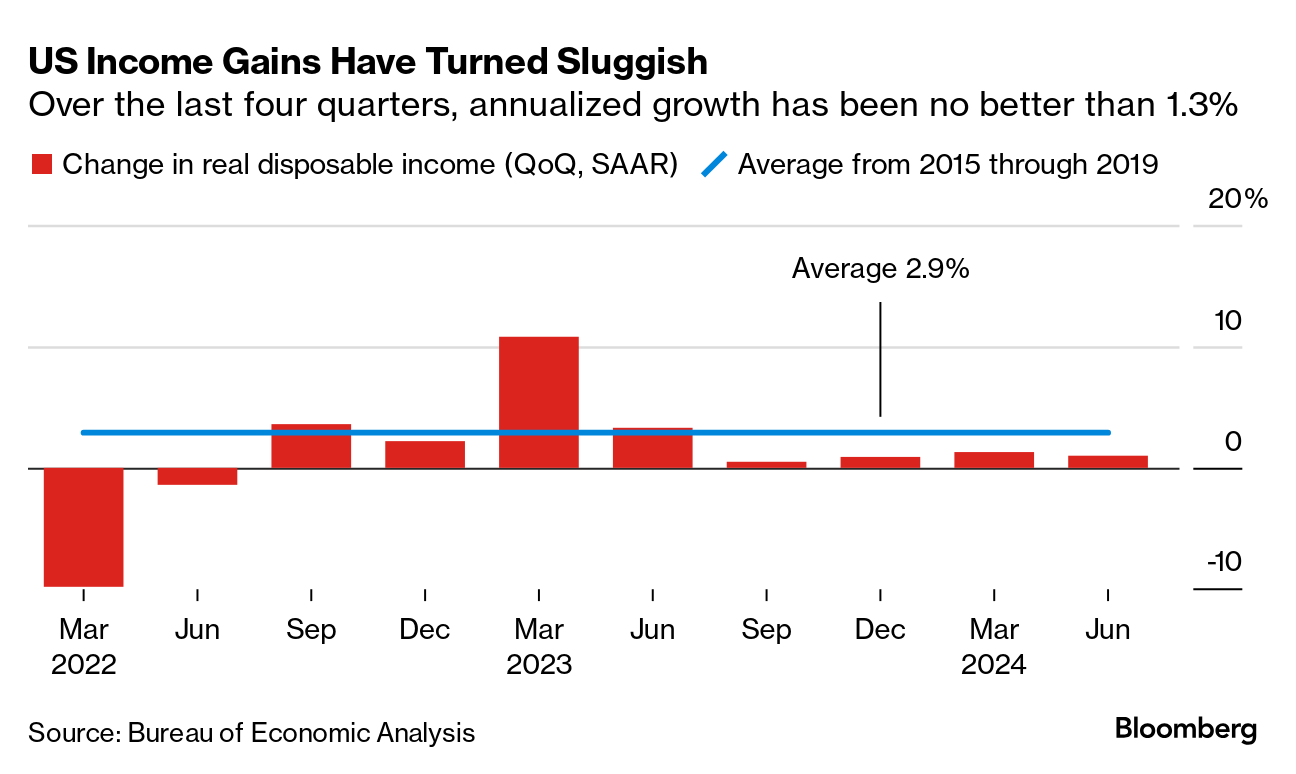

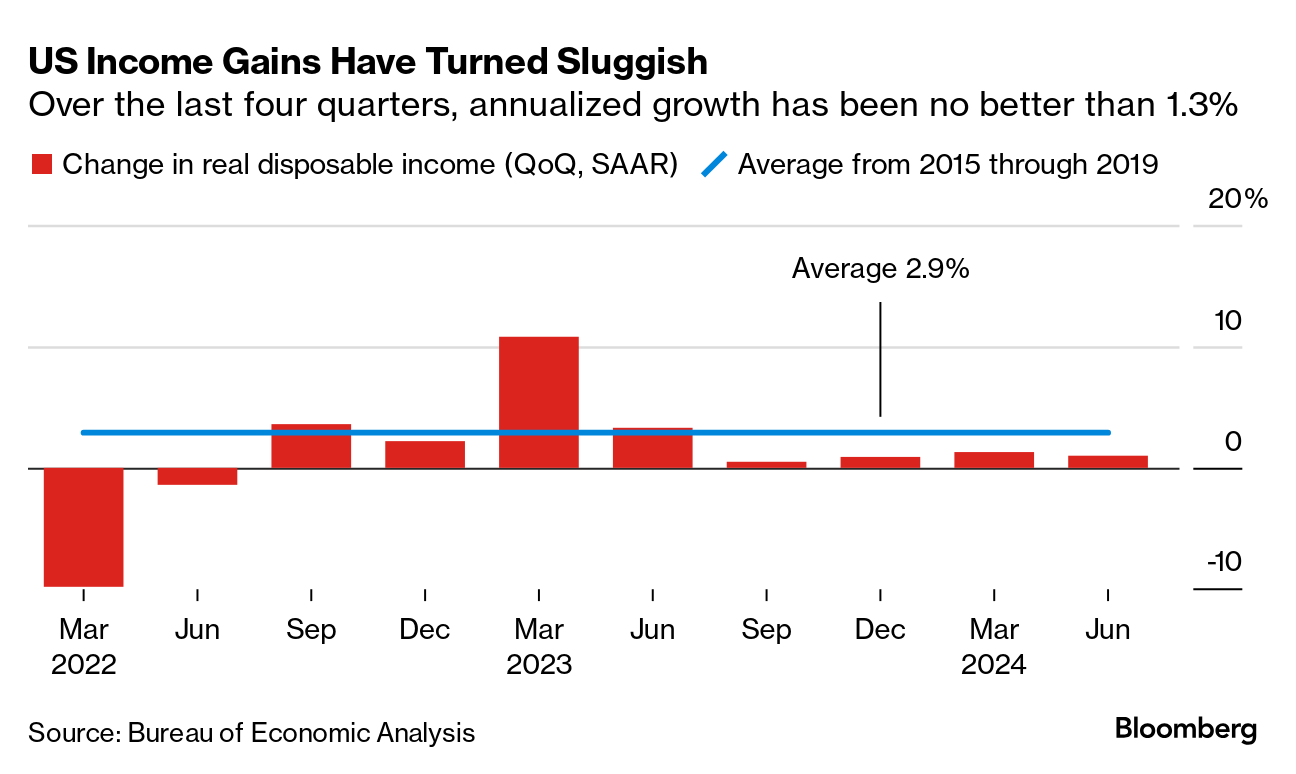

Personal incomes, after adjusting for inflation, have been rising at a notably weaker pace even than the pre-pandemic period, as the chart below illustrates:

"The overall slope of the data doesn't feel like it's consistent" with the demand on display in the GDP report, according to Renaissance Macro Research's Neil Dutta.

He's not alone in expressing caution.

There's a notable gap between apparently solid data and deteriorating consumer sentiment. And prominent voices including former New York Fed President William Dudley and former Pimco CEO Mohamed El-Erian — both of them current Bloomberg Opinion contributors — are among those calling for the Fed to lower interest rates.

Yet the outwardly strong GDP growth figure will, if anything, take pressure off the Fed to lower rates.

"It does feel like we are in this weird spot where strong data might increase the risks to the economy," according to Dutta. "If I am a business, I'm tolerating a margin squeeze now on the expectation the Fed will help stabilize demand soon. If the Fed doesn't act, then the risks build."

Need-to-Know Research

One reason why the US economy and financial markets have shown much more resilience to Fed tightening than most expected is that both are still operating under the impact of a massive excess injection of money.

"The amount of money the Fed printed was meant for a recession four times as severe as the one we actually experienced" thanks to Covid and pandemic shutdowns, Stephen Jen and Fatih Yilmaz at Eurizon SLJ Capital wrote in a note Thursday.

The duo created estimates for the demand for money using models incorporating factors including economic activity, interest rates, wealth effects and expected inflation, and used data across three decades to 2019. And the result showed that the M1 gauge of money supply vastly exceeded what was needed during the pandemic.

"Our calculations suggest that a 40% increase in M1 would have been sufficient," they wrote. "But the Fed actually increased M1 by 150% within only a few quarters."

The 2.8% GDP gain in the second quarter trounced economists' median forecast for 2%, and marked an acceleration from the 1.4% posted for the first three months of this year. The biggest driver: personal spending, as consumers shelled out for new cars and furniture.

Coming after a particular nervy day for investors on Wall Street, Thursday's report declared the economy to be doing just fine.

