Vacation vibes

Anyone who dislikes being pinned down about their plans after an upcoming

vacation might have picked up a familiar vibe from Christine Lagarde on

Thursday.

The European Central Bank president, on the verge of a long break between gatherings, was pointedly non-committal about what could transpire at the subsequent meeting on Sept. 12.

"The question of September and what we do in September is wide open and will be determined on the basis of all the data that we will be receiving," Lagarde told reporters quizzing her on the prospect of a cut in borrowing costs.

Christine Lagarde in Frankfurt on July 18. Photographer: Alex Kraus

Christine Lagarde in Frankfurt on July 18. Photographer: Alex Kraus

That vague response contrasts with just how specific she and her colleagues had been about the prospect for an interest-rate cut in June. Lagarde had first aired that idea as early as January.

The contrast in approach is deliberate of course. Behind the scenes, policymakers look back on their collective communication leading up to June as a bit of a tactical error.

They had made such a commitment to cut that they ended up having to do so despite the awkward backdrop of inflation having just quickened again.

Officials remain unsure about whether consumer-price growth is really as contained as it needs to be. Services inflation, in particular, failed to slow in June. At 4.1%, its pace is twice the overall goal targeted by the ECB.

As David Powell of Bloomberg Economics points out, restaurant bills make up almost a fifth of that increase, a far faster tempo than it did in the decade before the pandemic.

Read the full research on the Terminal

Such factors give policymakers pause for thought. While investors are almost fully pricing in two more rate cuts this year, officials are increasingly wondering if they may only be able to deliver one of those, according to people familiar with the matter.

Luckily for them, they have time to work it out — some of which could well be spent researching the matter at the region's beachside restaurants.

Ever since the ECB changed its calendar in 2015 to take fewer decisions each year, officials have had bigger pauses between them. This time round, the gap will be eight weeks — their longest summer break since the height of the pandemic in 2020.

Need-to-Know Research

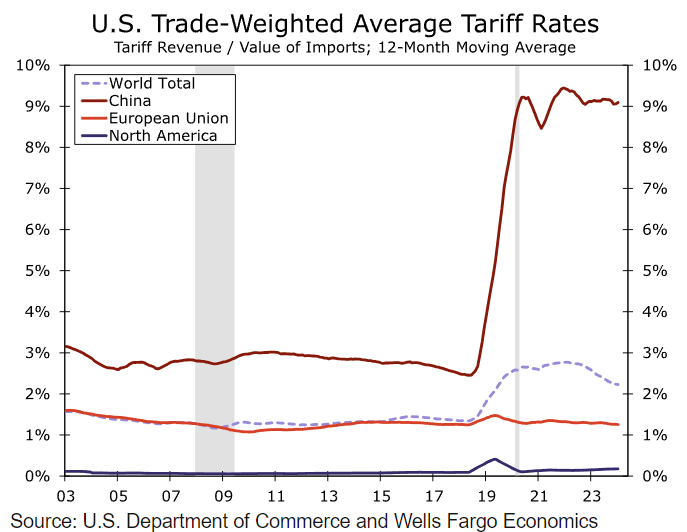

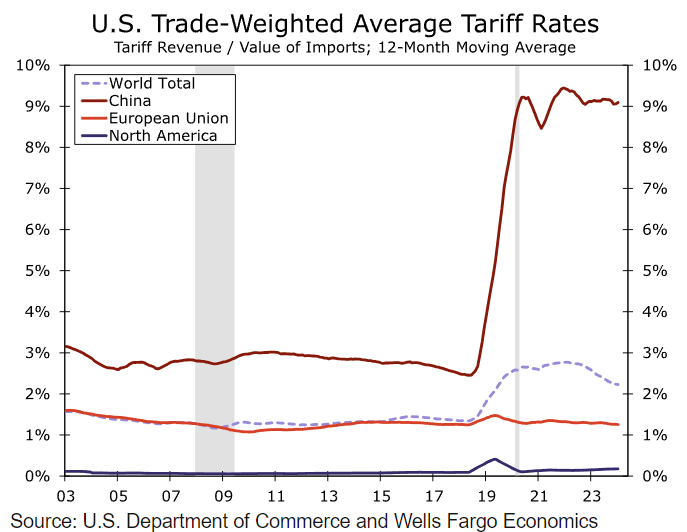

The US economy faces the danger of a contraction next year if Washington were to impose a 60% tariff on Chinese imports and a universal 10% levy on goods from other trading partners, according to calculations by Wells Fargo in a scenario that incorporates retaliation.

"Real GDP would contract by 0.4% in 2025" in the "Trump + retaliation" scenario, Wells Fargo economists Jay Bryson and Azhar Iqbal wrote in a note Thursday. They referred to Donald Trump campaign proposals for 60% China tariffs and a 10% universal tariff.

The jobless rate would climb to 4.8% by 2026, while core CPI inflation would top out at 4.3% in 2025, the Wells Fargo model suggests. "Higher prices erode growth in real income, which causes real GDP growth to slow, if not contract. The unemployment rate would rise. In short, the tariff increases would impart a modest stagflationary shock to the economy."

The European Central Bank president, on the verge of a long break between gatherings, was pointedly non-committal about what could transpire at the subsequent meeting on Sept. 12.

"The question of September and what we do in September is wide open and will be determined on the basis of all the data that we will be receiving," Lagarde told reporters quizzing her on the prospect of a cut in borrowing costs.

That vague response contrasts with just how specific she and her colleagues had been about the prospect for an interest-rate cut in June. Lagarde had first aired that idea as early as January.

The contrast in approach is deliberate of course. Behind the scenes, policymakers look back on their collective communication leading up to June as a bit of a tactical error.

They had made such a commitment to cut that they ended up having to do so despite the awkward backdrop of inflation having just quickened again.

Officials remain unsure about whether consumer-price growth is really as contained as it needs to be. Services inflation, in particular, failed to slow in June. At 4.1%, its pace is twice the overall goal targeted by the ECB.

As David Powell of Bloomberg Economics points out, restaurant bills make up almost a fifth of that increase, a far faster tempo than it did in the decade before the pandemic.

Read the full research on the Terminal

Such factors give policymakers pause for thought. While investors are almost fully pricing in two more rate cuts this year, officials are increasingly wondering if they may only be able to deliver one of those, according to people familiar with the matter.

Luckily for them, they have time to work it out — some of which could well be spent researching the matter at the region's beachside restaurants.

Ever since the ECB changed its calendar in 2015 to take fewer decisions each year, officials have had bigger pauses between them. This time round, the gap will be eight weeks — their longest summer break since the height of the pandemic in 2020.

Need-to-Know Research

The US economy faces the danger of a contraction next year if Washington were to impose a 60% tariff on Chinese imports and a universal 10% levy on goods from other trading partners, according to calculations by Wells Fargo in a scenario that incorporates retaliation.

"Real GDP would contract by 0.4% in 2025" in the "Trump + retaliation" scenario, Wells Fargo economists Jay Bryson and Azhar Iqbal wrote in a note Thursday. They referred to Donald Trump campaign proposals for 60% China tariffs and a 10% universal tariff.

The jobless rate would climb to 4.8% by 2026, while core CPI inflation would top out at 4.3% in 2025, the Wells Fargo model suggests. "Higher prices erode growth in real income, which causes real GDP growth to slow, if not contract. The unemployment rate would rise. In short, the tariff increases would impart a modest stagflationary shock to the economy."

No comments