Trumpflation worries

When investors in November 2016 were presented with Republican Donald Trump's presidential election victory and the retention of his party's control of Congress, "reflation" trades became the order of the day.

A policy platform of tax cuts and regulation rollback seemed tailor-made to juice economic growth. Stocks rose, and bond yields recovered from the record-low levels reached earlier in the year.

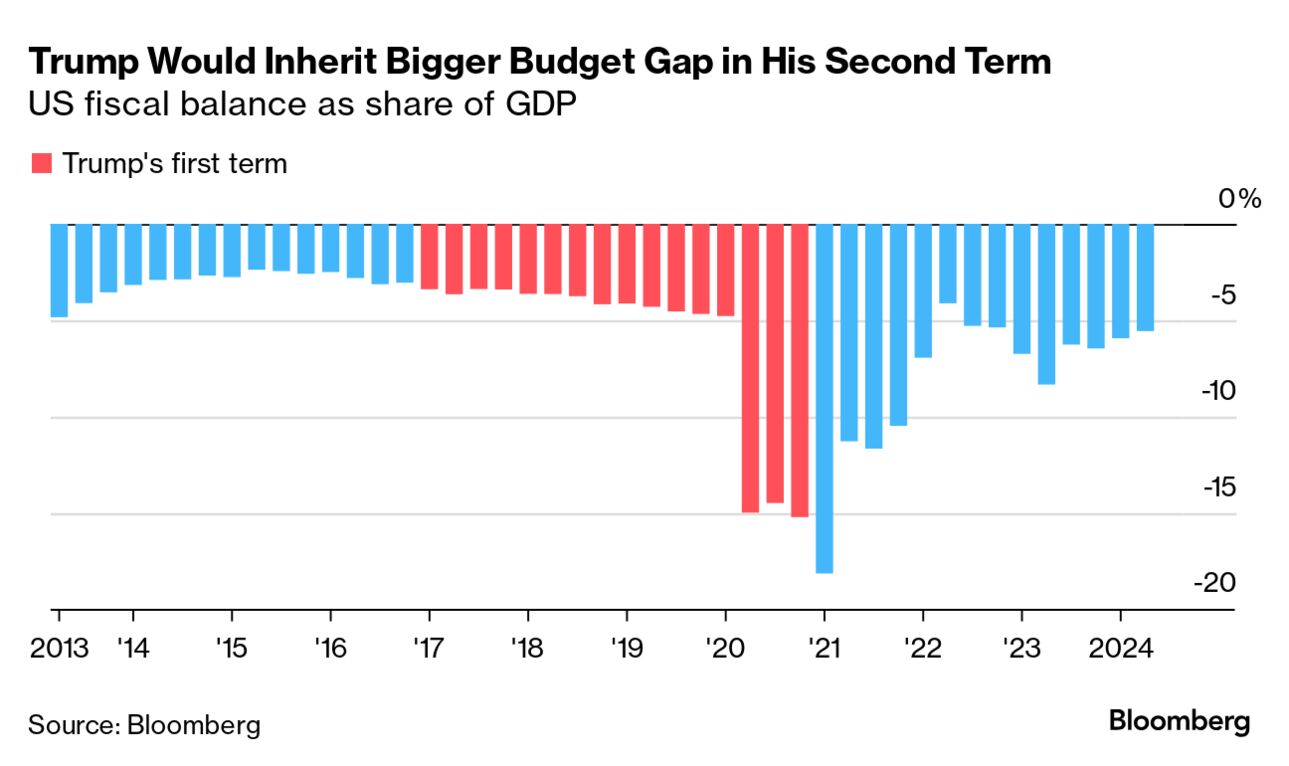

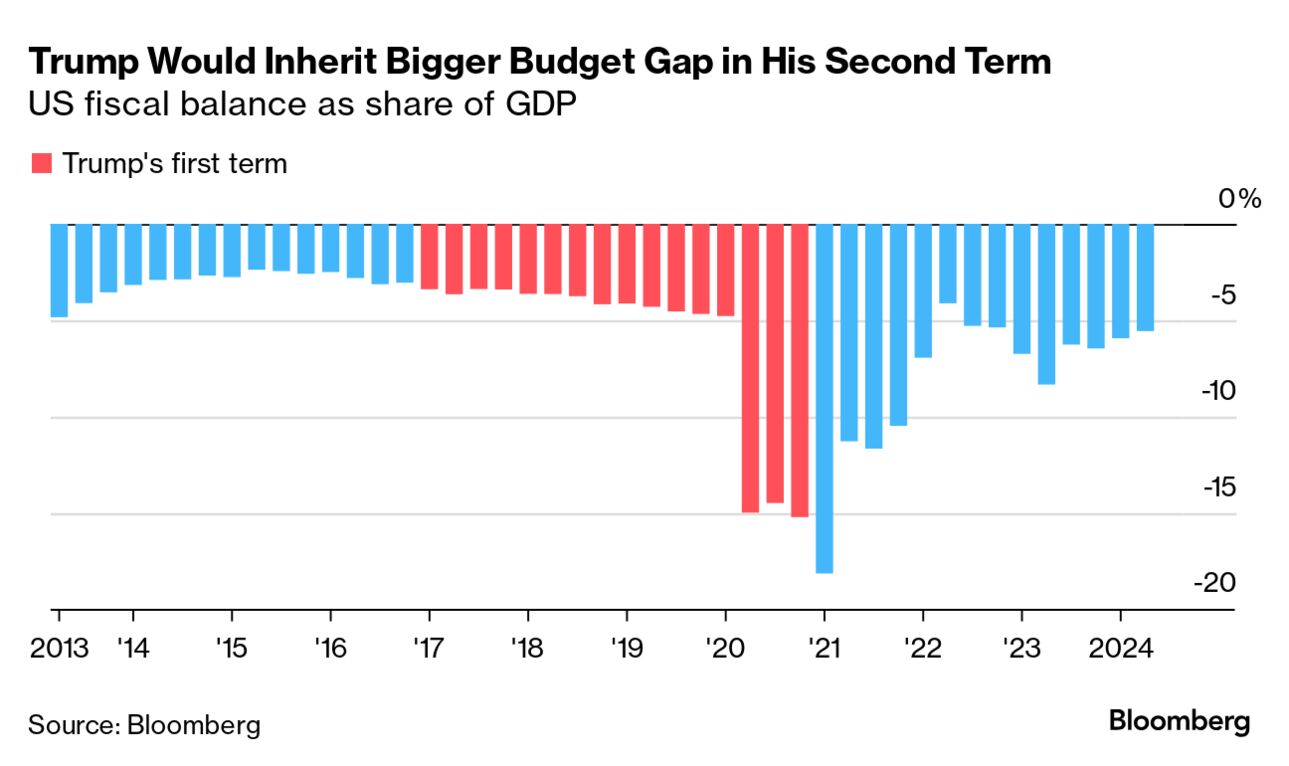

The context back then was an inflation rate well below 2%, and a government debt load of about 76% of GDP.