But there's more to the story.

Looking under the hood, economists are starting to ask whether conditions are really as good as the data suggests — given the warning signals that leading indicators have been sending for months, as this newsletter flagged earlier this week.

The labor market has been cooling, with the jobless rate rising.

Real estate is trapped by high borrowing costs, as the drop in June new home sales showcased Wednesday.

Personal incomes, after adjusting for inflation, have been rising at a notably weaker pace even than the pre-pandemic period, as the chart below illustrates:

"The overall slope of the data doesn't feel like it's consistent" with the demand on display in the GDP report, according to Renaissance Macro Research's Neil Dutta.

He's not alone in expressing caution.

There's a notable gap between apparently solid data and deteriorating consumer sentiment. And prominent voices including former New York Fed President William Dudley and former Pimco CEO Mohamed El-Erian — both of them current Bloomberg Opinion contributors — are among those calling for the Fed to lower interest rates.

Yet the outwardly strong GDP growth figure will, if anything, take pressure off the Fed to lower rates.

"It does feel like we are in this weird spot where strong data might increase the risks to the economy," according to Dutta. "If I am a business, I'm tolerating a margin squeeze now on the expectation the Fed will help stabilize demand soon. If the Fed doesn't act, then the risks build."

Need-to-Know Research

One reason why the US economy and financial markets have shown much more resilience to Fed tightening than most expected is that both are still operating under the impact of a massive excess injection of money.

"The amount of money the Fed printed was meant for a recession four times as severe as the one we actually experienced" thanks to Covid and pandemic shutdowns, Stephen Jen and Fatih Yilmaz at Eurizon SLJ Capital wrote in a note Thursday.

The duo created estimates for the demand for money using models incorporating factors including economic activity, interest rates, wealth effects and expected inflation, and used data across three decades to 2019. And the result showed that the M1 gauge of money supply vastly exceeded what was needed during the pandemic.

"Our calculations suggest that a 40% increase in M1 would have been sufficient," they wrote. "But the Fed actually increased M1 by 150% within only a few quarters."

No comments