Stubborn US deficits

Despite historically rapid economic growth, strong jobs gains and notable wage increases, the US fiscal deficit for the first three quarters of the fiscal year is barely different from the giant shortfall recorded last year.

That's according to an update Monday from the nonpartisan Congressional Budget Office, which said the deficit — adjusted for shifts in the calendar — was just $22 billion smaller than it was at this point in 2023.

This is a big difference from the last economic recovery, in the 2010s, when the budget deficit shrank steadily. Republicans blame a spendthrift President Joe Biden for this outcome, while Democrats say that tax cuts enacted by former GOP President Donald Trump eroded the US revenue base.

But a deeper look at the US fiscal situation shows that neither interpretation captures what's going on.

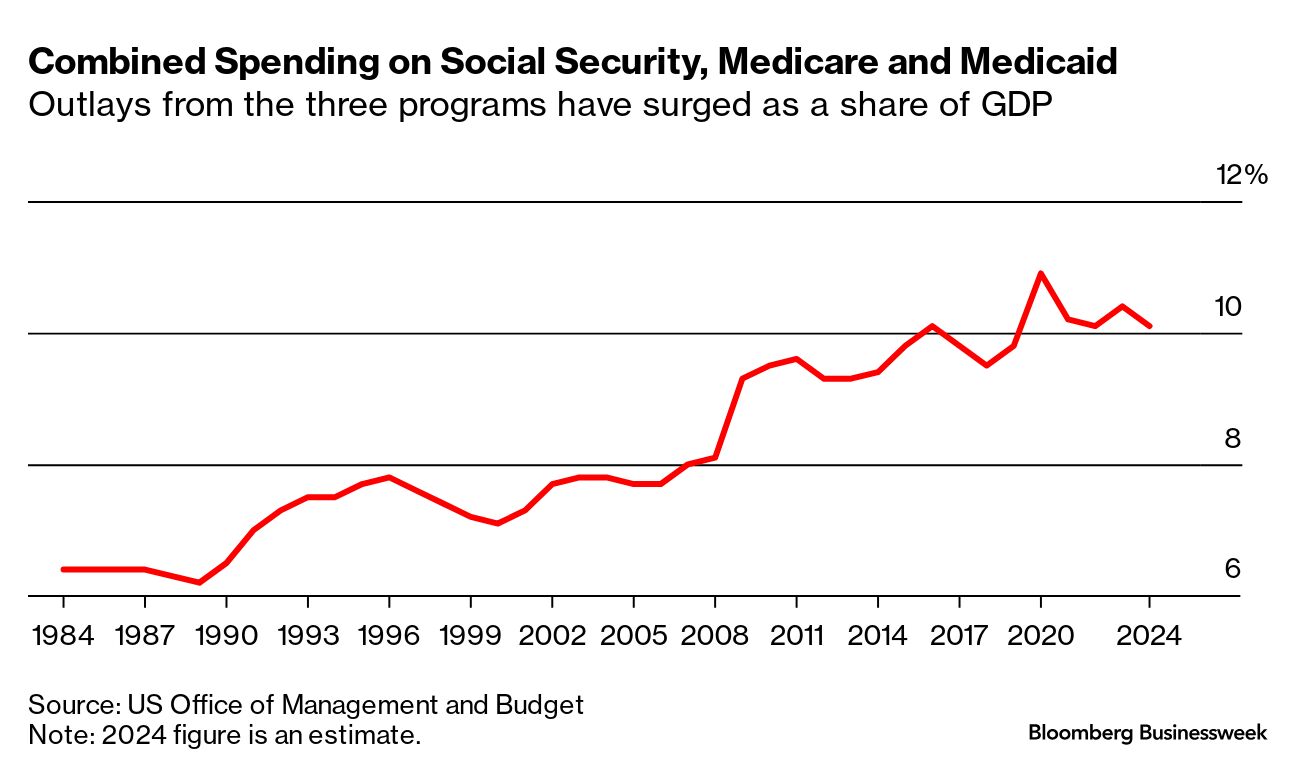

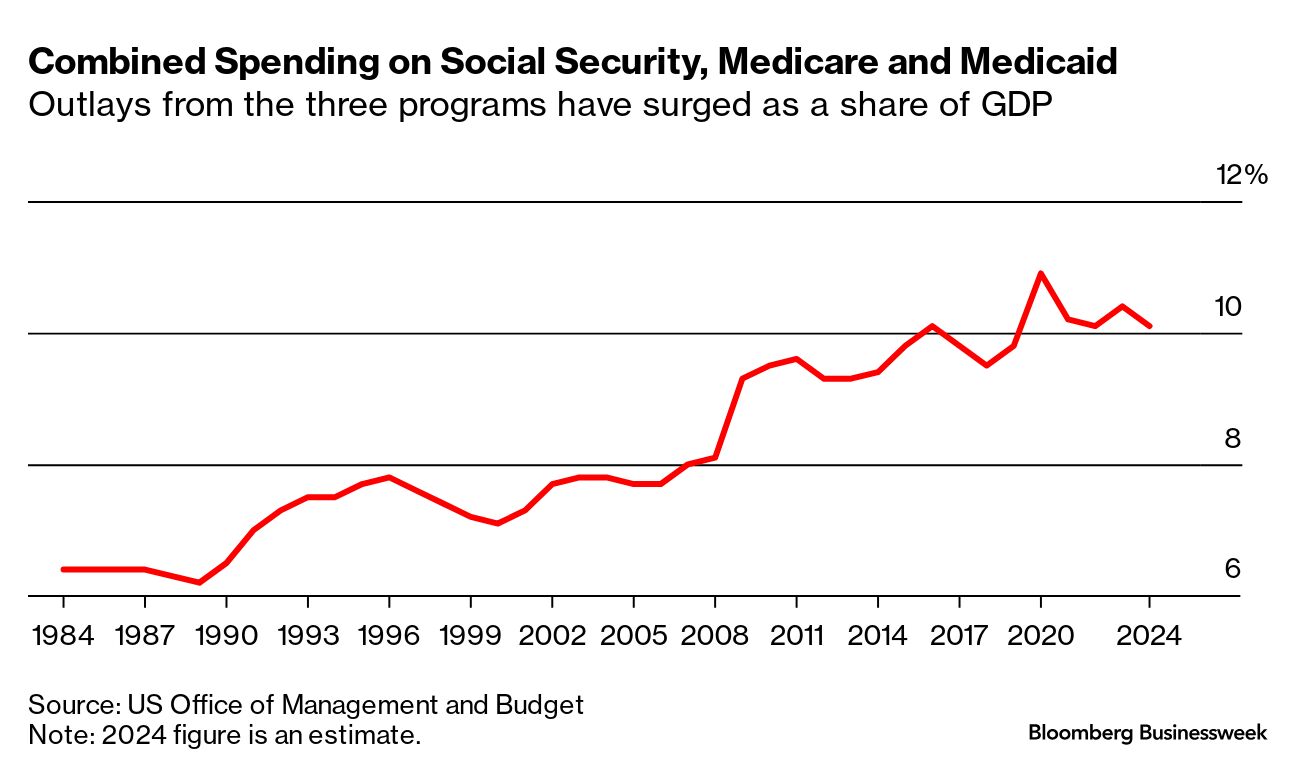

It's mainly down to the aging of the US population, which is inflating the number of beneficiaries receiving Social Security and Medicare benefits. And neither party in Washington is wild about taking on an overhaul of those popular programs.

Another big factor is higher interest rates, which have boosted the payments the government has to make on its debt. Past increases in the overall debt mean this is a whoppingly large bill, amounting to more than what the Defense Department spends on military programs.

The White House itself projected earlier this year that tax revenue will come in at 18% of gross domestic product for 2024, slightly higher than the 17.2% average over the period from 1984 to 2023. In other words, no obvious massive erosion of the tax take despite the lower rates in place.

As for discretionary spending, which incorporates the annual appropriations Congress and the White House must agree on each year, that's seen at less than 7% of GDP this year, below the 7.5% averaged over the past four decades.