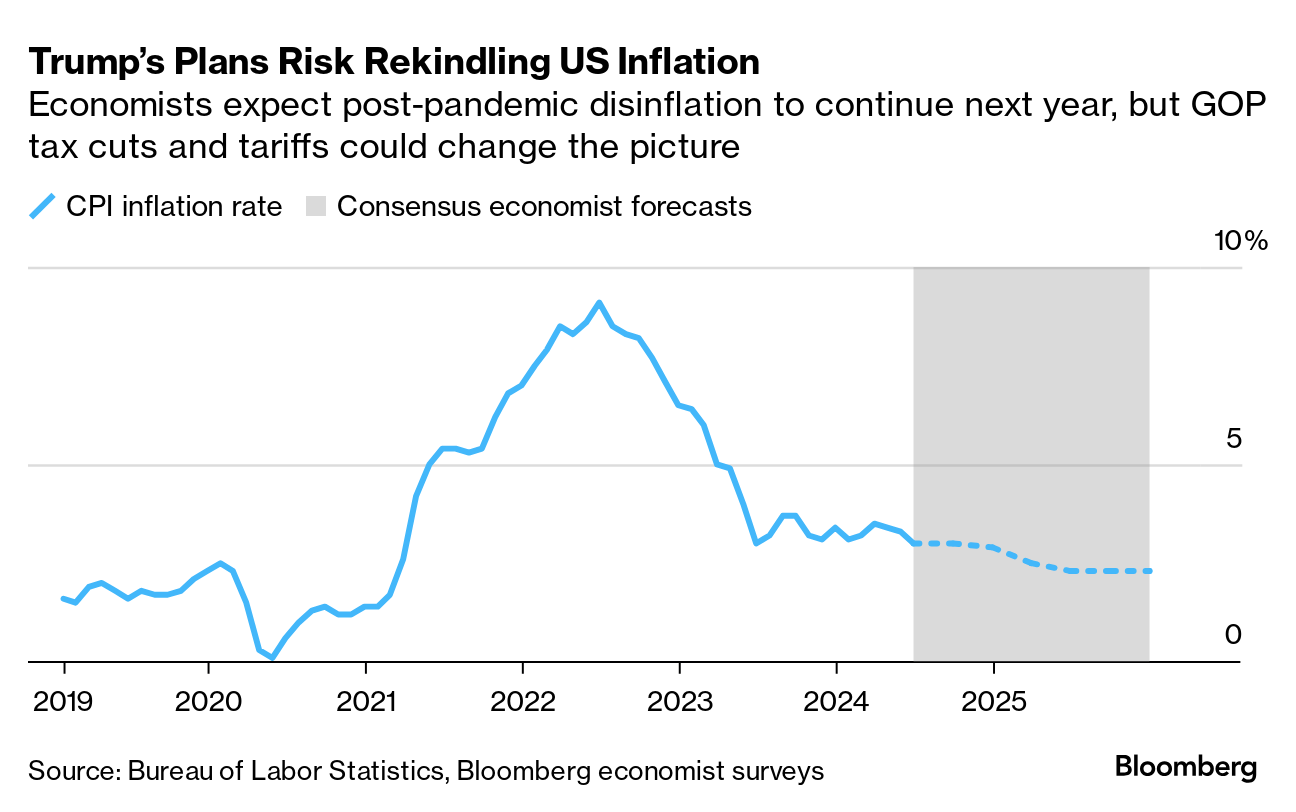

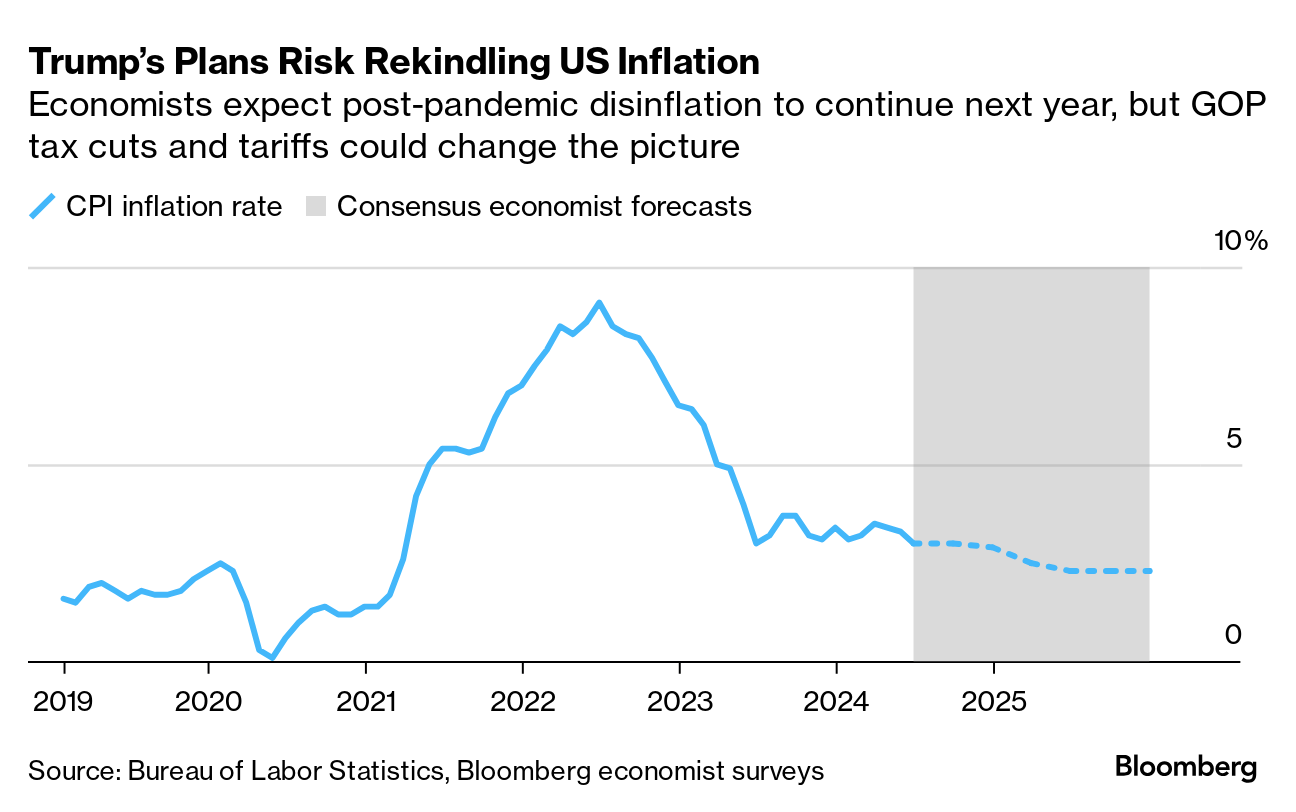

Fast forward to today, and the Republican economic agenda is spurring a slightly different narrative. A combination of further tax reductions, across-the-board tariff hikes and curbs on immigration is stoking the risk of inflation remaining at elevated rates — in turn spurring concerns about US fiscal sustainability.

The context has changed dramatically in eight years, of course, thanks to Covid and other crises that have unfolded since then. Federal Reserve policymakers have struggled to get US inflation rates back to 2%, and core measures remain closer to 3%. And debt has soared, to approximately 100% of US GDP, with the trajectory heading to record highs.

Now, "the worst outcome for markets is a Republican sweep" of both the White House and Congress, says Jeffrey Sherman, deputy chief investment officer at DoubleLine Capital.

It's ironic that while the Republican party platform pledges to "end inflation," economists see Trump's policies as adding to price pressures.

Trump's plan includes a reciprocal tariff strategy that risks tit-for-tat escalation not just with China, but allies as well. Further tax cuts, if unfunded, would deepen worries about giant US borrowing requirements — something that already started spooking investors last year.

And draconian curbs on immigrants risk arresting the labor-force growth that has helped to fill a record number of unfilled jobs in recent years, in turn keeping wage pressures lower than otherwise.

"On their face, the stated policies would bring at minimum a significant burst of inflation," said Julia Coronado, founder of MacroPolicy Perspectives and a former Fed economist.

That in turn could keep US interest rates higher for even longer. Padhraic Garvey, ING's Americas regional head of research, says "our longer-term projections with a more inflationary environment under a Trump presidency could lead to a 75 basis point higher neutral" rate for the Fed's benchmark.

