Beyond Kuznets

When the Great Depression ravaged the US in the 1930s, America's policy makers had no way of comprehensively measuring just how bad the economic damage was.

They asked Simon Kuznets of the National Bureau of Economic Research to develop a data set that would gauge the health of their vast nation. The Gross National Product and later Gross Domestic Product were thus born.

Simon Kuznets Photographer: AFP via Getty Images

Simon Kuznets Photographer: AFP via Getty Images

Today, policymakers the world over rely on GDP to gauge economic health. Global bodies like the World Bank use it to rank countries, measure their progress and gauge their ability to pay back loans. Markets hang on quarterly updates. And voters tend to kick out their governments if they can't deliver numbers big enough to show they're doing a good job.

China — after decades of chasing and usually beating lofty GDP targets — is now seeking to break its addiction to Kuznets's formulation.

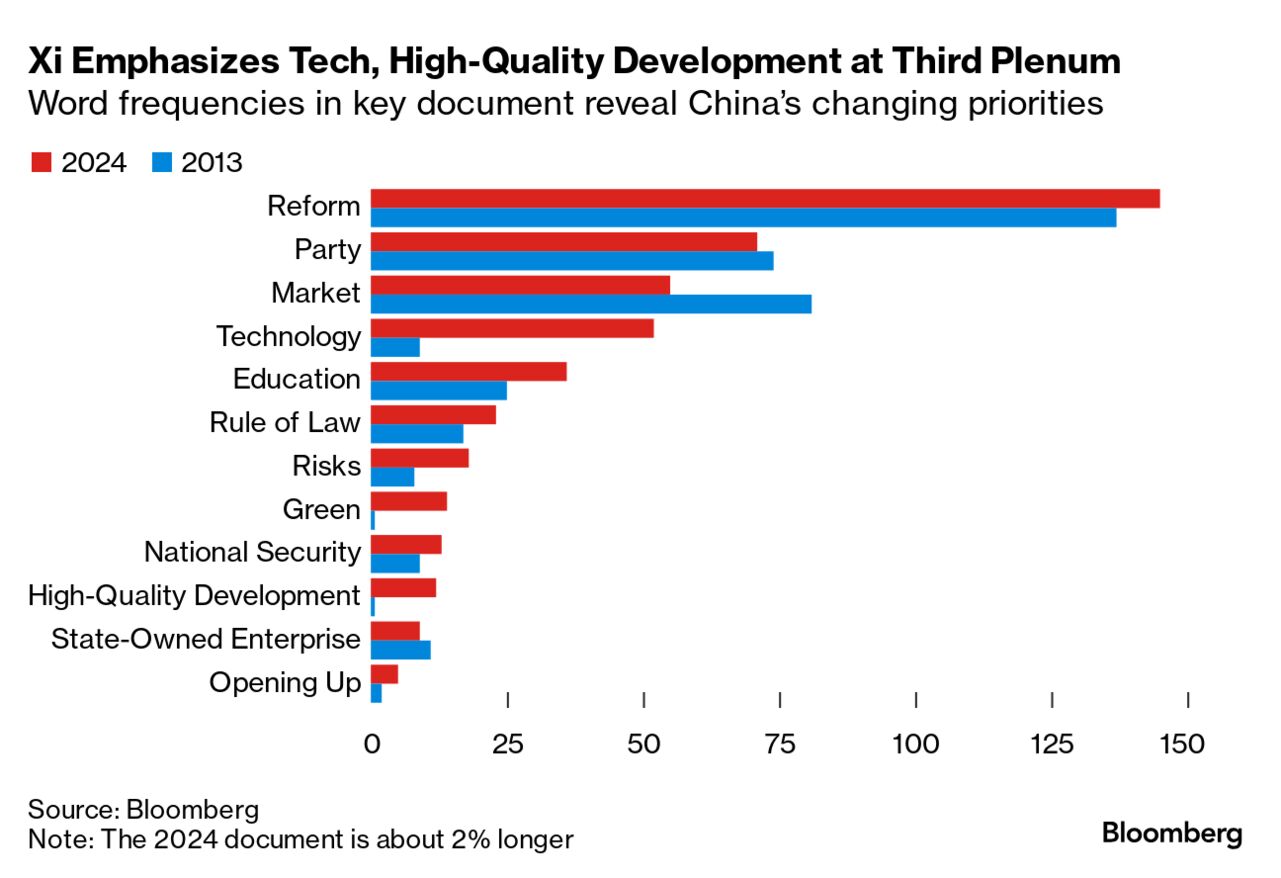

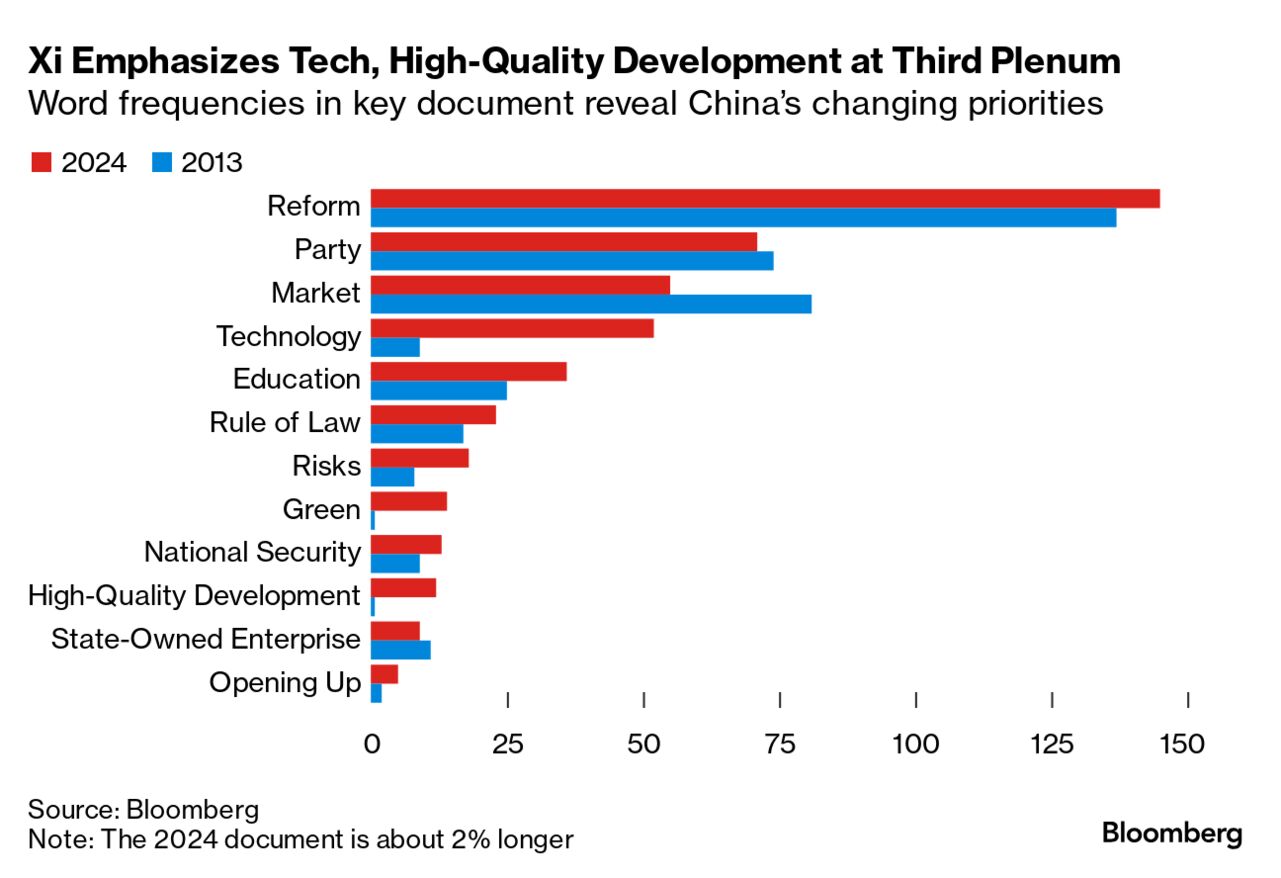

President Xi Jinping has been imploring his Communist cadres and the nation to focus instead on "high-quality" growth that's greener, requires less debt and is driven by technological advances.