Mandatory spending programs are much, much bigger — set to reach a total of 15.3% of GDP this year, or 3 full percentage points over the 40-year average.

The Social Security Administration estimates there will be more than 67 million people receiving benefits in 2024, an increase of more than 8 million since 2015.

But there are no formal plans from either party to revamp Social Security.

Meantime, deficits going forward are expected to be so large that debt as a share of GDP is poised to hit all-time highs, the CBO projected last month.

Need-to-Know Research

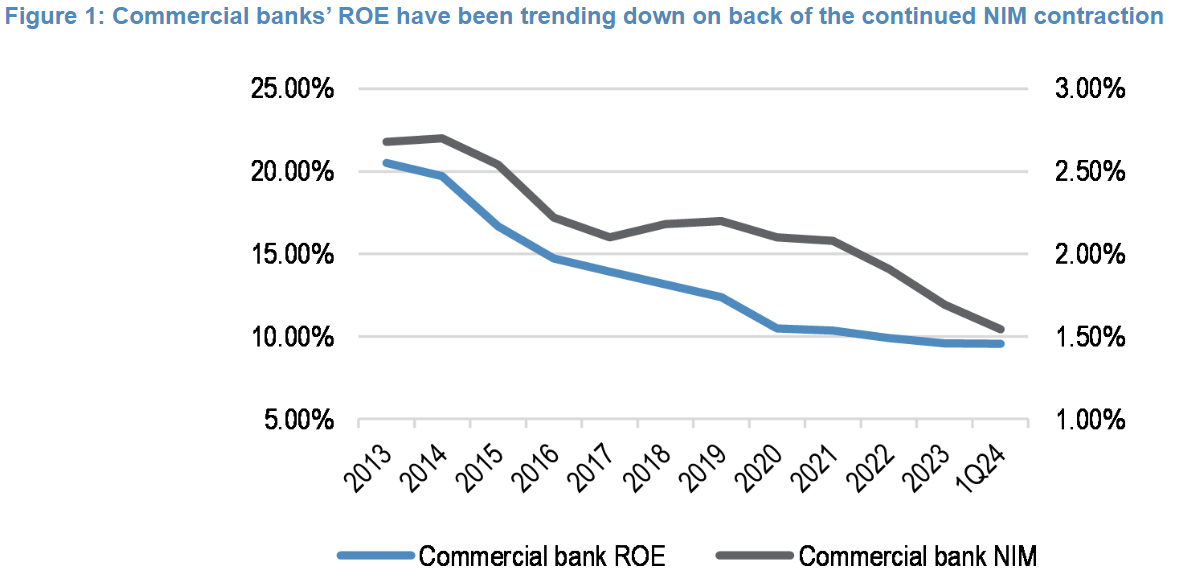

One key reason why China's policymakers have for some months now been concerned about interest rates falling too low has been the damage it does to the nation's banking system. Analysis by JPMorgan Chase shows they have reason to worry.

Chinese banks get the vast majority of their revenue from the difference between the interest they receive and what they pay out. And net-interest margins, or NIMs, have compressed so much that banks' return on equity has hit "a level that will limit their ability to generate sufficient capital to sustain macro growth and digest bad debts," JPMorgan analysts including Katherine Lei wrote in a note this week.

To avert "a significant decline in credit growth" and to avoid having to recapitalize the banks in coming years, it's "essential" for policymakers to stabilize NIMs, Lei and her colleagues wrote.

That's according to an update Monday from the nonpartisan Congressional Budget Office, which said the deficit — adjusted for shifts in the calendar — was just $22 billion smaller than it was at this point in 2023.

This is a big difference from the last economic recovery, in the 2010s, when the budget deficit shrank steadily. Republicans blame a spendthrift President Joe Biden for this outcome, while Democrats say that tax cuts enacted by former GOP President Donald Trump eroded the US revenue base.

But a deeper look at the US fiscal situation shows that neither interpretation captures what's going on.

It's mainly down to the aging of the US population, which is inflating the number of beneficiaries receiving Social Security and Medicare benefits. And neither party in Washington is wild about taking on an overhaul of those popular programs.

