Argentina's gas growth

Argentina's Vaca Muerta, a vast shale formation often likened to the US Permian Basin, has only offered a series of false dawns in recent years.

That may be about to change.

Pan American Energy Group, half-owned by BP Plc, this month struck a 20-year deal for a floating liquefied natural gas facility on Argentina's Atlantic coast. The vessel will process shale gas for export starting in 2027.

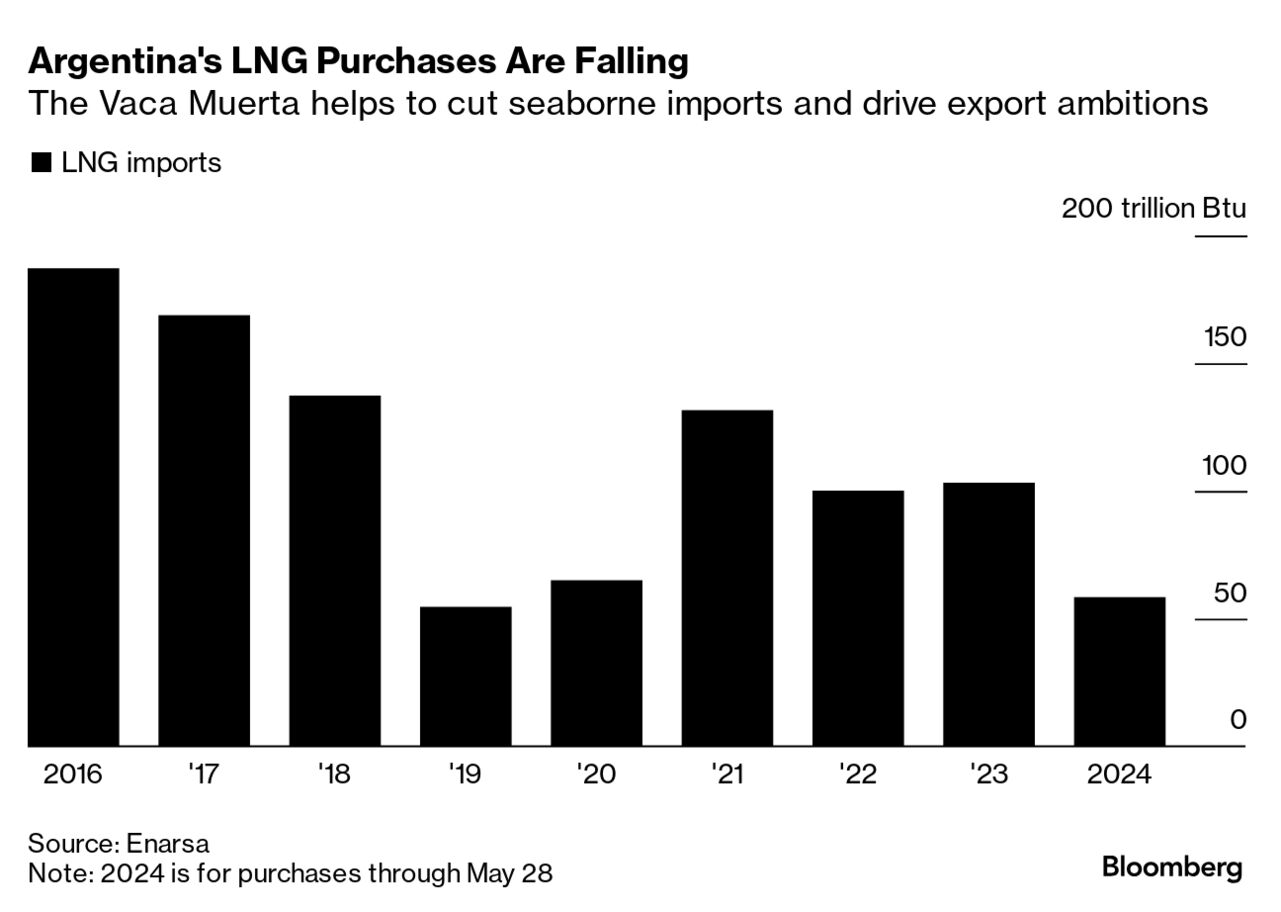

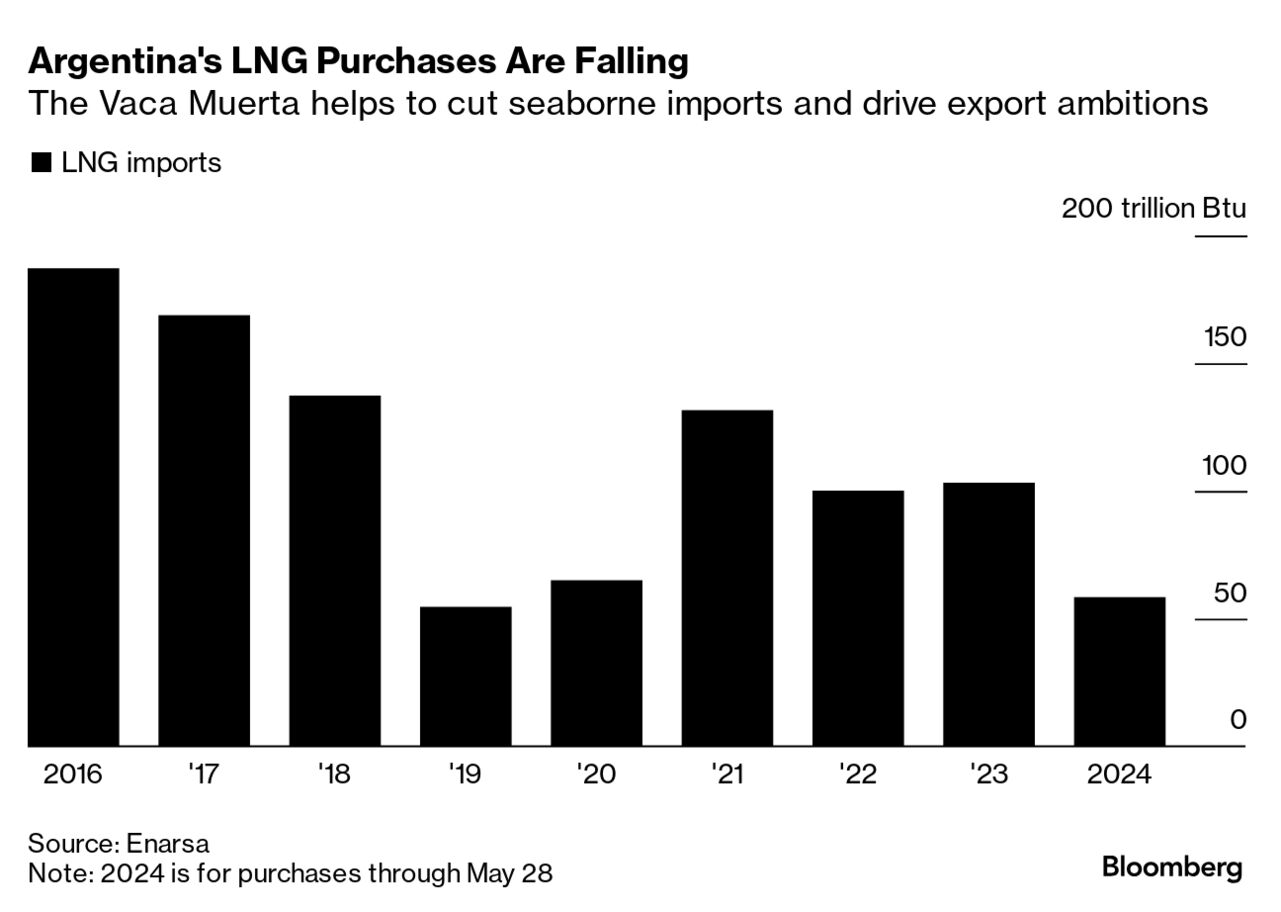

That agreement adds to the gathering momentum in the Vaca Muerta. Badly needed oil and gas pipeline infrastructure is finally being built out, allowing production to grow.

There's optimism over the business-friendly policies of President Javier Milei, whose vow to end intervention in the domestic oil market and scrap capital controls is aimed at drawing investment.

A package of tax, currency and customs benefits drafted by Milei's administration may improve the economics of fossil-fuel projects considerably. The program lays out investors' rights to use export proceeds freely, including keeping them abroad.

But a note of caution: Argentina has been here before.

Enthusiasm for its shale reserves in the past decade attracted big foreign companies such as Exxon Mobil Corp. and ConocoPhillips, only to see them exit several years later as projects failed to get off the ground.

In 2020, amid the economic and financial turmoil of the pandemic, state-run oil and gas producer YPF SA canceled a 10-year lease on a floating liquefaction plant after less than two years.

Now, the expected arrival of a new LNG vessel — adding as much as 2.5 million metric tons of the fuel a year risks swelling a potential glut.

A YPF venture with Malaysia's Petroliam Nasional Bhd. wants another floating facility in place by 2027. And from the US to the Middle East, other large producers are expanding capacity, too.

Exporters will be betting on continued growth in consumption of LNG, viewed by many as a "bridge fuel" amid the energy transition.

