New toolkit

China is taking a step forward in its long-standing ambition to give markets more control in determining interest rates.

But first, the central bank is taking two step backs by tightening its grip on both ends of the yield curve.

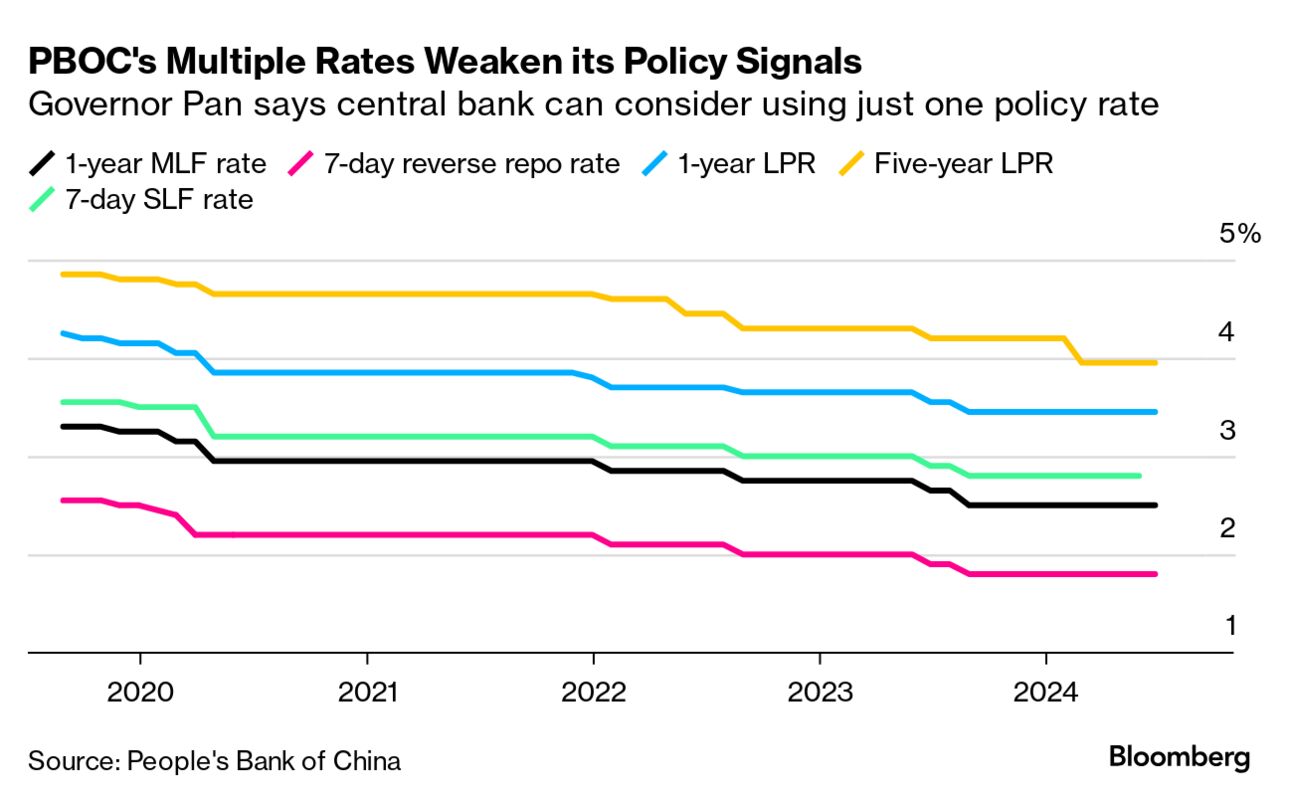

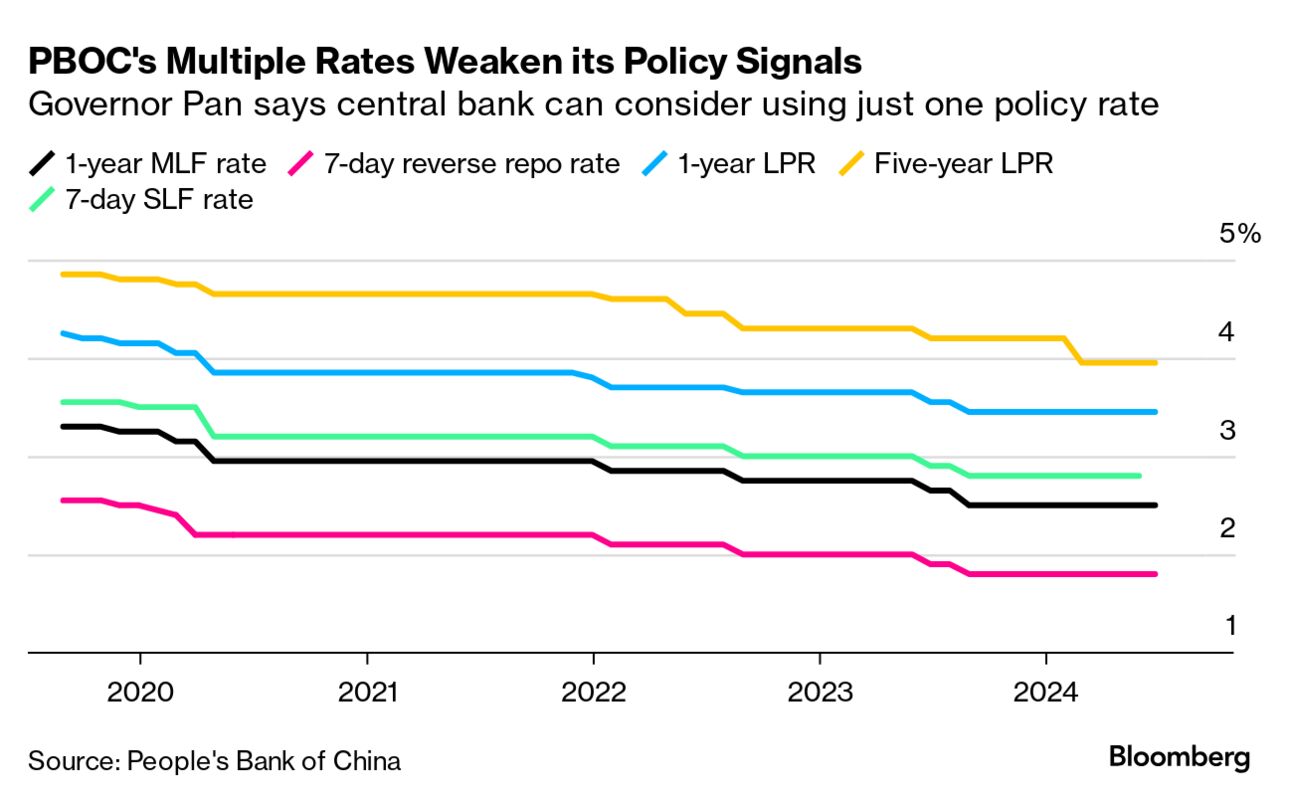

In an important speech last month, People's Bank of China Governor Pan Gongsheng outlined plans to switch to using just one key short-term policy rate (instead of the complex corridor system that's currently in use). To get to the monetary promised land where one rate rules them all, he's first having to set some guard rails before he lets markets take the driver's seat.

The new benchmark rate is widely expected to be the cost of the seven-day reverse repo — a daily tool that allows banks to borrow from the PBOC against their bond holdings.

That would bring it in line with the Fed and most other central banks that use a short-term benchmark as their main monetary policy tool and allow the market to help determine rates across the yield curve out from there.

The PBOC on Monday took another step toward that goal, introducing a new mechanism to influence short-term borrowing costs that'll effectively narrow the scope for wide swings caused by variations in liquidity.

It'll do that by conducting repurchase or reverse repurchase agreements each afternoon as needed, on top of its existing morning operations. If you need a refresher, repos are agreements to sell bonds and buy them back later (in this case overnight) while reverse repos are the opposite.

Importantly, the PBOC said the new plan will be used ad hoc, suggesting it may hope the signaling effect of having a clear short-term benchmark will eventually mean it doesn't need to keep jumping in and out of the market.

Bloomberg Economics's David Qu says the new afternoon operation window closes a gap in the PBOC's defenses and will ease market fears over any potential funding crunches.

As for longer-term rates, Pan isn't ready to cede control to bond traders there just yet either: He's preparing a bold new experiment where the central bank will short sell bonds to keep long-term yields from falling too low due to concerns investors may get burned if yields were to spike.

Taken together, the moves to narrow the corridor around the presumed new short-term benchmark and sell bonds to keep longer-term yields from falling too low give Pan more control over monetary policy. And that's crucial for his quest to eventually cede some of that control to markets.

