China’s plenum

With the world's eyes fixed on the very public and ultra-partisan drama of US presidential politics this week, the staid and opaque gathering of China's top officials in Beijing could hardly be more of a contrast.

Behind closed doors, Xi Jinping and around 200 of his top Communist cadres will map out long-term plans for the economy in a once-every-five-year meeting known as the Third Plenum. Importantly, it's a political rather than policy meeting, so don't expect specific stimulus measures to boost China's faltering economy.

Instead, it'll be broad brush strokes on the nation's long-term direction.

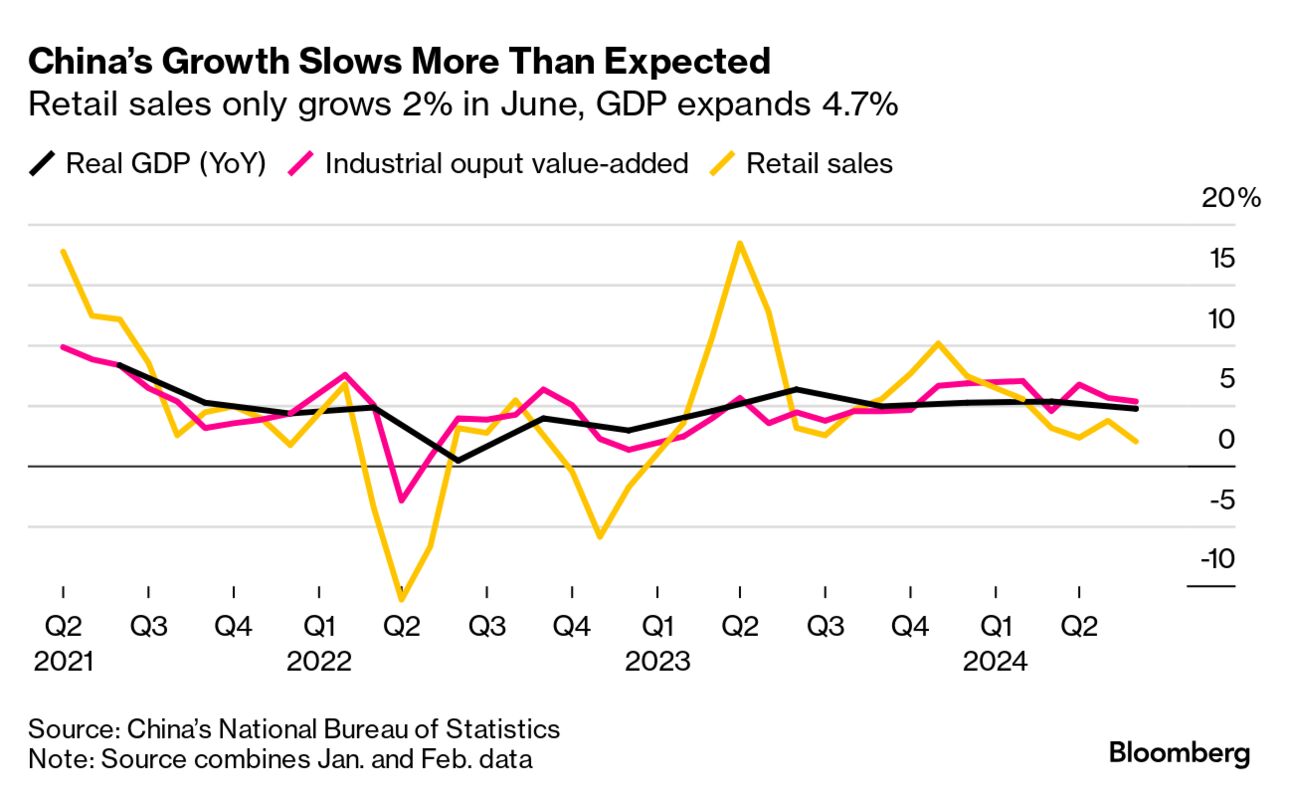

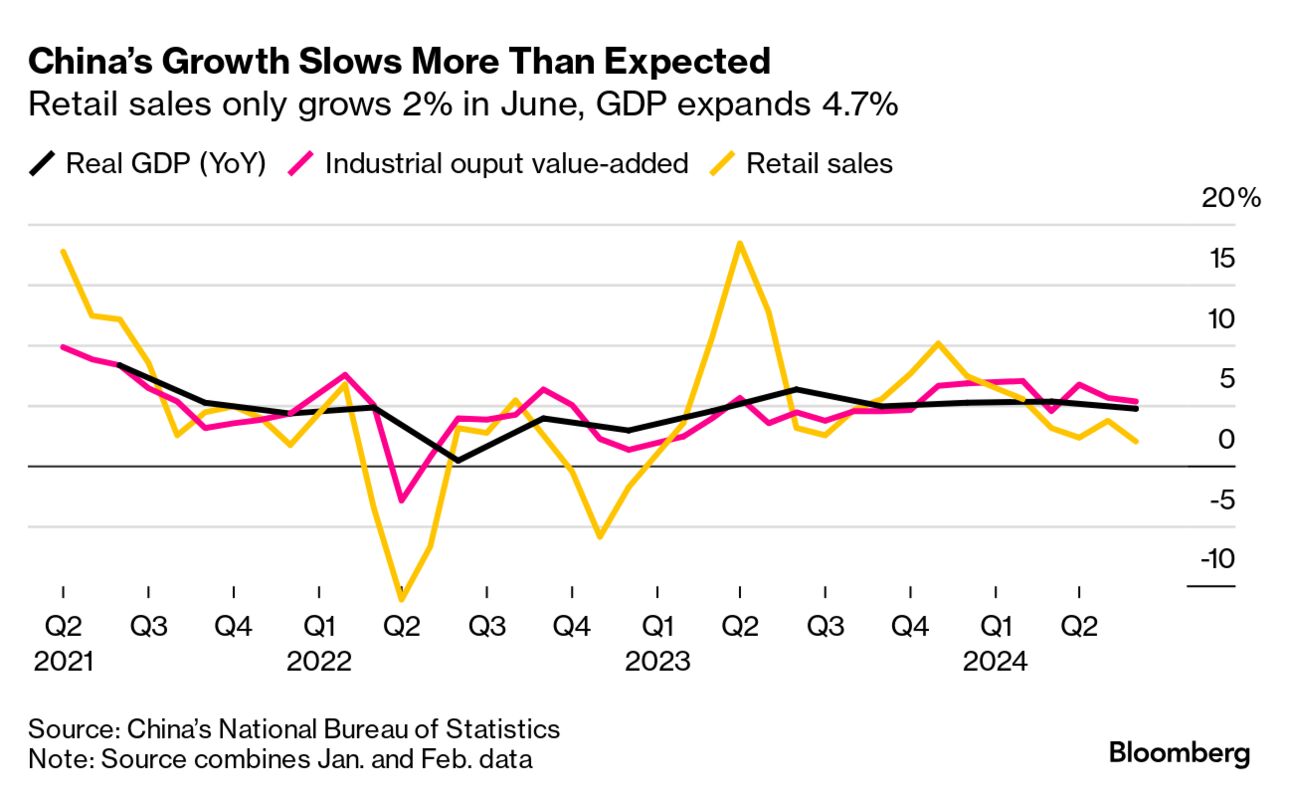

"It will provide signals on how China plans to cultivate new long-term growth drivers, get more traction from stimulus and deal with a range of challenges - from a housing crash and increasing barriers to foreign markets and critical technologies, to stiff demographic headwinds," Bloomberg Economics's Chang Shu and Eric Zhu wrote in a preview of the July 15-18 gathering.

Goldman Sachs economists led by Andrew Tilton expect the reform focus at will be on "containing left-tail risks" and "growing right-tail potential" for China in the "post-property era." These may include fiscal and financial reforms to contain financial risks and prevent spillovers from the property downturn, and support for emerging industries and urbanization to boost China's long-term growth, the economists wrote.

Xi is pushing for an overhaul of China's growth model away from debt-fueled and polluting high-speed expansions to leaner, greener "high-quality growth." It's a push that has strategic implications — China wants to ensure it develops self sufficiency in key technologies so it can't be frozen out if tensions with the US worsen, either economically or militarily.