Need-to-Know Research

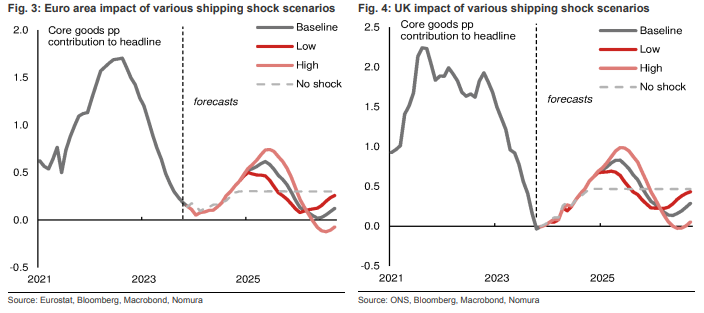

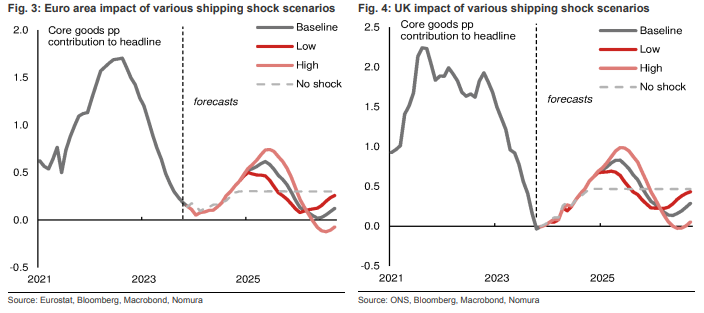

Central banks may have to cut interest rates more slowly than expected next year, for a reason that's not fully appreciated yet.

The culprit, according to Nomura: a three-month surge in the cost to transport merchandise around the world in containers.

"We think markets are underestimating the risk of rising shipping prices," Nomura economists George Moran, George Buckley, Andrzej Szczepaniak, David Seif wrote in research note published Wednesday. "Our model suggests there may be notable upward pressure on inflation."

How would container rates feed through to consumer inflation? With a delay, Nomura's economists calculated, citing the experience following the 2021-22 jump in shipping costs.

"During this time there was a lag between shipping prices and core goods inflation of 11 months for the UK and 14 months for the euro area," they wrote. "Out of all the European countries, Switzerland experienced the shortest lags of just nine months , so this may provide an early warning signal for the UK and euro area."

A policy platform of tax cuts and regulation rollback seemed tailor-made to juice economic growth. Stocks rose, and bond yields recovered from the record-low levels reached earlier in the year.

The context back then was an inflation rate well below 2%, and a government debt load of about 76% of GDP.

Fast forward to today, and the Republican economic agenda is spurring a slightly different narrative. A combination of further tax reductions, across-the-board tariff hikes and curbs on immigration is stoking the risk of inflation remaining at elevated rates — in turn spurring concerns about US fiscal sustainability.

The context has changed dramatically in eight years, of course, thanks to Covid and other crises that have unfolded since then. Federal Reserve policymakers have struggled to get US inflation rates back to 2%, and core measures remain closer to 3%. And debt has soared, to approximately 100% of US GDP, with the trajectory heading to record highs.

Now, "the worst outcome for markets is a Republican sweep" of both the White House and Congress, says Jeffrey Sherman, deputy chief investment officer at DoubleLine Capital.

It's ironic that while the Republican party platform pledges to "end inflation," economists see Trump's policies as adding to price pressures.

Trump's plan includes a reciprocal tariff strategy that risks tit-for-tat escalation not just with China, but allies as well. Further tax cuts, if unfunded, would deepen worries about giant US borrowing requirements — something that already started spooking investors last year.

And draconian curbs on immigrants risk arresting the labor-force growth that has helped to fill a record number of unfilled jobs in recent years, in turn keeping wage pressures lower than otherwise.

"On their face, the stated policies would bring at minimum a significant burst of inflation," said Julia Coronado, founder of MacroPolicy Perspectives and a former Fed economist.

That in turn could keep US interest rates higher for even longer. Padhraic Garvey, ING's Americas regional head of research, says "our longer-term projections with a more inflationary environment under a Trump presidency could lead to a 75 basis point higher neutral" rate for the Fed's benchmark.

Need-to-Know Research

Central banks may have to cut interest rates more slowly than expected next year, for a reason that's not fully appreciated yet.

The culprit, according to Nomura: a three-month surge in the cost to transport merchandise around the world in containers.

"We think markets are underestimating the risk of rising shipping prices," Nomura economists George Moran, George Buckley, Andrzej Szczepaniak, David Seif wrote in research note published Wednesday. "Our model suggests there may be notable upward pressure on inflation."

How would container rates feed through to consumer inflation? With a delay, Nomura's economists calculated, citing the experience following the 2021-22 jump in shipping costs.

"During this time there was a lag between shipping prices and core goods inflation of 11 months for the UK and 14 months for the euro area," they wrote. "Out of all the European countries, Switzerland experienced the shortest lags of just nine months , so this may provide an early warning signal for the UK and euro area."

No comments