Need-to-Know Research

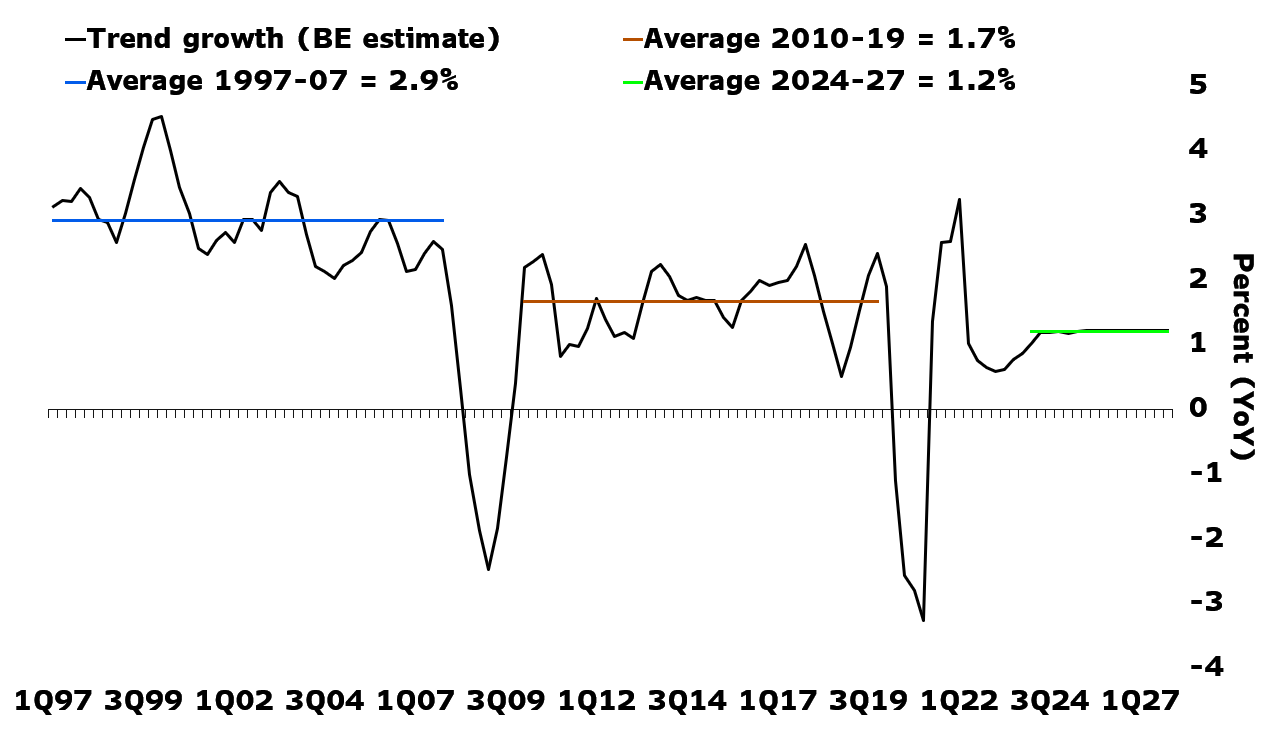

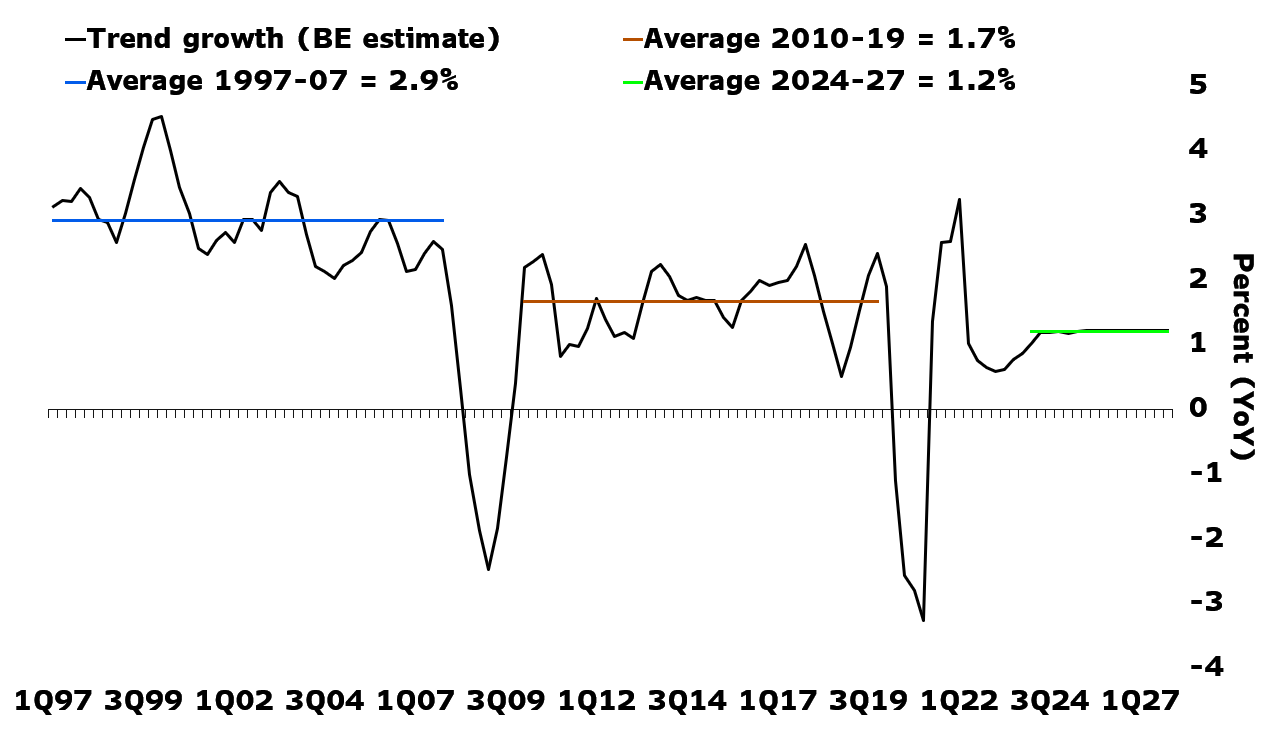

Promising stronger growth is easy, but delivering it is harder, says Ana Andrade of Bloomberg Economics.

The new UK chancellor — Rachel Reeves — has announced a series of measures to unlock faster gains in gross domestic product, with a heavy focus on planning reform and investment. The policies are a step in the right direction, but she faces a number of obstacles.

"History is littered with examples of house-building targets being missed," economists Andrade, Dan Hanson and Niraj Shah wrote in a report. "We also think there is too much faith being placed in the private sector to fill the investment gap."

The economists reckon that there's unlikely to be a "dramatic" change in the UK economy's medium-term path. But they acknowledge that the Labour government's policies "pose an upside risk to our view."

But first, the central bank is taking two step backs by tightening its grip on both ends of the yield curve.

In an important speech last month, People's Bank of China Governor Pan Gongsheng outlined plans to switch to using just one key short-term policy rate (instead of the complex corridor system that's currently in use). To get to the monetary promised land where one rate rules them all, he's first having to set some guard rails before he lets markets take the driver's seat.

The new benchmark rate is widely expected to be the cost of the seven-day reverse repo — a daily tool that allows banks to borrow from the PBOC against their bond holdings.

That would bring it in line with the Fed and most other central banks that use a short-term benchmark as their main monetary policy tool and allow the market to help determine rates across the yield curve out from there.

The PBOC on Monday took another step toward that goal, introducing a new mechanism to influence short-term borrowing costs that'll effectively narrow the scope for wide swings caused by variations in liquidity.