Last week, as we previewed the once-every-five-year Third Plenum, we wrote about Xi's ambition to rewire the economy. And sure enough, the official read out after the four-day meeting stressed that "high-quality development is the top mission of building a modern socialist country."

That vague slogan is typically interpreted to emphasize the quality of economic growth over its absolute pace. Problem is, no one quite knows how to measure whether the new goals are being met or not.

Often, that's because the goals are more about what not to do than what to do — don't pollute, don't use excessive debt. Other times, it's because the new goals are vague or conflicting — the government's promotion of "common prosperity," for example, has led to unexpected industry crackdowns that wiped out wealth and jobs.

Now, across provincial governments, the central government bureaucracy, government-linked think tanks and private economists, there's a push to come up with a way to measure just what "high quality" growth looks like.

Among provincial efforts:

Jiangsu's gauge contains elements such as manufacturing value added as a percentage of GDP, the urbanization rate, percentage of loans to small firms, residents' disposable income, R&D expenses and air pollution.

Hunan has a measuring framework that contains 34 metrics.

Guangdong is working on a framework with some 41 metrics that include things like the number of patents, water quality and social benefits.

While there's no uniform definition of what "high quality" growth is, it's becoming clearer that while ever China continues to make progress on upgrading its economy, the kind of reflexive all-out stimulus of the past just to hit a specific GDP number is unlikely to happen this time around.

Instead, there'll be incremental steps, such as a modest cut to a key short-term policy rate, and structural moves, including plans to bolster the finances of indebted local governments, announced Sunday.

The Third Plenum "has clearly not been a game changer in terms of the reforms announced," said Alicia Garcia Herrero, chief Asia Pacific economist at Natixis. "It seems as if the Chinese authorities prefer to muddle through while doubling down on their convictions. The problem is that there by now much more mud to deal with."

The Best of Bloomberg Economics

European Central Bank policymakers say there's no rush on a next move.

UK Chancellor Rachel Reeves is facing growing demands to loosen the Treasury's purse strings to raise pay for public sector workers.

India's budget is expected to curb the fiscal deficit, while still cutting taxes and boosting welfare spending. The government already set a fairly conservative economic growth forecast for the current fiscal year.

A key US regulator has privately found half of the major banks it oversees have an inadequate grasp of a broad swath of potential risks.

Bigger debt loads and erratic politics are haunting bond markets.

