Yellen and politics

Janet Yellen, arguably isn't a natural political operative. Trained as a labor economist, she served over a period of decades at the Federal Reserve, an independent agency that has an institutional bias toward staying out of partisan debates. As Treasury secretary, she's not specialized in politicking on Capitol Hill or taking the lead on legislative negotiations.

Nevertheless, in recent months Yellen has become a target of criticism from a number of Republicans who are aligned with former President Donald Trump. The topic over which she's being raked is wonky: the Treasury's strategy for funding the budget deficit.

But at a time of hyper-polarized politics, even the relatively obscure mechanics of US debt auctions are fair game.

There are two main thrusts of the argument that Yellen is playing politics with issuance. First, her team last November scaled back an increase in sales of longer-term securities. This was ostensibly to reduce long-term interest rates, which had climbed to the highest in more than a decade.

That in turn juiced the economy — something that helps Yellen's boss, President Joe Biden, as he seeks reelection against Trump in November.

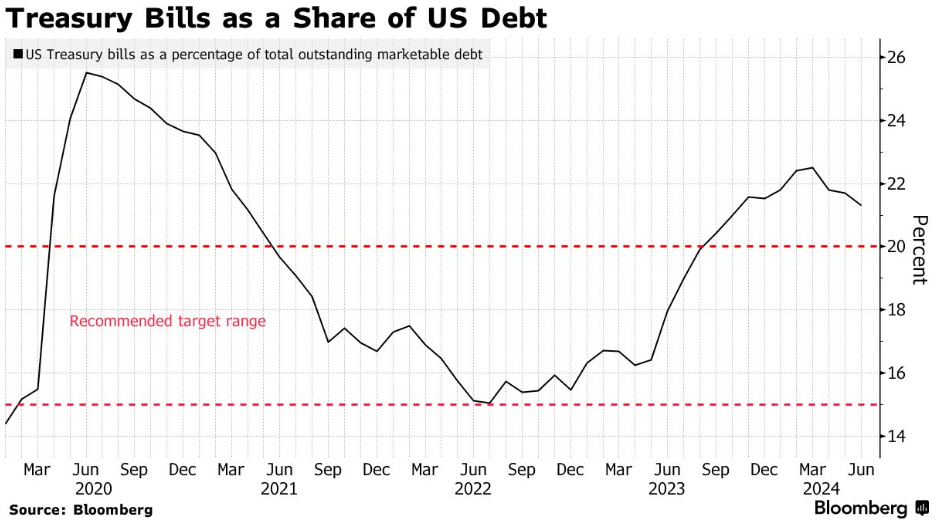

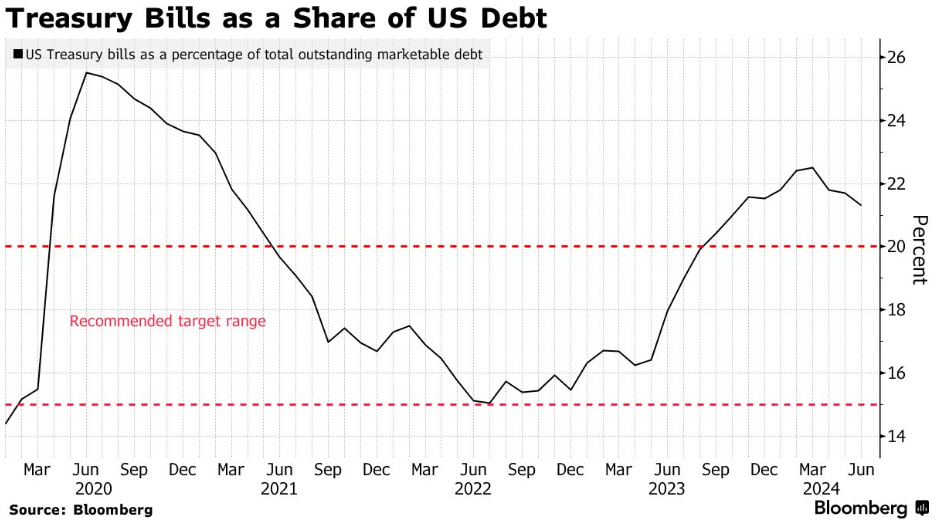

The second contention is that, by ramping up sales of short-dated securities — Treasury bills — Yellen's team is effectively boosting interest payments to savers. Money market funds invest in bills. More income means more room to spend, again boosting the economy and aiding Biden.