It'll do that by conducting repurchase or reverse repurchase agreements each afternoon as needed, on top of its existing morning operations. If you need a refresher, repos are agreements to sell bonds and buy them back later (in this case overnight) while reverse repos are the opposite.

Importantly, the PBOC said the new plan will be used ad hoc, suggesting it may hope the signaling effect of having a clear short-term benchmark will eventually mean it doesn't need to keep jumping in and out of the market.

Bloomberg Economics's David Qu says the new afternoon operation window closes a gap in the PBOC's defenses and will ease market fears over any potential funding crunches.

As for longer-term rates, Pan isn't ready to cede control to bond traders there just yet either: He's preparing a bold new experiment where the central bank will short sell bonds to keep long-term yields from falling too low due to concerns investors may get burned if yields were to spike.

Taken together, the moves to narrow the corridor around the presumed new short-term benchmark and sell bonds to keep longer-term yields from falling too low give Pan more control over monetary policy. And that's crucial for his quest to eventually cede some of that control to markets.

Need-to-Know Research

Promising stronger growth is easy, but delivering it is harder, says Ana Andrade of Bloomberg Economics.

The new UK chancellor — Rachel Reeves — has announced a series of measures to unlock faster gains in gross domestic product, with a heavy focus on planning reform and investment. The policies are a step in the right direction, but she faces a number of obstacles.

"History is littered with examples of house-building targets being missed," economists Andrade, Dan Hanson and Niraj Shah wrote in a report. "We also think there is too much faith being placed in the private sector to fill the investment gap."

The economists reckon that there's unlikely to be a "dramatic" change in the UK economy's medium-term path. But they acknowledge that the Labour government's policies "pose an upside risk to our view."

No comments