Supermarket super-flation

One of the most noticeable, and financially painful, parts of the surge in US cost of living after Covid struck was the run-up in "food-at-home" prices — in other words, grocery bills.

No one accustomed to putting items into supermarket shopping carts could miss the can of tomatoes that had doubled in price, or an eye-watering jump in the cost of beef.

Now, in the fresh analysis aisle — as it were — comes a look at what exactly caused the increase, published by the Federal Reserve Bank of New York. Economist Thomas Klitgaard starts by showing the scale of the change.

Over the five years prior to the pandemic, the consumer price index category for food-at-home was "essentially unchanged." That suggests the 2019 grocery bill wasn't a whole lot different than the 2014 one. Then in 2020 prices rose 4%, then 6%, then an additional 12% in 2022.

In all, this index soared by 25% from the final quarter of 2019 to the first quarter of 2023.

There were two key components, Klitgaard finds. First, the underlying price of commodities went up substantially. Second, the wage bill at supermarkets soared. What wasn't a big factor, according to Klitgaard, was price gouging by the companies.

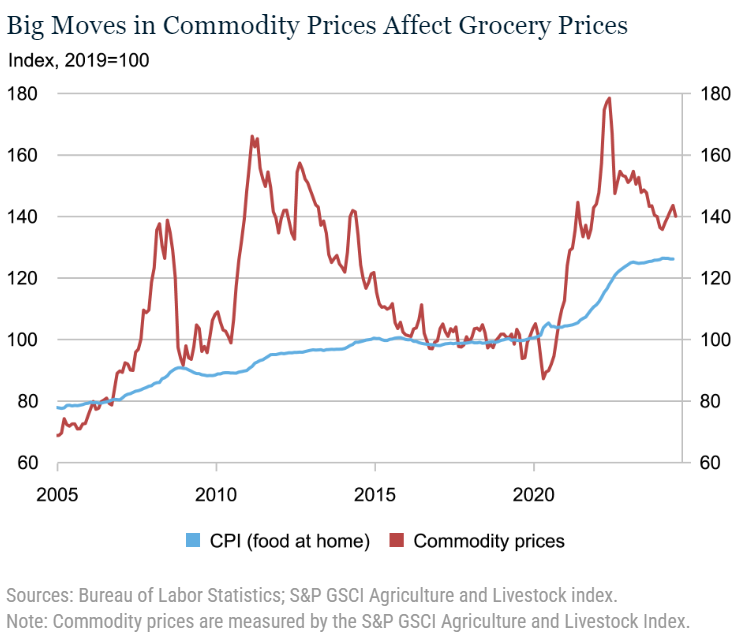

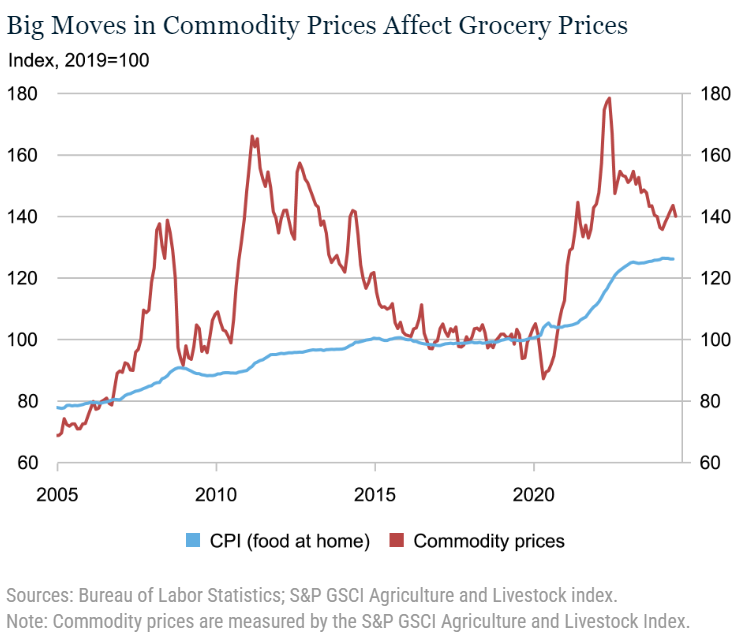

Given all the other elements that go into food prices, it can take a big swing in commodities to have an impact on supermarket prices. And there was a very big swing in the early 2020s — especially in grain prices, which cascade down to items including beef, pork, poultry, eggs and dairy products.

Teresa Kroeger, a Bureau of Labor Statistics economist, calculates that from December 2019 to February 2022, a wholesale measure of grains prices jumped 73.5%.

Part of that was higher shipping and energy costs, in turn affected by the mismatch between supply and demand when governments shuttered then reopened their economies.