Another big factor is higher interest rates, which have boosted the payments the government has to make on its debt. Past increases in the overall debt mean this is a whoppingly large bill, amounting to more than what the Defense Department spends on military programs.

The White House itself projected earlier this year that tax revenue will come in at 18% of gross domestic product for 2024, slightly higher than the 17.2% average over the period from 1984 to 2023. In other words, no obvious massive erosion of the tax take despite the lower rates in place.

As for discretionary spending, which incorporates the annual appropriations Congress and the White House must agree on each year, that's seen at less than 7% of GDP this year, below the 7.5% averaged over the past four decades.

Mandatory spending programs are much, much bigger — set to reach a total of 15.3% of GDP this year, or 3 full percentage points over the 40-year average.

The Social Security Administration estimates there will be more than 67 million people receiving benefits in 2024, an increase of more than 8 million since 2015.

But there are no formal plans from either party to revamp Social Security.

Meantime, deficits going forward are expected to be so large that debt as a share of GDP is poised to hit all-time highs, the CBO projected last month.

Need-to-Know Research

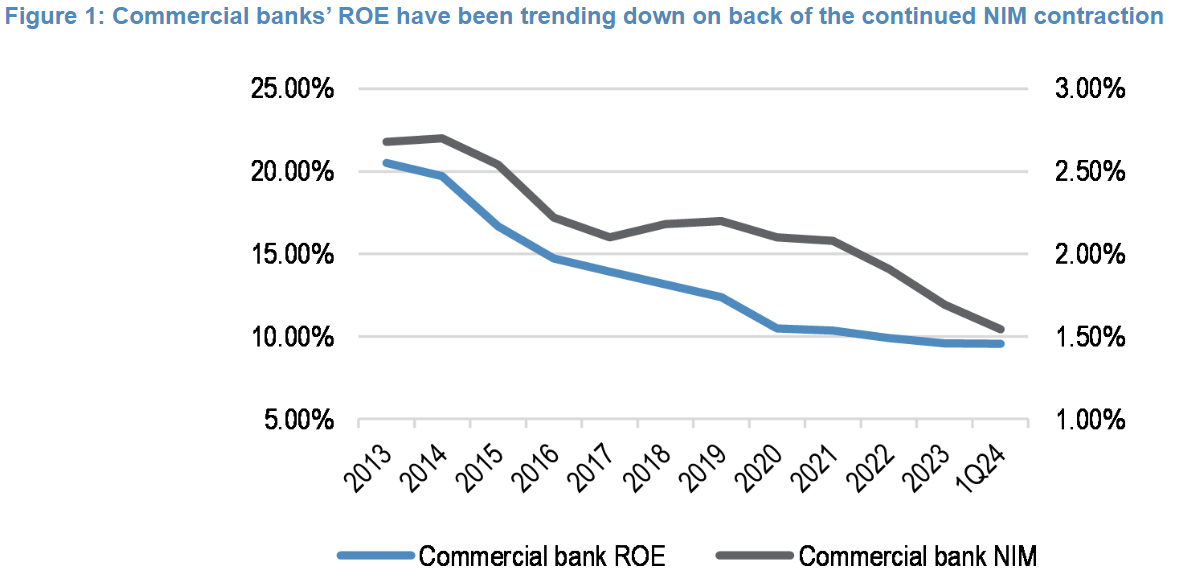

One key reason why China's policymakers have for some months now been concerned about interest rates falling too low has been the damage it does to the nation's banking system. Analysis by JPMorgan Chase shows they have reason to worry.

Chinese banks get the vast majority of their revenue from the difference between the interest they receive and what they pay out. And net-interest margins, or NIMs, have compressed so much that banks' return on equity has hit "a level that will limit their ability to generate sufficient capital to sustain macro growth and digest bad debts," JPMorgan analysts including Katherine Lei wrote in a note this week.

Source: National Financial Regulatory Administration, JPMorgan Chase & Co.

To avert "a significant decline in credit growth" and to avoid having to recapitalize the banks in coming years, it's "essential" for policymakers to stabilize NIMs, Lei and her colleagues wrote.

No comments