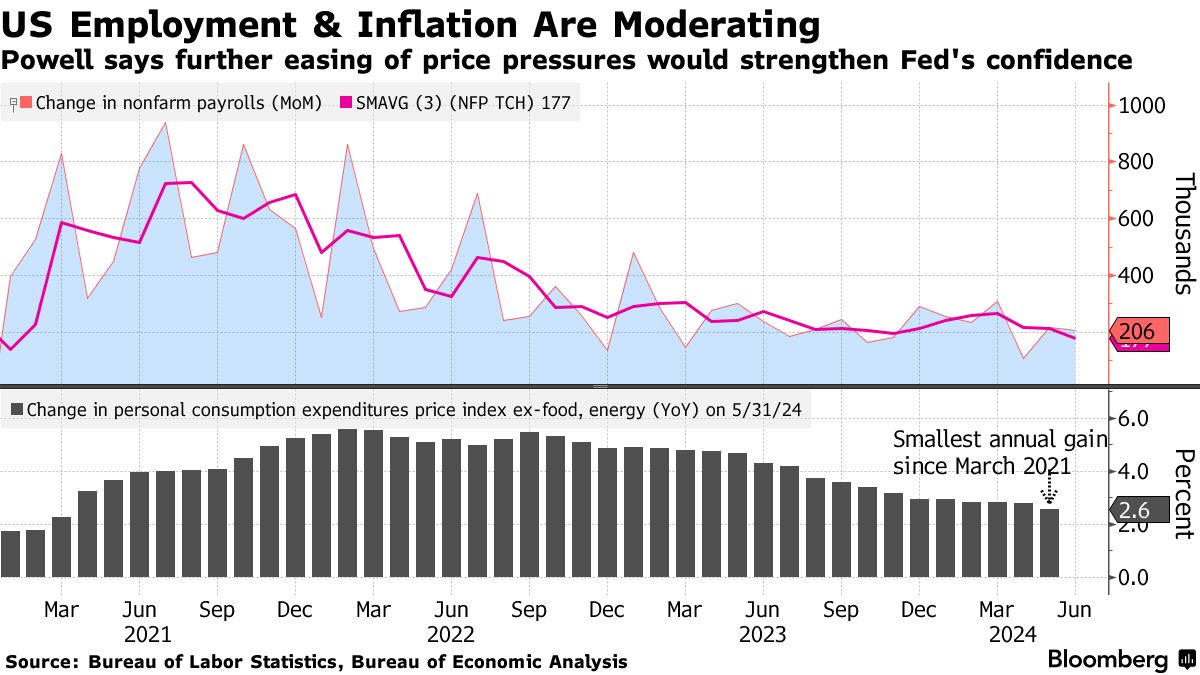

Inflation focus

Federal Reserve Chair Jerome Powell's response was short and to the point when asked at a Senate hearing Tuesday what the central bank was looking for to get started with rate cuts: "We need just to see more good inflation data, that's all."

Powell is unlikely to elaborate much on Wednesday on his second day of semi-annual congressional testimony. And that's in large part because the next big inflation report is just one day away.

Forecasters expect Thursday's US consumer price index release to show a modest 0.2% rise in the core measure (excluding food and energy) for a second month in June, according to the median estimate in a Bloomberg survey. If that pans out, it would mark the smallest set of back-to-back increases since August.

With investors already betting on two rate cuts this year, starting in September, a good outcome Thursday would all but guarantee a shift in tone at the Fed's upcoming July 30-31 policy meeting, finally teeing up the long-awaited unwind of the post-pandemic tightening cycle.

But there were enough weird occurrences in the May CPI report to possibly foreshadow some curveballs in store for the June data. The two big ones to watch are rents and non-housing services prices.

Rents posted another solid increase in May due to unusual surges in certain cities, including the most important one for the index—New York—which suggests downside risk in June as they unwind.

On the other hand, non-housing services prices actually fell in May, for the first time since 2021, thanks to a decline in motor vehicle insurance costs—one of the hottest categories in the index lately. No one sees that repeating. And a big bounce back in June could yet spoil the fun.