Part of the grains-price surge was also down to China, which was ramping up livestock-feed purchases as it rebuilt its hog supply in the wake of an African swine fever outbreak.

And then in 2022 Russia invaded Ukraine, causing massive disruption to global grain trade. US grain prices climbed an additional 24.1% during the first four months of that war, Kroeger wrote in a report last year.

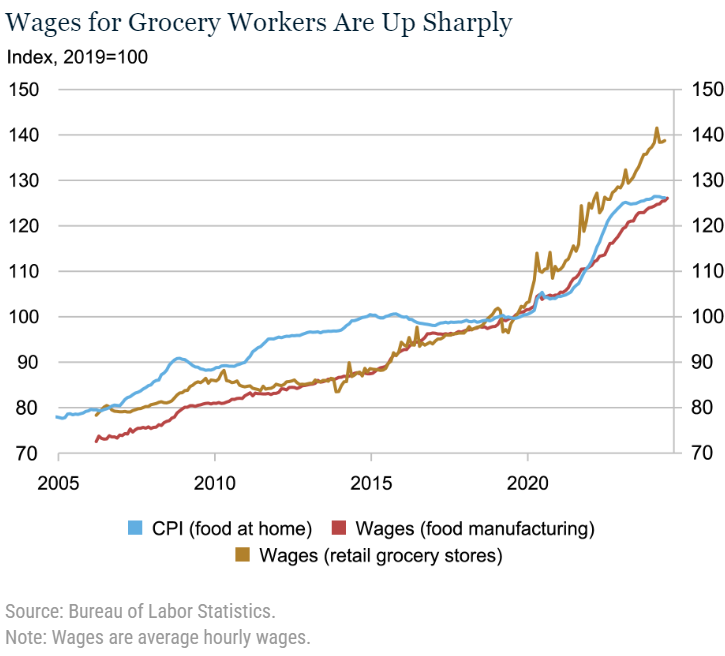

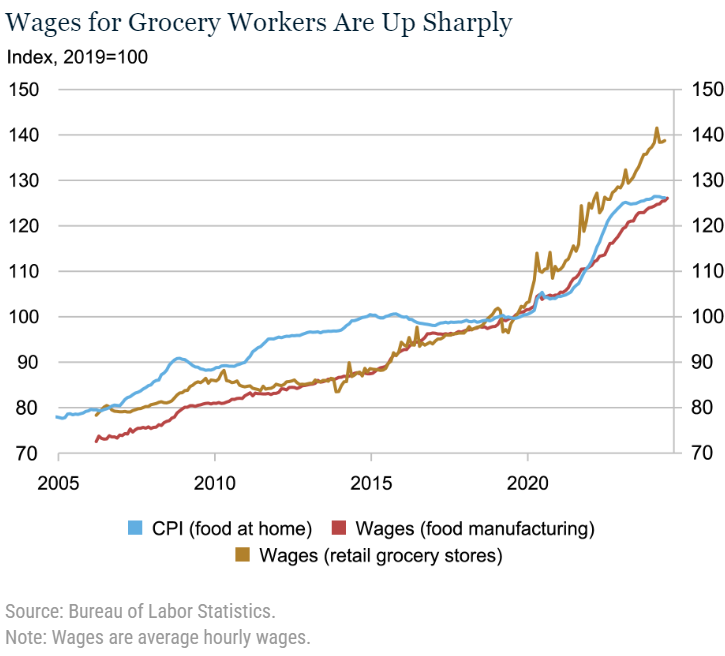

As for pay, that went up in the food-retailing sector just as everywhere else thanks to a shortage of job-seekers during the pandemic. But these relatively low-wage, public-facing jobs saw particularly large gains.

Retail grocery workers' pay since 2019 has climbed roughly 15 percentage points more than for the workforce as a whole, according to Klitgaard at the New York Fed.

While grain prices have slumped since 2022, the wage bill keeps going up — with average hourly earnings up 6% in May from a year before. And Klitgaard warns that may bode ill for shoppers going forward.

"An open question is whether grocery inflation can stay as moderate as it has been since early 2023 with grocery worker wage inflation still elevated," he wrote.

