America's LNG lure Meg O'Neill chief executive officer of Woodside Energy Group Ltd

Australia's Woodside Energy Group Ltd. made a bold leap into US liquefied natural gas with its agreement to acquire Tellurian Inc. for $900 million in cash.

Tellurian owns Driftwood, a proposed multibillion-dollar LNG export terminal in Louisiana. The takeover could make Woodside the second foreign entity to control such a facility after QatarEnergy, which holds a majority stake in the Golden Pass project.

Japanese electricity generator Jera Co. and French energy giant TotalEnergies SE hold minority stakes in other US sites.

The trend toward foreign investments is likely to continue as Woodside looks for partners to help it bear the cost of Driftwood. Saudi Aramco could be among those it courts as the petrostate looks to expand internationally.

Abu Dhabi's state oil company and Woodside's existing Japanese LNG buyers also may be contenders, said Saul Kavonic, an analyst at MST Financial Services Pty.

The primary attractions of US LNG are the flexibility to ship to either Asia or Europe, and its cheapness compared with prices in those regions. Despite the market volatility, the arbitrage opportunities can make a huge investment in American export capacity worthwhile.

The Driftwood project also offers Woodside and other prospective investors the advantage of being fully permitted while the Biden administration has placed a moratorium on approving other developments.

A final investment decision on Driftwood is expected by early next year. If all four phases are built, it could be one of the largest such plants in the US.

Still, big challenges lie in store for any effort to construct an LNG export facility. It will have to secure customer contracts, keep a lid on costs and hire construction workers at a time when the availability of skilled labor is stretched thin by expansion along the Gulf Coast.

A case in point is Texas' Golden Pass, in which QatarEnergy holds a 70% stake and Exxon Mobil Corp. the rest. The project near the Louisiana border has suffered cost overruns and multiple delays as lead contractor Zachry Holdings Inc. filed for bankruptcy in May.

For all the promises of US LNG, the trials and tribulations of that project won't escape the attention of any serious potential investor.