The Week Ahead

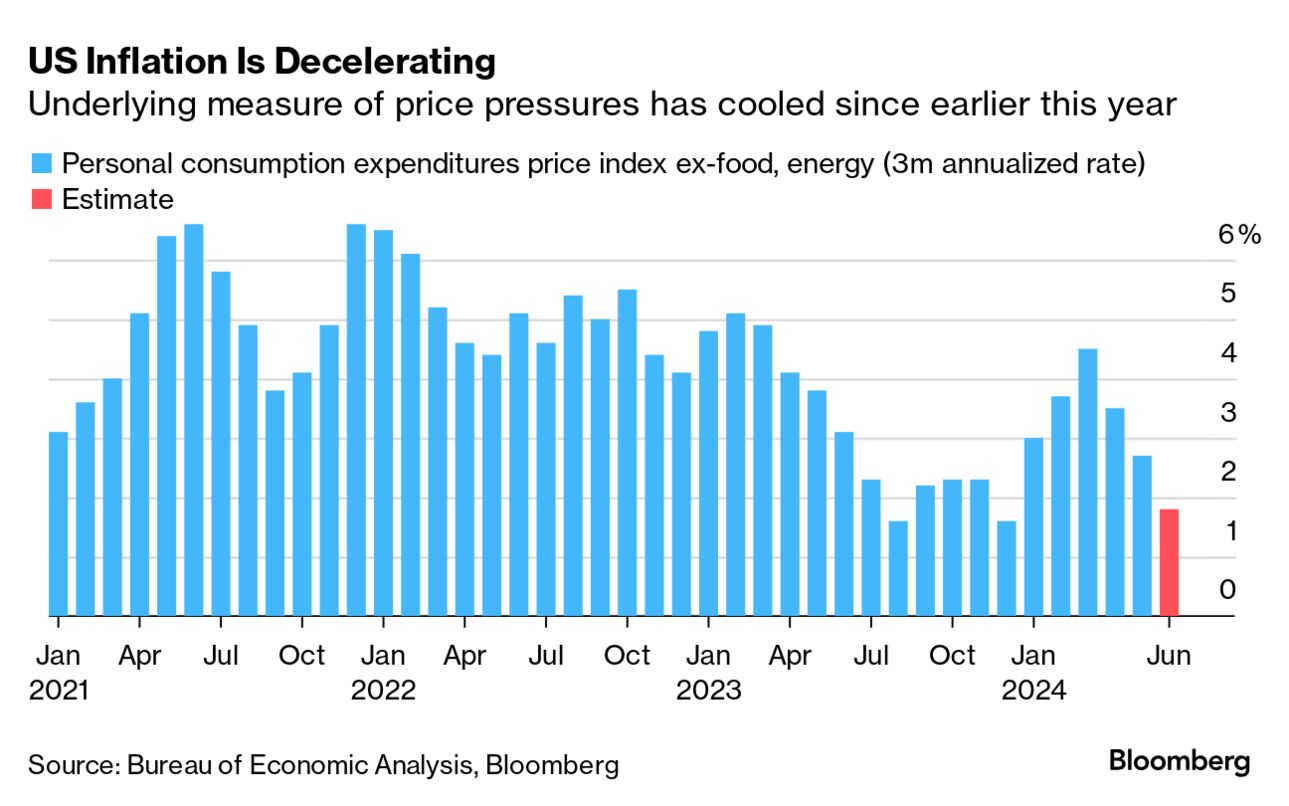

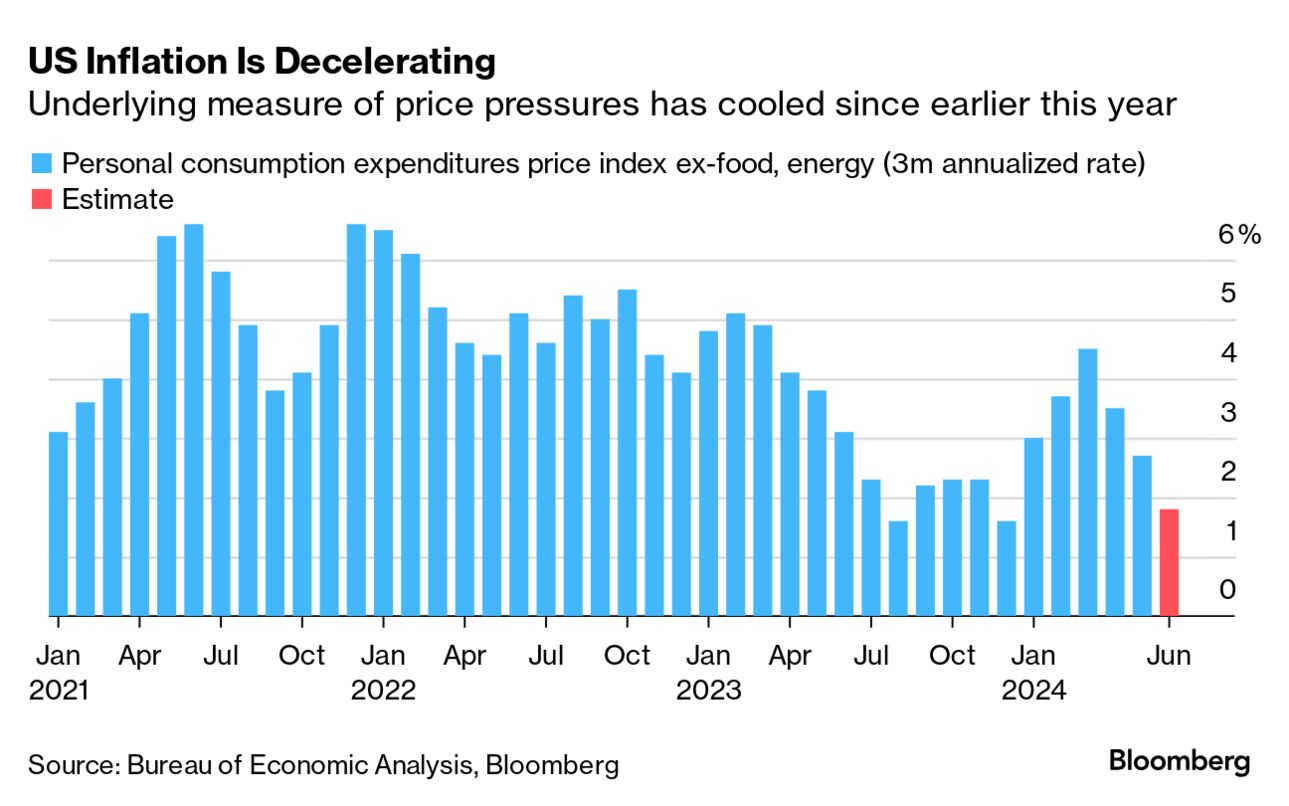

The runway for a Federal Reserve rate cut will come more into focus this week with fresh signs inflation is abating and economic activity is simmering down.

Economists expect the personal consumption expenditures price index minus food and energy — due on Friday — to rise 0.1% in June for a second straight month. That would bring three-month annualized core inflation down to the slowest pace this year and below the Fed's 2% target.

The busy US economic data calendar includes separate reports on June sales of previously owned and new homes. Economists project a moderate increase in new-home purchases and a fourth-straight decline in contract closings on existing properties.

Elsewhere, Group of 20 finance ministers and central bank chiefs will gather for two days of meetings in Rio de Janeiro, purchasing manager surveys will be released from Japan to the UK, and central banks from Canada to Turkey to Russia to Nigeria will set rates.

See here for the rest of the week's economic events.

Need-to-Know Research

The rise in the US unemployment rate has reached, or approached, a magnitude to trigger "rules" that dictate a recession is looming. While there are "good reasons why this time might be different," it would be unwise to dismiss the signals, JPMorgan Chase's Michael Feroli says.

