Houthis' shipping impact

The conflict between Yemen's Houthis and Israel escalated even more in recent days after the militant group struck Tel Aviv, and Israel retaliated by hitting targets near the port of Hodeidah.

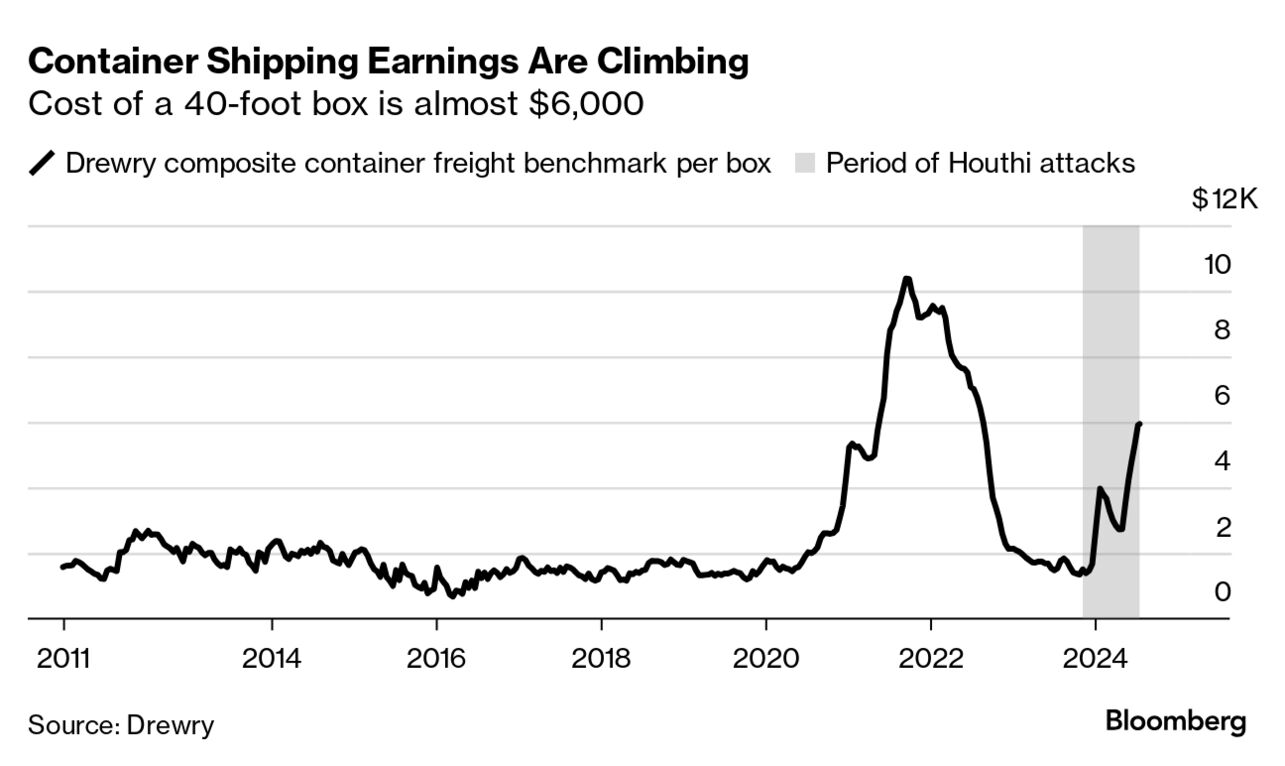

In some corners of shipping markets, the cost of transporting goods continues to spiral.

Rates for the containers that haul everything from TVs to toys are at levels that would be considered eye-opening at any time other than during the post-2020 bout of inflation. From just $1,660 at the end of last year, a 40-foot steel box now costs almost $6,000 to move.

Other sectors are feeling the effects, too, with a host of crude oil tankers finding new lines of business carrying fuel. That switch comes as refined product ships earn more because the Houthi-induced diversion around Africa stretches the fleet.

There's little sign of those freight-boosting disruptions easing.

The Houthis recently embarked on sea drone attacks to damage vessels, and at times swarm ships with multiple methods of assault.

A recent UK Navy update portrayed a grim account of one ship being targeted five times in five hours as it traveled through the Red Sea. Two security analysts described those attacks as normal, pointing to others that have endured a similar fury.

In addition to risking the lives of vulnerable sailors, the attacks also tempt environmental disaster, with a stark reminder from a large oil slick that appeared in the Red Sea last week.

All the while, oil prices remain stuck in a range. While a handful of traders recently purchased some bullish call options that would profit from a spike back toward $100, market volatility is low and there's little concern about the impact on the commodity itself.

That's in stark contrast with shipping markets, though, where earnings remain high, and the repercussions for the cost of goods may soon return.