The roster of Republican critics includes GOP Senators Bill Hagerty and John Kennedy, along with Trump fundraiser Scott Bessent, a hedge-fund manager who outlined his objections against Yellen last month.

The Treasury's debt sales strategy was designed to create an economic "sugar high," Kennedy said to Yellen at a hearing last month. While the Fed was beavering away at trying to rein in inflation, "you're beavering away trying to increase it," he said.

Yellen's team appears to have taken the criticisms seriously enough that on Thursday the department deployed its top official in charge of overseeing debt issuance, Joshua Frost, to deliver the most extensive set of remarks on the subject by a policymaker in well over a decade.

Frost walked through in detail how the Treasury sets its strategy, and how the decisions made over the past several months are entirely in accord with the federal government's long-standing mantra of being "regular and predictable" in how it sells securities.

How effective his detailed speech will prove with Republican lawmakers remains to be seen. Meantime, the next quarterly announcement on Treasury debt-issuance strategy looms, on July 31.

Need-to-Know Research

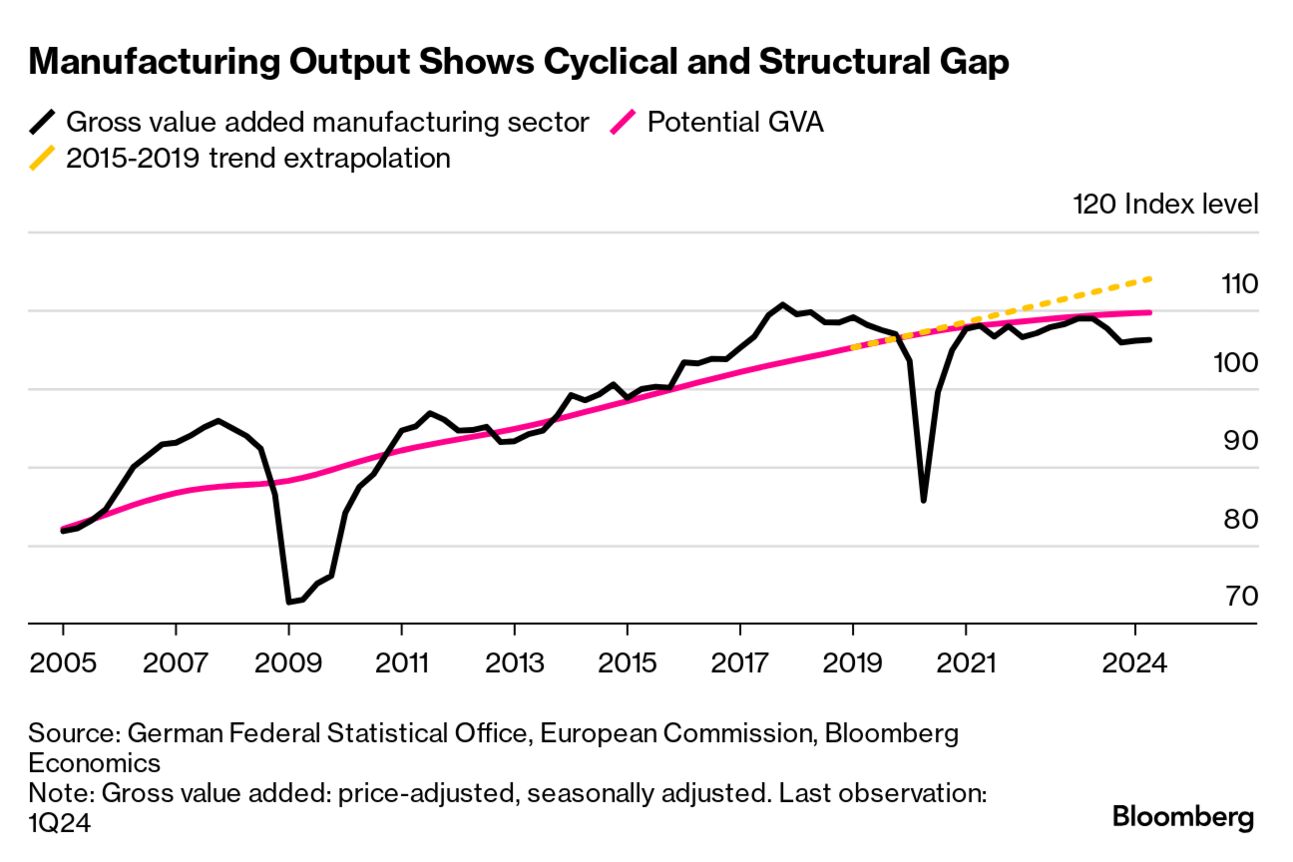

Germany's industrial sector has taken a permanent hit from its crisis in energy supply, Bloomberg Economics analysis shows.

The biggest European economy's reliance on Russian gas left it vulnerable when Russia invaded Ukraine, triggering major disruption to German supplies. BE analysis released Thursday suggested that half of an estimated 7% shortfall in industrial activity will persist.

"A cyclical industrial recovery is to be expected as monetary policy eases and demand returns," said Martin Ademmer at Bloomberg Economics. "But there'll be no return to pre-2019 norms — the sector appears to have taken a permanent hit."

Nevertheless, in recent months Yellen has become a target of criticism from a number of Republicans who are aligned with former President Donald Trump. The topic over which she's being raked is wonky: the Treasury's strategy for funding the budget deficit.