--Ruth Liao, Bloomberg News

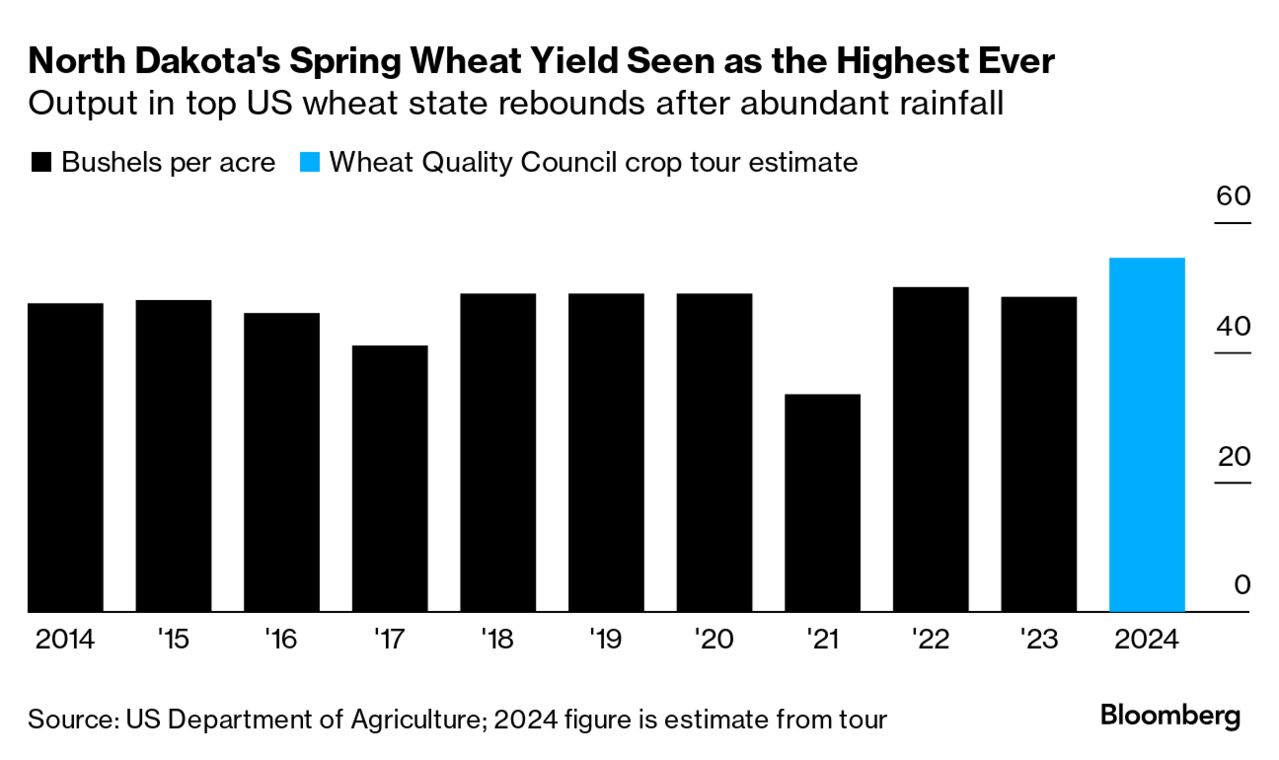

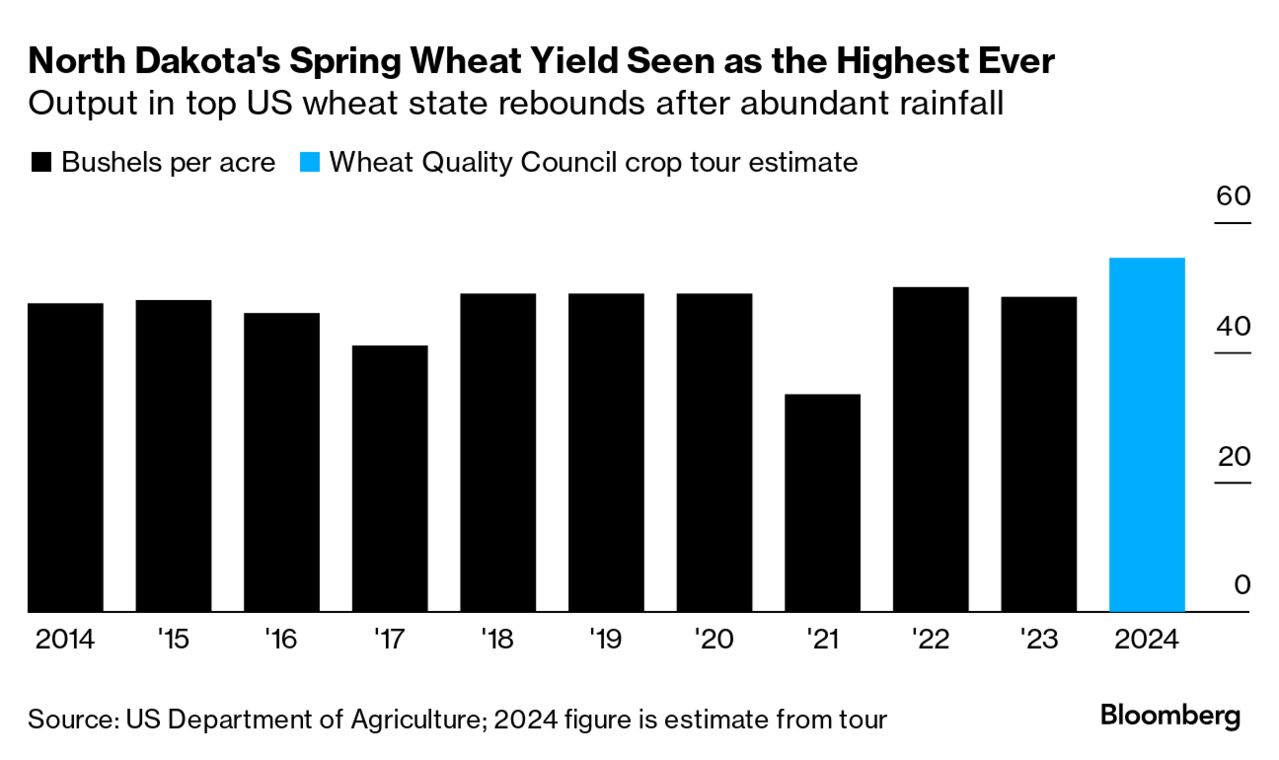

Chart of the day

Record-high wheat yields in North Dakota are set to further expand American grain supplies and should help quell food inflation. Dozens of wheat traders, millers and bakers fanned out across the fields in an annual crop tour this week. The state's primary variety should yield 54.5 bushels per acre, which would be its most ever.

Today's top stories

Oil dipped after touching a six-week low in the previous session as traders assessed lower US stockpiles and weakness in Chinese demand. Brent traded near $82 in London and was little changed for the week.

Sinochem Group Co. is in talks to sell a minority stake in the Peregrino oil and gas field off the coast of Brazil to independent producer Prio SA, according to people familiar to the matter.