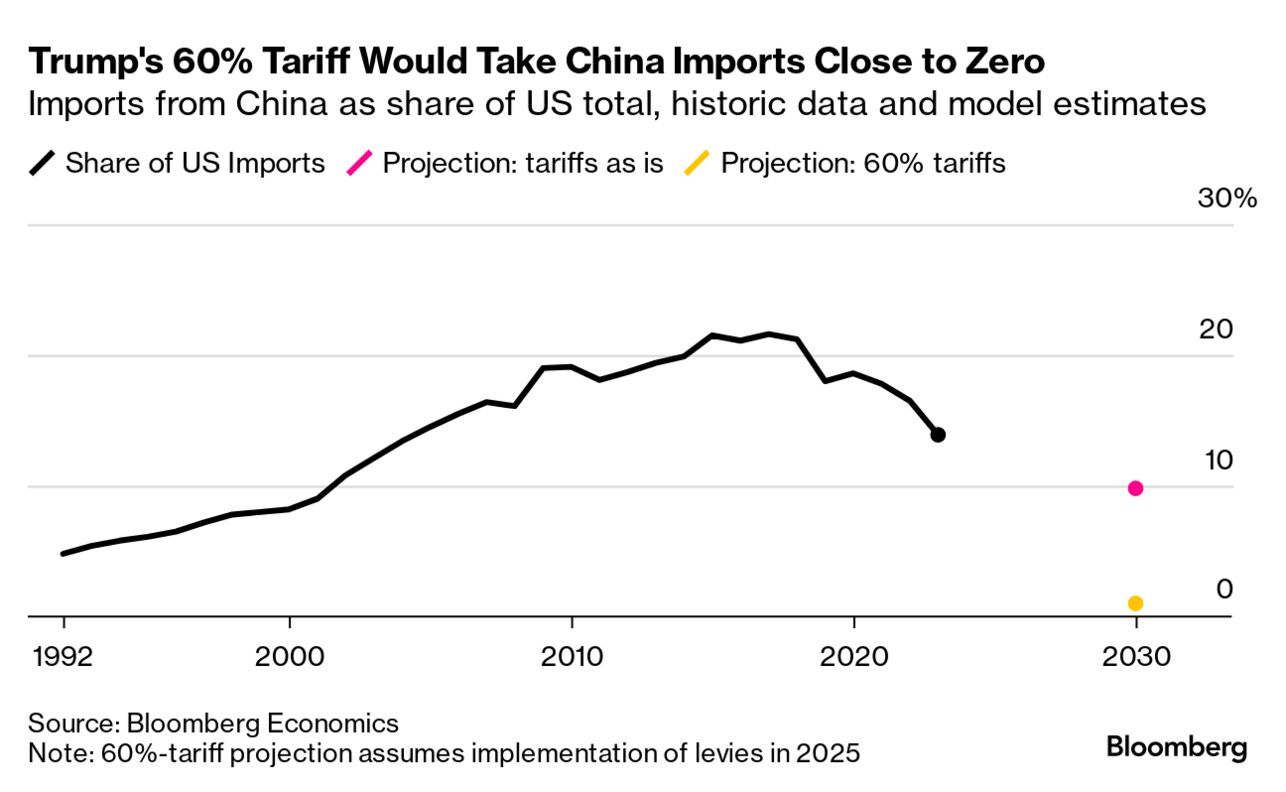

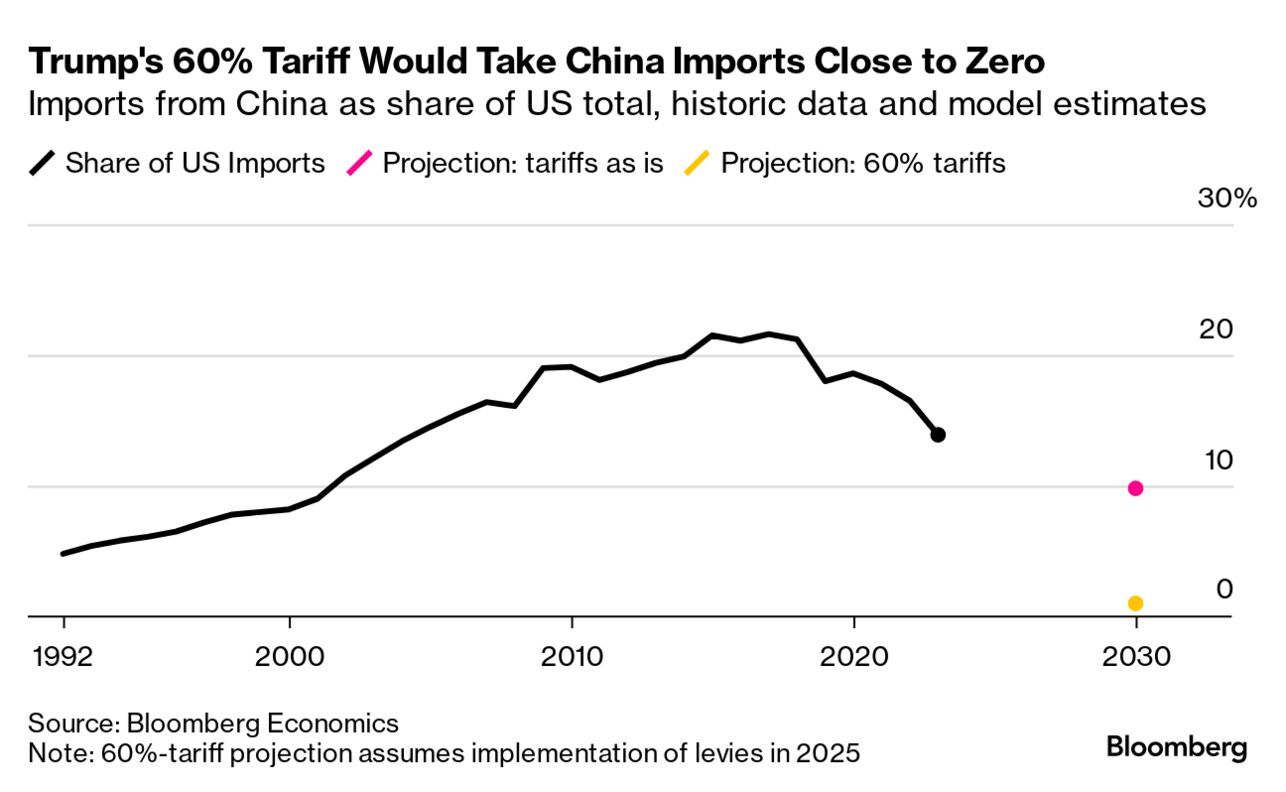

That makes events across the Pacific critical for China's leaders. Donald Trump's fist-clenching emergence from the weekend's assassination attempt raised the odds of his reelection, political analysts say. And that makes the 60% tariffs he has threatened on Chinese goods more likely too — though of course a lot can change between now and November.

Tariffs of 60% would slam Chinese shipments to the US down to almost zero, a Bloomberg Economics analysis showed in February.

The increased threat of a second Trump presidency and Monday's weaker-than-expected economic data add urgency to Beijing's efforts this week to map out a path toward long-term and balanced economic growth.

"The focus of the 3rd Plenum will be on elaborating the notion of 'Chinese modernization,' the signature ideology and source of legitimacy for the current regime," says Macquarie Group China economist Larry Hu.