Need-to-Know Research

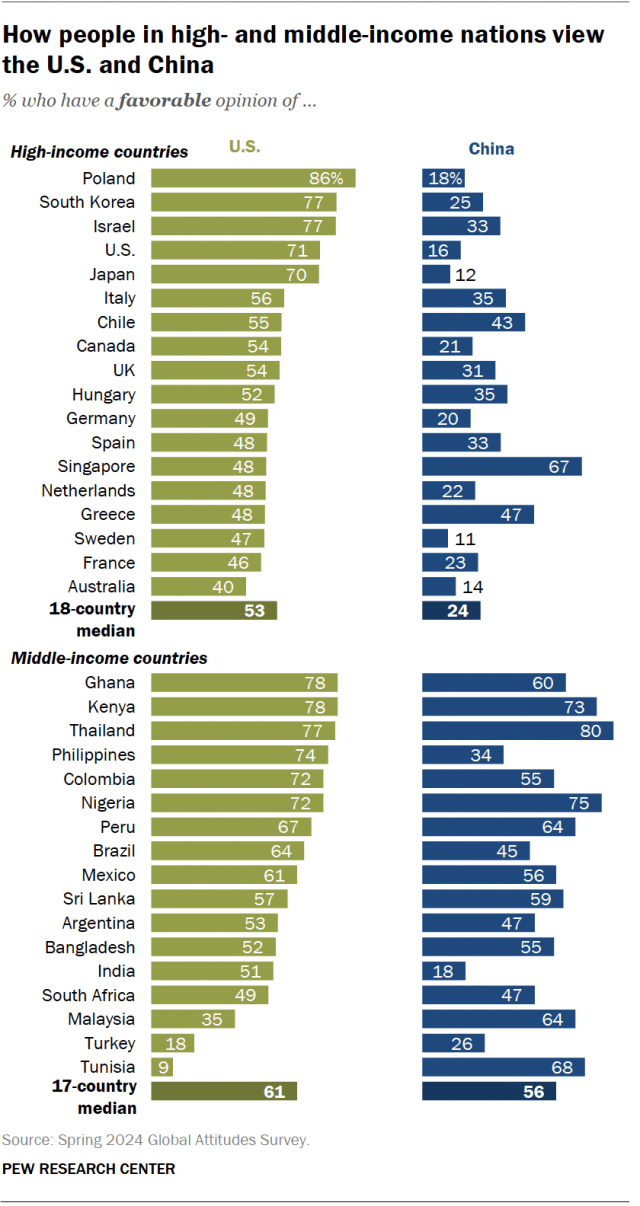

The US had a largely more favorable image than China in 35 high- and middle-income countries surveyed by the Pew Research Center, showing Beijing's effort to win hearts and minds globally still has a ways to go.

More than twice as many people saw the US positively than they viewed China across 18 high-income countries, with the gap most stark in Poland, Japan, the US and South Korea, survey results released Tuesday suggested. That contrasts with views in the 17 middle-income countries polled, which favored both countries similarly.

The survey results show both a challenge and an opportunity for Beijing, which is seeking to weaken the US's global influence and court Global South countries. While middle-income countries tended to have a rosier view of China, the US maintained a slight edge even among the poorer group of nations in the surveys conducted earlier this year.

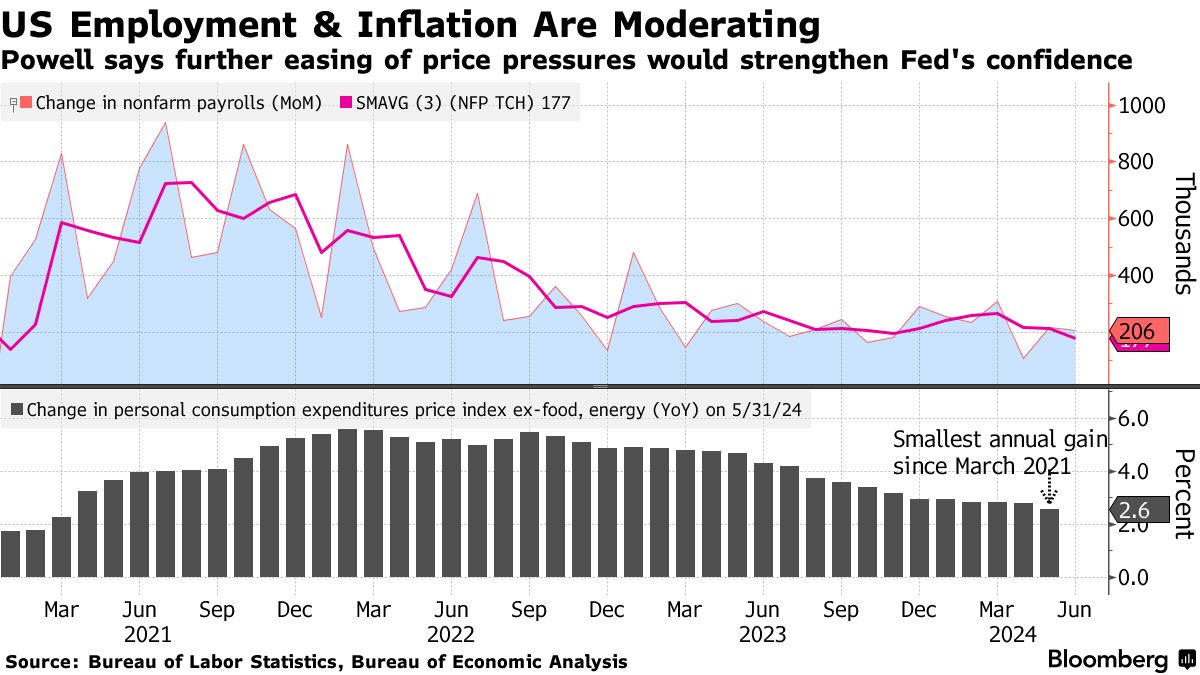

Powell is unlikely to elaborate much on Wednesday on his second day of semi-annual congressional testimony. And that's in large part because the next big inflation report is just one day away.