If global demand holds up, Argentina's ambitions for the Vaca Muerta may finally start to become a reality.

Jonathan Gilbert, Bloomberg News

That may be about to change.

Pan American Energy Group, half-owned by BP Plc, this month struck a 20-year deal for a floating liquefied natural gas facility on Argentina's Atlantic coast. The vessel will process shale gas for export starting in 2027.

That agreement adds to the gathering momentum in the Vaca Muerta. Badly needed oil and gas pipeline infrastructure is finally being built out, allowing production to grow.

There's optimism over the business-friendly policies of President Javier Milei, whose vow to end intervention in the domestic oil market and scrap capital controls is aimed at drawing investment.

A package of tax, currency and customs benefits drafted by Milei's administration may improve the economics of fossil-fuel projects considerably. The program lays out investors' rights to use export proceeds freely, including keeping them abroad.

But a note of caution: Argentina has been here before.

Enthusiasm for its shale reserves in the past decade attracted big foreign companies such as Exxon Mobil Corp. and ConocoPhillips, only to see them exit several years later as projects failed to get off the ground.

In 2020, amid the economic and financial turmoil of the pandemic, state-run oil and gas producer YPF SA canceled a 10-year lease on a floating liquefaction plant after less than two years.

Now, the expected arrival of a new LNG vessel — adding as much as 2.5 million metric tons of the fuel a year risks swelling a potential glut.

A YPF venture with Malaysia's Petroliam Nasional Bhd. wants another floating facility in place by 2027. And from the US to the Middle East, other large producers are expanding capacity, too.

Exporters will be betting on continued growth in consumption of LNG, viewed by many as a "bridge fuel" amid the energy transition.

If global demand holds up, Argentina's ambitions for the Vaca Muerta may finally start to become a reality.

Jonathan Gilbert, Bloomberg News

No comments