The Week Ahead

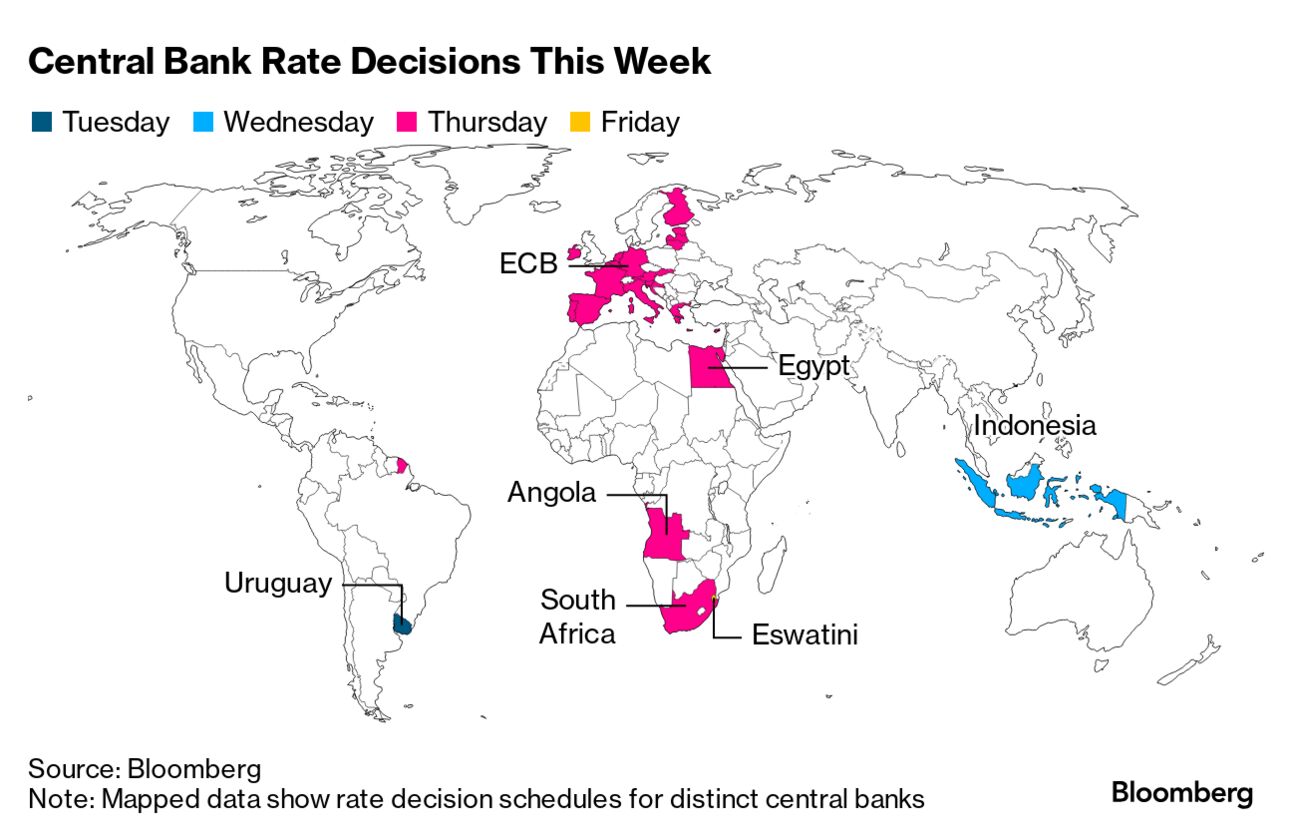

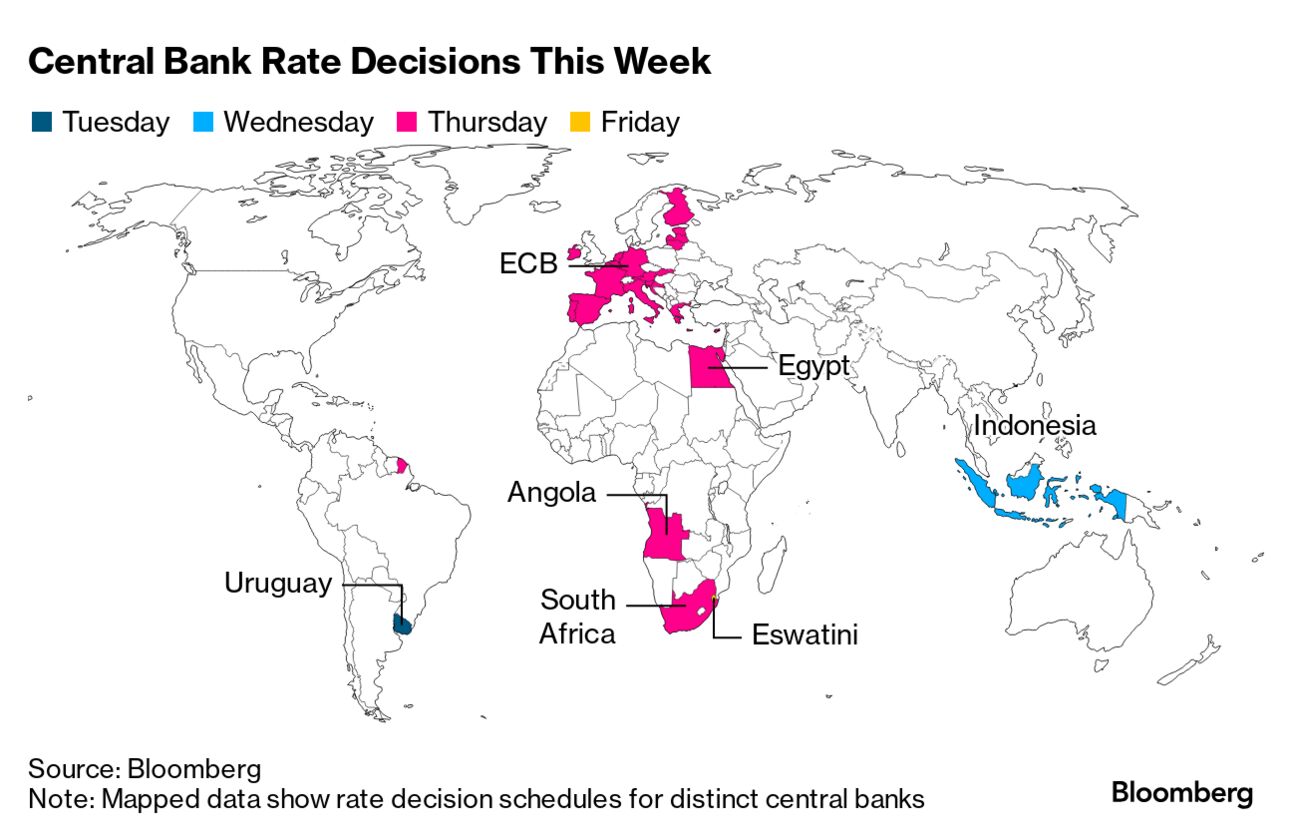

ECB officials may be about to prime investors for another rate cut, though only after one of the longest-ever summer breaks between decisions.

With a move on Thursday effectively ruled out as policymakers take time to assess the strength of lingering inflation pressures, traders are likely to watch closely for any clues offered by President Christine Lagarde on prospects for the Sept. 12 meeting.

By then, the ECB will have seen two more monthly consumer-price readings, and have newly-compiled forecasts in hand as well. Several policymakers have stated a preference for acting at such quarterly occasions when fresh projections are available.

Elsewhere, reports that may show declining US retail sales and decelerating inflation in the UK and Canada, along with rate meetings in Indonesia, Egypt and South Africa, are among the highlights. Investors will also scour new economic forecasts from the IMF.

See here for the rest of the week's economic events.