Jerome Powell, chairman of the US Federal Reserve. Photographer: Tierney L. Cross/Bloomberg

Forecasters expect Thursday's US consumer price index release to show a modest 0.2% rise in the core measure (excluding food and energy) for a second month in June, according to the median estimate in a Bloomberg survey. If that pans out, it would mark the smallest set of back-to-back increases since August.

With investors already betting on two rate cuts this year, starting in September, a good outcome Thursday would all but guarantee a shift in tone at the Fed's upcoming July 30-31 policy meeting, finally teeing up the long-awaited unwind of the post-pandemic tightening cycle.

But there were enough weird occurrences in the May CPI report to possibly foreshadow some curveballs in store for the June data. The two big ones to watch are rents and non-housing services prices.

Rents posted another solid increase in May due to unusual surges in certain cities, including the most important one for the index—New York—which suggests downside risk in June as they unwind.

On the other hand, non-housing services prices actually fell in May, for the first time since 2021, thanks to a decline in motor vehicle insurance costs—one of the hottest categories in the index lately. No one sees that repeating. And a big bounce back in June could yet spoil the fun.

Need-to-Know Research

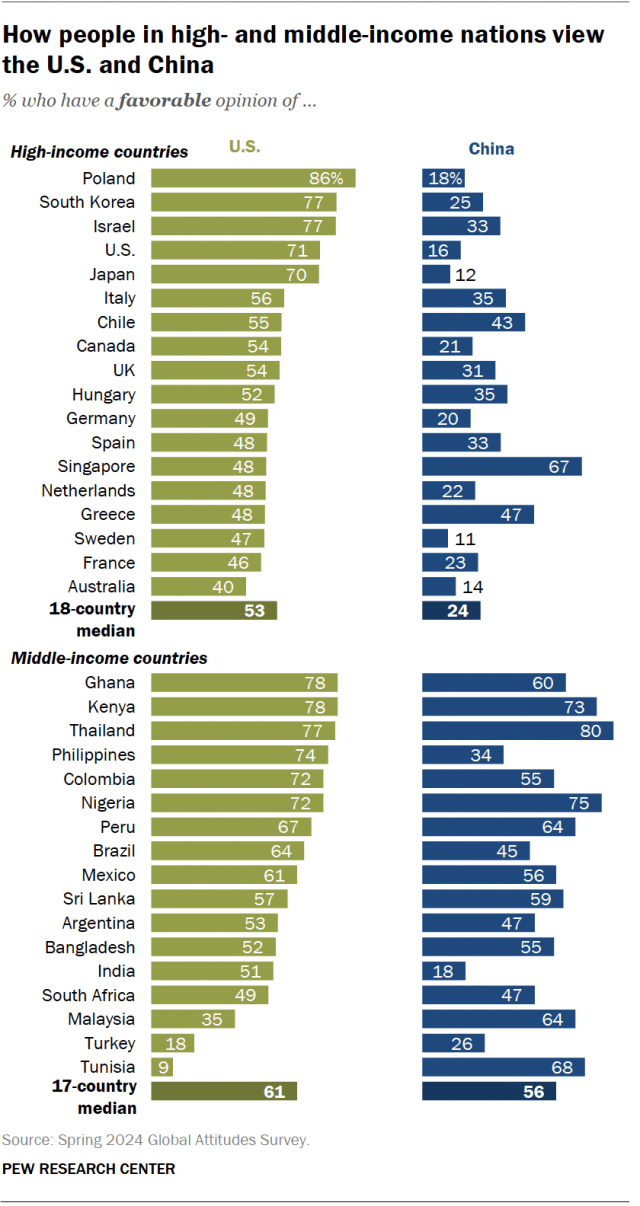

The US had a largely more favorable image than China in 35 high- and middle-income countries surveyed by the Pew Research Center, showing Beijing's effort to win hearts and minds globally still has a ways to go.

More than twice as many people saw the US positively than they viewed China across 18 high-income countries, with the gap most stark in Poland, Japan, the US and South Korea, survey results released Tuesday suggested. That contrasts with views in the 17 middle-income countries polled, which favored both countries similarly.

The survey results show both a challenge and an opportunity for Beijing, which is seeking to weaken the US's global influence and court Global South countries. While middle-income countries tended to have a rosier view of China, the US maintained a slight edge even among the poorer group of nations in the surveys conducted earlier this year.

No comments