But at a time of hyper-polarized politics, even the relatively obscure mechanics of US debt auctions are fair game.

Janet Yellen. Photographer: Tierney L. Cross/Bloomberg

There are two main thrusts of the argument that Yellen is playing politics with issuance. First, her team last November scaled back an increase in sales of longer-term securities. This was ostensibly to reduce long-term interest rates, which had climbed to the highest in more than a decade.

That in turn juiced the economy — something that helps Yellen's boss, President Joe Biden, as he seeks reelection against Trump in November.

The second contention is that, by ramping up sales of short-dated securities — Treasury bills — Yellen's team is effectively boosting interest payments to savers. Money market funds invest in bills. More income means more room to spend, again boosting the economy and aiding Biden.

The roster of Republican critics includes GOP Senators Bill Hagerty and John Kennedy, along with Trump fundraiser Scott Bessent, a hedge-fund manager who outlined his objections against Yellen last month.

The Treasury's debt sales strategy was designed to create an economic "sugar high," Kennedy said to Yellen at a hearing last month. While the Fed was beavering away at trying to rein in inflation, "you're beavering away trying to increase it," he said.

Yellen's team appears to have taken the criticisms seriously enough that on Thursday the department deployed its top official in charge of overseeing debt issuance, Joshua Frost, to deliver the most extensive set of remarks on the subject by a policymaker in well over a decade.

Frost walked through in detail how the Treasury sets its strategy, and how the decisions made over the past several months are entirely in accord with the federal government's long-standing mantra of being "regular and predictable" in how it sells securities.

How effective his detailed speech will prove with Republican lawmakers remains to be seen. Meantime, the next quarterly announcement on Treasury debt-issuance strategy looms, on July 31.