Need-to-Know Research

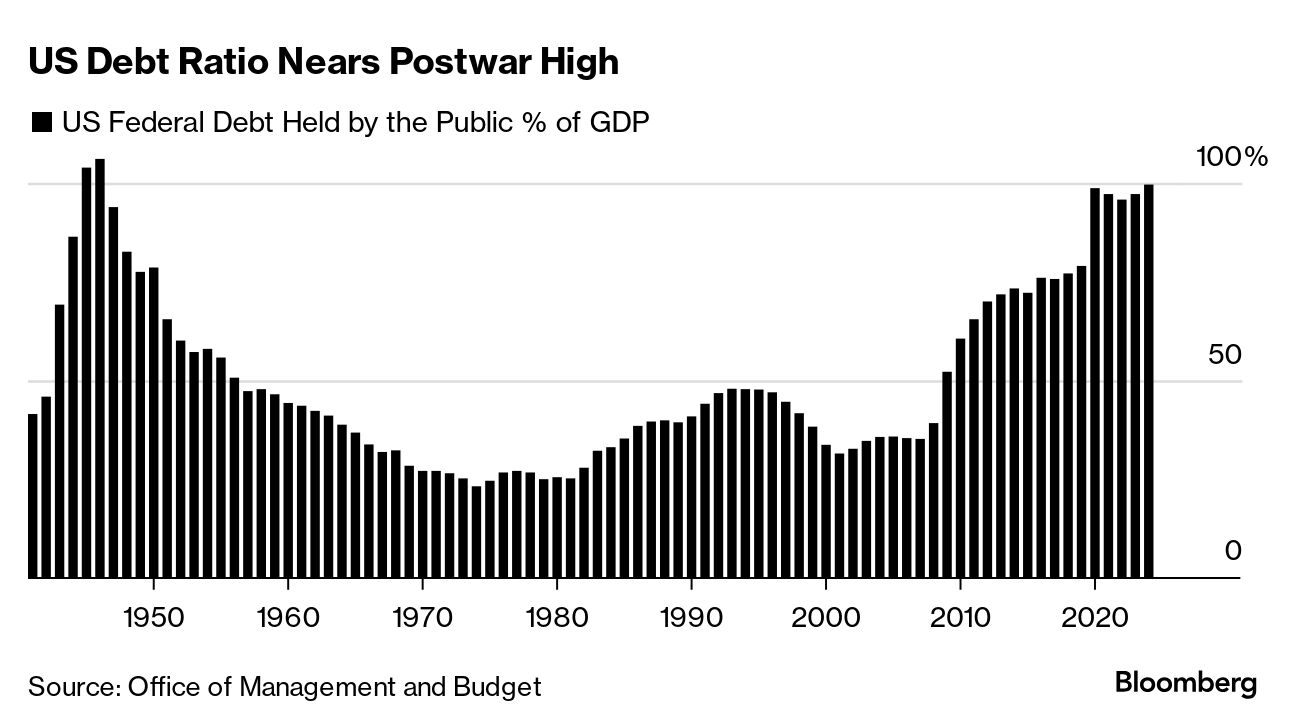

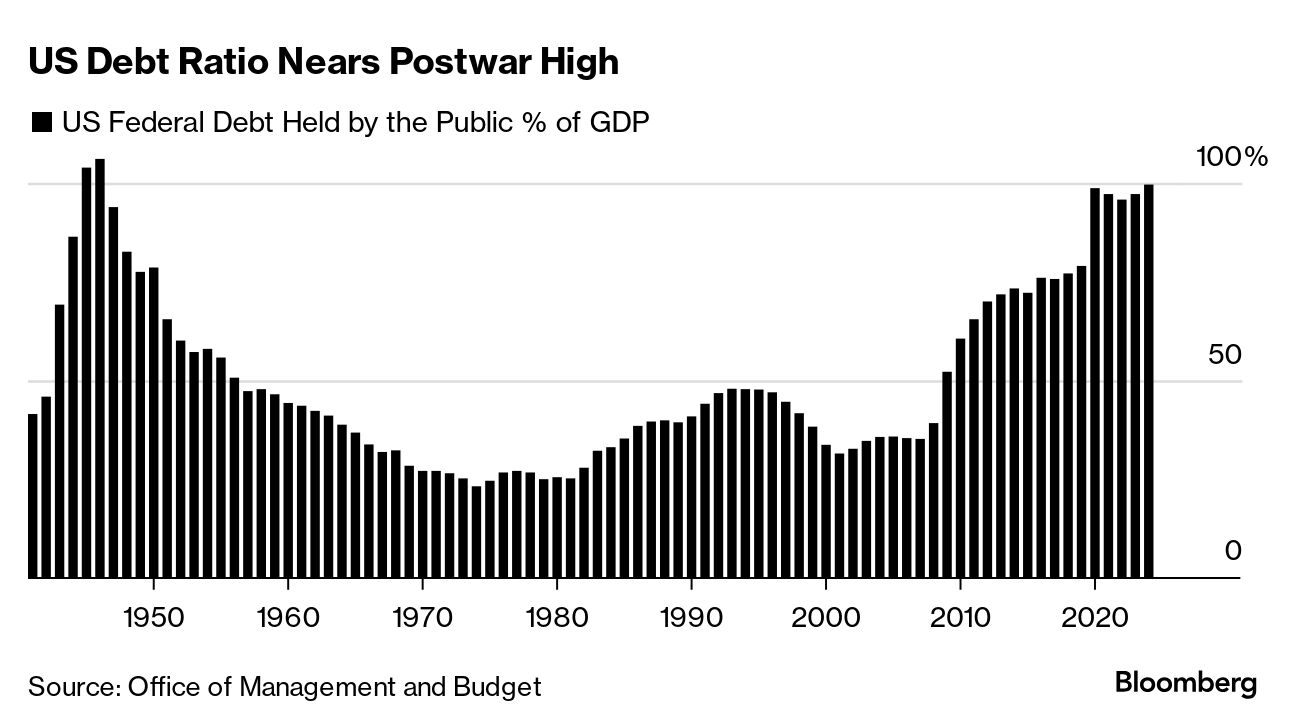

When it comes to the US fiscal trajectory, Washington should take no solace from the fact that Japan has maintained a much larger debt burden without suffering any loss in confidence in its creditworthiness and attendant surge in borrowing costs.