The so-called Sahm rule is when the three-month average unemployment rate is 0.5 percentage point above the lows hit over the previous 12 months. We're now at 0.46. Ex-New York Fed President Bill Dudley's separate measure, which compares the jobless rate with the overall cyclical low, has already been hit, notes Feroli, JPMorgan's chief US economist.

Source: Bureau of Labor Statistics, JPMorgan Chase

Labor hoarding in the wake of the pandemic could affect today's situation, though the record suggests that job-finding probability is more important than layoffs in driving the jobless rate, Feroli wrote in a note last week. "The historical record here and abroad argues against complacency," he wrote. "Particularly as long as hiring rates are trending lower."

They asked Simon Kuznets of the National Bureau of Economic Research to develop a data set that would gauge the health of their vast nation. The Gross National Product and later Gross Domestic Product were thus born.

Today, policymakers the world over rely on GDP to gauge economic health. Global bodies like the World Bank use it to rank countries, measure their progress and gauge their ability to pay back loans. Markets hang on quarterly updates. And voters tend to kick out their governments if they can't deliver numbers big enough to show they're doing a good job.

China — after decades of chasing and usually beating lofty GDP targets — is now seeking to break its addiction to Kuznets's formulation.

President Xi Jinping has been imploring his Communist cadres and the nation to focus instead on "high-quality" growth that's greener, requires less debt and is driven by technological advances.