Need-to-Know Research

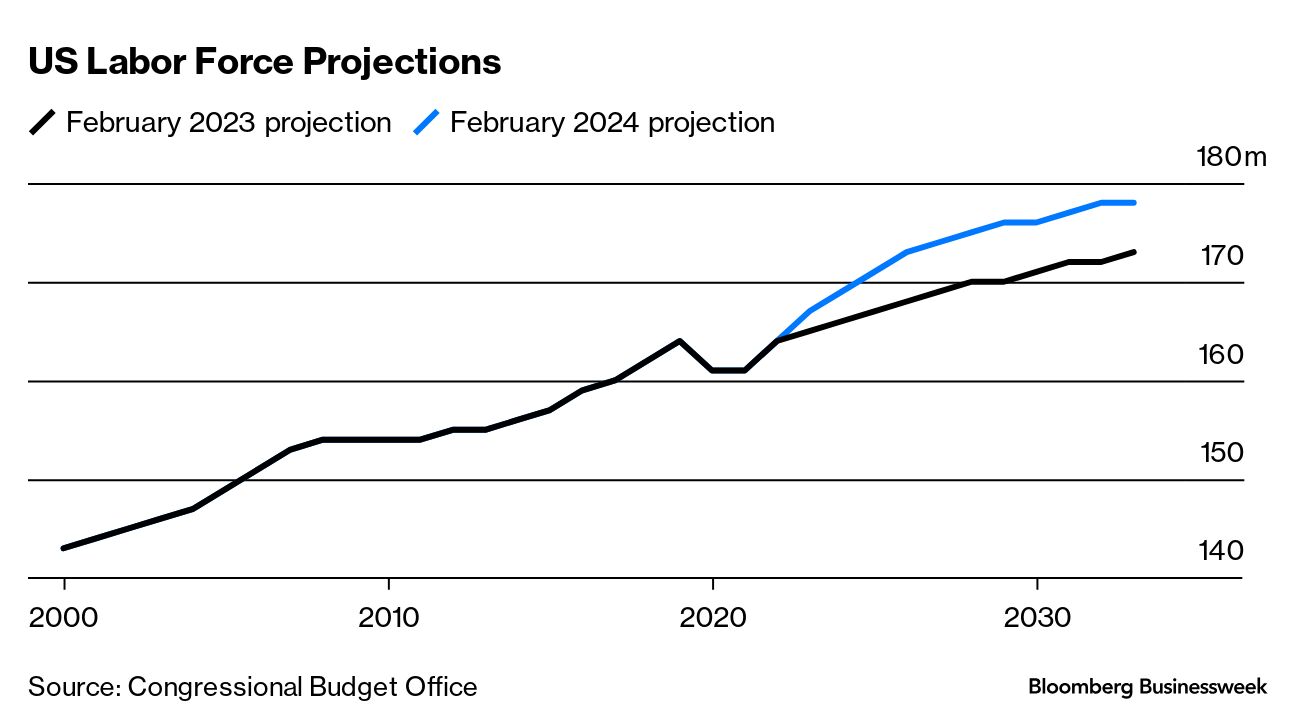

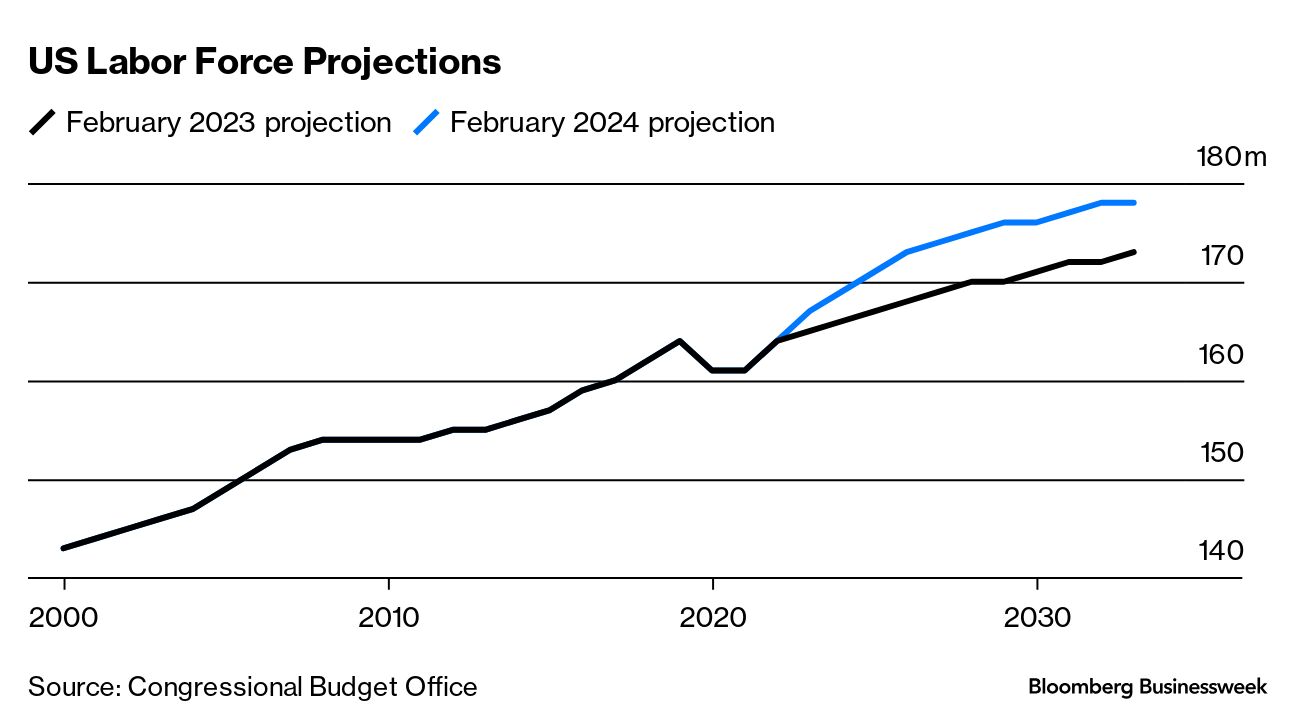

Just as US measures on immigration are tightening up — and may tighten even further if Donald Trump wins against President Joe Biden in November — new analysis gauges the extent to which the recent influx of foreign-born workers helped to address American labor shortages.

"Around one-fifth of the easing of labor market tightness in 2023 can be attributed to the spike in immigration," San Francisco Fed economist Evgeniya Duzhak estimated in a paper published this week by the Federal Reserve Bank of San Francisco. That pattern should continue at least for some months, according to her analysis.

The US expanded humanitarian parole for 640,000 people from Cuba, Haiti, Ukraine and Nicaragua and extended temporary protected status to about 472,000 Venezuelans in the last couple of years. Duzhak said in her paper she expects many of these people to continue entering the labor force throughout 2024 due to delays in processing.

No one accustomed to putting items into supermarket shopping carts could miss the can of tomatoes that had doubled in price, or an eye-watering jump in the cost of beef.

Now, in the fresh analysis aisle — as it were — comes a look at what exactly caused the increase, published by the Federal Reserve Bank of New York. Economist Thomas Klitgaard starts by showing the scale of the change.

Over the five years prior to the pandemic, the consumer price index category for food-at-home was "essentially unchanged." That suggests the 2019 grocery bill wasn't a whole lot different than the 2014 one. Then in 2020 prices rose 4%, then 6%, then an additional 12% in 2022.

In all, this index soared by 25% from the final quarter of 2019 to the first quarter of 2023.

There were two key components, Klitgaard finds. First, the underlying price of commodities went up substantially. Second, the wage bill at supermarkets soared. What wasn't a big factor, according to Klitgaard, was price gouging by the companies.

Given all the other elements that go into food prices, it can take a big swing in commodities to have an impact on supermarket prices. And there was a very big swing in the early 2020s — especially in grain prices, which cascade down to items including beef, pork, poultry, eggs and dairy products.

Reprinted from Liberty Street Economics blog post.