That's from Robert Subbaraman, Nomura's chief economist, and colleague Yiru Chen, in a note earlier this month. "America is not Japan," they wrote. They highlighted that Japan's ageing, loss-averse population for decades has been content to store household savings "in low-yielding bank deposits that banks used to purchase low-yielding government bonds."

"It is difficult to envisage America becoming frugal in the way of Japan" and channeling private-sector savings to Uncle Sam, the duo wrote. While it's true that private holdings of Treasuries have climbed, this is a "less stable" base of buyers than in Japan.

Subbaraman and Chen described scenarios where private investors could quickly exit. In conclusion, the US fiscal outlook is a "silent problem" for now. "Until it is not."

Behind closed doors, Xi Jinping and around 200 of his top Communist cadres will map out long-term plans for the economy in a once-every-five-year meeting known as the Third Plenum. Importantly, it's a political rather than policy meeting, so don't expect specific stimulus measures to boost China's faltering economy.

Instead, it'll be broad brush strokes on the nation's long-term direction.

"It will provide signals on how China plans to cultivate new long-term growth drivers, get more traction from stimulus and deal with a range of challenges - from a housing crash and increasing barriers to foreign markets and critical technologies, to stiff demographic headwinds," Bloomberg Economics's Chang Shu and Eric Zhu wrote in a preview of the July 15-18 gathering.

Goldman Sachs economists led by Andrew Tilton expect the reform focus at will be on "containing left-tail risks" and "growing right-tail potential" for China in the "post-property era." These may include fiscal and financial reforms to contain financial risks and prevent spillovers from the property downturn, and support for emerging industries and urbanization to boost China's long-term growth, the economists wrote.

Xi is pushing for an overhaul of China's growth model away from debt-fueled and polluting high-speed expansions to leaner, greener "high-quality growth." It's a push that has strategic implications — China wants to ensure it develops self sufficiency in key technologies so it can't be frozen out if tensions with the US worsen, either economically or militarily.

That makes events across the Pacific critical for China's leaders. Donald Trump's fist-clenching emergence from the weekend's assassination attempt raised the odds of his reelection, political analysts say. And that makes the 60% tariffs he has threatened on Chinese goods more likely too — though of course a lot can change between now and November.

Tariffs of 60% would slam Chinese shipments to the US down to almost zero, a Bloomberg Economics analysis showed in February.

The increased threat of a second Trump presidency and Monday's weaker-than-expected economic data add urgency to Beijing's efforts this week to map out a path toward long-term and balanced economic growth.

"The focus of the 3rd Plenum will be on elaborating the notion of 'Chinese modernization,' the signature ideology and source of legitimacy for the current regime," says Macquarie Group China economist Larry Hu.

The Week Ahead

ECB officials may be about to prime investors for another rate cut, though only after one of the longest-ever summer breaks between decisions.

With a move on Thursday effectively ruled out as policymakers take time to assess the strength of lingering inflation pressures, traders are likely to watch closely for any clues offered by President Christine Lagarde on prospects for the Sept. 12 meeting.

By then, the ECB will have seen two more monthly consumer-price readings, and have newly-compiled forecasts in hand as well. Several policymakers have stated a preference for acting at such quarterly occasions when fresh projections are available.

Elsewhere, reports that may show declining US retail sales and decelerating inflation in the UK and Canada, along with rate meetings in Indonesia, Egypt and South Africa, are among the highlights. Investors will also scour new economic forecasts from the IMF.

See here for the rest of the week's economic events.

Need-to-Know Research

When it comes to the US fiscal trajectory, Washington should take no solace from the fact that Japan has maintained a much larger debt burden without suffering any loss in confidence in its creditworthiness and attendant surge in borrowing costs.

That's from Robert Subbaraman, Nomura's chief economist, and colleague Yiru Chen, in a note earlier this month. "America is not Japan," they wrote. They highlighted that Japan's ageing, loss-averse population for decades has been content to store household savings "in low-yielding bank deposits that banks used to purchase low-yielding government bonds."

"It is difficult to envisage America becoming frugal in the way of Japan" and channeling private-sector savings to Uncle Sam, the duo wrote. While it's true that private holdings of Treasuries have climbed, this is a "less stable" base of buyers than in Japan.

Subbaraman and Chen described scenarios where private investors could quickly exit. In conclusion, the US fiscal outlook is a "silent problem" for now. "Until it is not."

No comments