Last week, as we previewed the once-every-five-year Third Plenum, we wrote about Xi's ambition to rewire the economy. And sure enough, the official read out after the four-day meeting stressed that "high-quality development is the top mission of building a modern socialist country."

That vague slogan is typically interpreted to emphasize the quality of economic growth over its absolute pace. Problem is, no one quite knows how to measure whether the new goals are being met or not.

Often, that's because the goals are more about what not to do than what to do — don't pollute, don't use excessive debt. Other times, it's because the new goals are vague or conflicting — the government's promotion of "common prosperity," for example, has led to unexpected industry crackdowns that wiped out wealth and jobs.

Now, across provincial governments, the central government bureaucracy, government-linked think tanks and private economists, there's a push to come up with a way to measure just what "high quality" growth looks like.

Among provincial efforts:

Jiangsu's gauge contains elements such as manufacturing value added as a percentage of GDP, the urbanization rate, percentage of loans to small firms, residents' disposable income, R&D expenses and air pollution.

Hunan has a measuring framework that contains 34 metrics.

Guangdong is working on a framework with some 41 metrics that include things like the number of patents, water quality and social benefits.

While there's no uniform definition of what "high quality" growth is, it's becoming clearer that while ever China continues to make progress on upgrading its economy, the kind of reflexive all-out stimulus of the past just to hit a specific GDP number is unlikely to happen this time around.

Instead, there'll be incremental steps, such as a modest cut to a key short-term policy rate, and structural moves, including plans to bolster the finances of indebted local governments, announced Sunday.

The Third Plenum "has clearly not been a game changer in terms of the reforms announced," said Alicia Garcia Herrero, chief Asia Pacific economist at Natixis. "It seems as if the Chinese authorities prefer to muddle through while doubling down on their convictions. The problem is that there by now much more mud to deal with."

The Best of Bloomberg Economics

European Central Bank policymakers say there's no rush on a next move.

UK Chancellor Rachel Reeves is facing growing demands to loosen the Treasury's purse strings to raise pay for public sector workers.

India's budget is expected to curb the fiscal deficit, while still cutting taxes and boosting welfare spending. The government already set a fairly conservative economic growth forecast for the current fiscal year.

A key US regulator has privately found half of the major banks it oversees have an inadequate grasp of a broad swath of potential risks.

Bigger debt loads and erratic politics are haunting bond markets.

The Week Ahead

The runway for a Federal Reserve rate cut will come more into focus this week with fresh signs inflation is abating and economic activity is simmering down.

Economists expect the personal consumption expenditures price index minus food and energy — due on Friday — to rise 0.1% in June for a second straight month. That would bring three-month annualized core inflation down to the slowest pace this year and below the Fed's 2% target.

The busy US economic data calendar includes separate reports on June sales of previously owned and new homes. Economists project a moderate increase in new-home purchases and a fourth-straight decline in contract closings on existing properties.

Elsewhere, Group of 20 finance ministers and central bank chiefs will gather for two days of meetings in Rio de Janeiro, purchasing manager surveys will be released from Japan to the UK, and central banks from Canada to Turkey to Russia to Nigeria will set rates.

See here for the rest of the week's economic events.

Need-to-Know Research

The rise in the US unemployment rate has reached, or approached, a magnitude to trigger "rules" that dictate a recession is looming. While there are "good reasons why this time might be different," it would be unwise to dismiss the signals, JPMorgan Chase's Michael Feroli says.

The so-called Sahm rule is when the three-month average unemployment rate is 0.5 percentage point above the lows hit over the previous 12 months. We're now at 0.46. Ex-New York Fed President Bill Dudley's separate measure, which compares the jobless rate with the overall cyclical low, has already been hit, notes Feroli, JPMorgan's chief US economist.

Source: Bureau of Labor Statistics, JPMorgan Chase

Labor hoarding in the wake of the pandemic could affect today's situation, though the record suggests that job-finding probability is more important than layoffs in driving the jobless rate, Feroli wrote in a note last week. "The historical record here and abroad argues against complacency," he wrote. "Particularly as long as hiring rates are trending lower."

No comments