Teresa Kroeger, a Bureau of Labor Statistics economist, calculates that from December 2019 to February 2022, a wholesale measure of grains prices jumped 73.5%.

Part of that was higher shipping and energy costs, in turn affected by the mismatch between supply and demand when governments shuttered then reopened their economies.

Part of the grains-price surge was also down to China, which was ramping up livestock-feed purchases as it rebuilt its hog supply in the wake of an African swine fever outbreak.

And then in 2022 Russia invaded Ukraine, causing massive disruption to global grain trade. US grain prices climbed an additional 24.1% during the first four months of that war, Kroeger wrote in a report last year.

As for pay, that went up in the food-retailing sector just as everywhere else thanks to a shortage of job-seekers during the pandemic. But these relatively low-wage, public-facing jobs saw particularly large gains.

Retail grocery workers' pay since 2019 has climbed roughly 15 percentage points more than for the workforce as a whole, according to Klitgaard at the New York Fed.

Reprinted from Liberty Street Economics blog post.

While grain prices have slumped since 2022, the wage bill keeps going up — with average hourly earnings up 6% in May from a year before. And Klitgaard warns that may bode ill for shoppers going forward.

"An open question is whether grocery inflation can stay as moderate as it has been since early 2023 with grocery worker wage inflation still elevated," he wrote.

Need-to-Know Research

Just as US measures on immigration are tightening up — and may tighten even further if Donald Trump wins against President Joe Biden in November — new analysis gauges the extent to which the recent influx of foreign-born workers helped to address American labor shortages.

"Around one-fifth of the easing of labor market tightness in 2023 can be attributed to the spike in immigration," San Francisco Fed economist Evgeniya Duzhak estimated in a paper published this week by the Federal Reserve Bank of San Francisco. That pattern should continue at least for some months, according to her analysis.

The US expanded humanitarian parole for 640,000 people from Cuba, Haiti, Ukraine and Nicaragua and extended temporary protected status to about 472,000 Venezuelans in the last couple of years. Duzhak said in her paper she expects many of these people to continue entering the labor force throughout 2024 due to delays in processing.

No comments