Need-to-Know Research

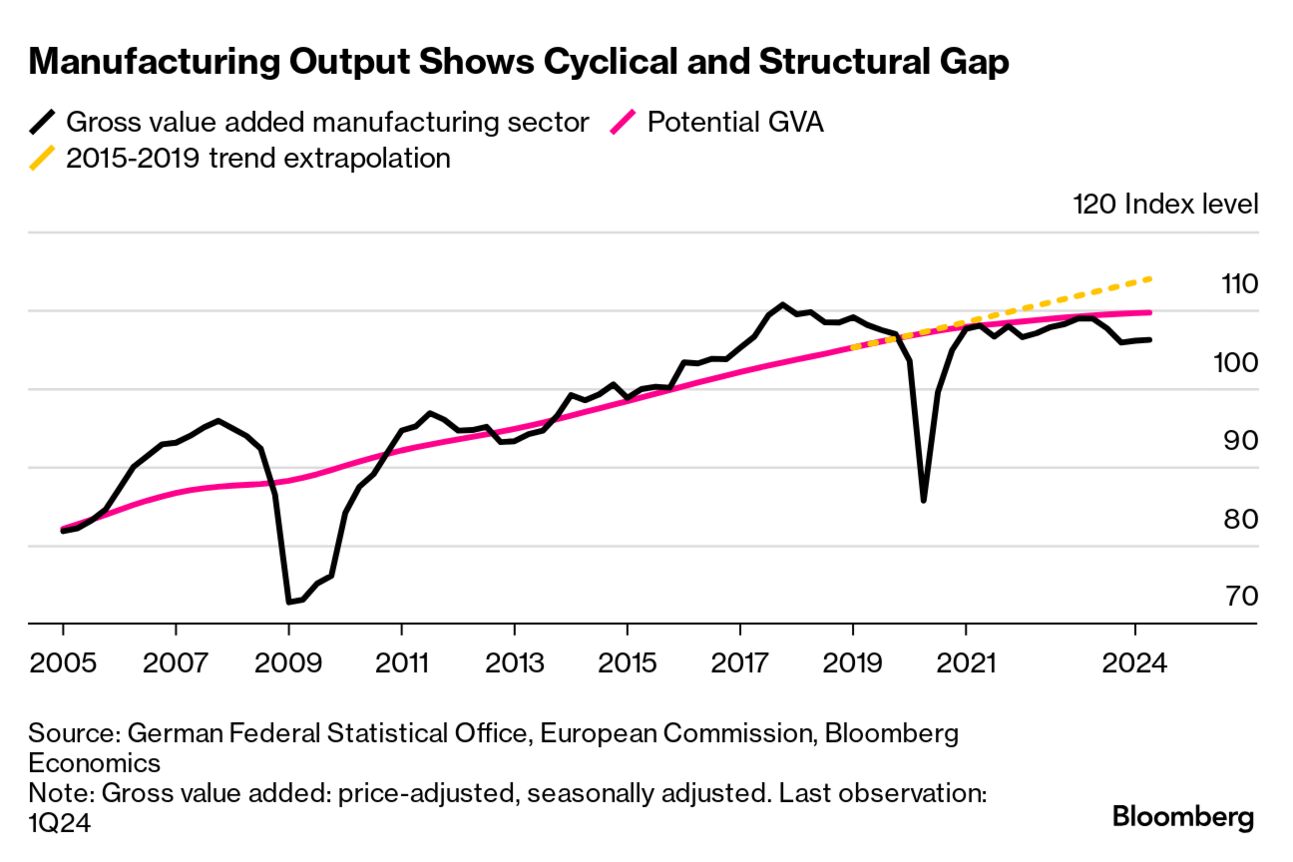

Germany's industrial sector has taken a permanent hit from its crisis in energy supply, Bloomberg Economics analysis shows.

The biggest European economy's reliance on Russian gas left it vulnerable when Russia invaded Ukraine, triggering major disruption to German supplies. BE analysis released Thursday suggested that half of an estimated 7% shortfall in industrial activity will persist.

"A cyclical industrial recovery is to be expected as monetary policy eases and demand returns," said Martin Ademmer at Bloomberg Economics. "But there'll be no return to pre-2019 norms — the sector appears to have taken a permanent hit."

No comments