--Verity Ratcliffe and Alex Longley, Bloomberg News

Chart of the day

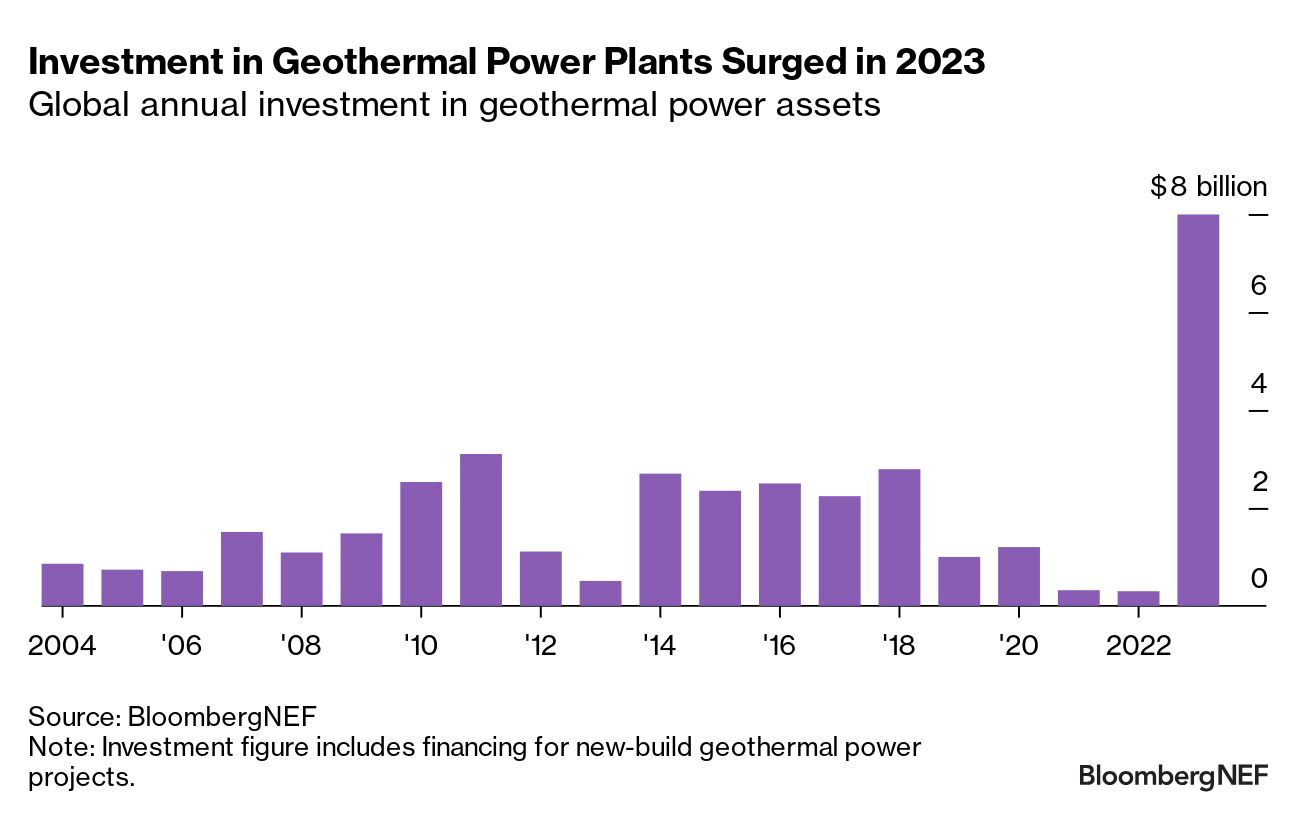

Global geothermal investment has soared, signaling a resurgence of interest in this long-overlooked sector. Data from BloombergNEF shows a 25-fold year-on-year increase in spending to $8 billion in 2023. However, that's still short of what's needed for the sector to reach its full potential and is only a fraction compared with other renewables. Last year's spending is equivalent to just 2% of the investments in solar and 3.6% of those in wind. BNEF sees global geothermal power capacity reaching 33 gigawatts by 2030.

In some corners of shipping markets, the cost of transporting goods continues to spiral.

Rates for the containers that haul everything from TVs to toys are at levels that would be considered eye-opening at any time other than during the post-2020 bout of inflation. From just $1,660 at the end of last year, a 40-foot steel box now costs almost $6,000 to move.

Other sectors are feeling the effects, too, with a host of crude oil tankers finding new lines of business carrying fuel. That switch comes as refined product ships earn more because the Houthi-induced diversion around Africa stretches the fleet.

There's little sign of those freight-boosting disruptions easing.

|

| Mashadifx |

The Houthis recently embarked on sea drone attacks to damage vessels, and at times swarm ships with multiple methods of assault.

A recent UK Navy update portrayed a grim account of one ship being targeted five times in five hours as it traveled through the Red Sea. Two security analysts described those attacks as normal, pointing to others that have endured a similar fury.

In addition to risking the lives of vulnerable sailors, the attacks also tempt environmental disaster, with a stark reminder from a large oil slick that appeared in the Red Sea last week.

All the while, oil prices remain stuck in a range. While a handful of traders recently purchased some bullish call options that would profit from a spike back toward $100, market volatility is low and there's little concern about the impact on the commodity itself.

That's in stark contrast with shipping markets, though, where earnings remain high, and the repercussions for the cost of goods may soon return.

--Verity Ratcliffe and Alex Longley, Bloomberg News

Chart of the day

|

| Bloomberg |

Global geothermal investment has soared, signaling a resurgence of interest in this long-overlooked sector. Data from BloombergNEF shows a 25-fold year-on-year increase in spending to $8 billion in 2023. However, that's still short of what's needed for the sector to reach its full potential and is only a fraction compared with other renewables. Last year's spending is equivalent to just 2% of the investments in solar and 3.6% of those in wind. BNEF sees global geothermal power capacity reaching 33 gigawatts by 2030.

No comments