Electricite de France SA may have to curb nuclear output starting July 31 as a heat wave warms a river used for cooling an atomic power station in the southwest.

Eni SpA's second-quarter profit was better than expected after a strong performance at its upstream business, prompting the company to raise its guidance for the year.

Rainfall is expected to bring some relief after a wildfire ripped through Canada's Rocky Mountain resort town of Jasper, destroying homes and businesses and threatening infrastructure in the evacuated community.

Best of the rest

Companies launch preservation projects in Brazil's Amazon region to claim carbon credits, but a Washington Post investigation finds that many of those efforts overlap with public lands, generating illegal profits.

Wind power can be a major source of tax revenue in the US, with operators being among the biggest payers, but an Associated Press analysis finds that efforts to block turbine projects are "widespread and growing."

Ammonia production is responsible for 2% of greenhouse gas emissions, and the industry is expected to grow 40% by midcentury. The Chemical Week podcast discusses the business, regulations and whether blue ammonia is actually "clean."

Tellurian owns Driftwood, a proposed multibillion-dollar LNG export terminal in Louisiana. The takeover could make Woodside the second foreign entity to control such a facility after QatarEnergy, which holds a majority stake in the Golden Pass project.

Japanese electricity generator Jera Co. and French energy giant TotalEnergies SE hold minority stakes in other US sites.

The trend toward foreign investments is likely to continue as Woodside looks for partners to help it bear the cost of Driftwood. Saudi Aramco could be among those it courts as the petrostate looks to expand internationally.

Abu Dhabi's state oil company and Woodside's existing Japanese LNG buyers also may be contenders, said Saul Kavonic, an analyst at MST Financial Services Pty.

The primary attractions of US LNG are the flexibility to ship to either Asia or Europe, and its cheapness compared with prices in those regions. Despite the market volatility, the arbitrage opportunities can make a huge investment in American export capacity worthwhile.

Meg O'Neill, chief executive officer of Woodside Energy Group Ltd., says the Tellurian deal could make her company a "global LNG powerhouse." Photographer: Philip Gostelow/Bloomberg

The Driftwood project also offers Woodside and other prospective investors the advantage of being fully permitted while the Biden administration has placed a moratorium on approving other developments.

A final investment decision on Driftwood is expected by early next year. If all four phases are built, it could be one of the largest such plants in the US.

Still, big challenges lie in store for any effort to construct an LNG export facility. It will have to secure customer contracts, keep a lid on costs and hire construction workers at a time when the availability of skilled labor is stretched thin by expansion along the Gulf Coast.

A case in point is Texas' Golden Pass, in which QatarEnergy holds a 70% stake and Exxon Mobil Corp. the rest. The project near the Louisiana border has suffered cost overruns and multiple delays as lead contractor Zachry Holdings Inc. filed for bankruptcy in May.

For all the promises of US LNG, the trials and tribulations of that project won't escape the attention of any serious potential investor.

--Ruth Liao, Bloomberg News

Chart of the day

Record-high wheat yields in North Dakota are set to further expand American grain supplies and should help quell food inflation. Dozens of wheat traders, millers and bakers fanned out across the fields in an annual crop tour this week. The state's primary variety should yield 54.5 bushels per acre, which would be its most ever.

Today's top stories

Oil dipped after touching a six-week low in the previous session as traders assessed lower US stockpiles and weakness in Chinese demand. Brent traded near $82 in London and was little changed for the week.

Sinochem Group Co. is in talks to sell a minority stake in the Peregrino oil and gas field off the coast of Brazil to independent producer Prio SA, according to people familiar to the matter.

Electricite de France SA may have to curb nuclear output starting July 31 as a heat wave warms a river used for cooling an atomic power station in the southwest.

Eni SpA's second-quarter profit was better than expected after a strong performance at its upstream business, prompting the company to raise its guidance for the year.

Rainfall is expected to bring some relief after a wildfire ripped through Canada's Rocky Mountain resort town of Jasper, destroying homes and businesses and threatening infrastructure in the evacuated community.

Best of the rest

Companies launch preservation projects in Brazil's Amazon region to claim carbon credits, but a Washington Post investigation finds that many of those efforts overlap with public lands, generating illegal profits.

Wind power can be a major source of tax revenue in the US, with operators being among the biggest payers, but an Associated Press analysis finds that efforts to block turbine projects are "widespread and growing."

Ammonia production is responsible for 2% of greenhouse gas emissions, and the industry is expected to grow 40% by midcentury. The Chemical Week podcast discusses the business, regulations and whether blue ammonia is actually "clean."

No comments