Fast and furious’ tariffs

The possibility that former President Donald Trump could win a second term has spurred China watchers to map out potential consequences for the world's No. 2 economy: in particular, what happens if the Republican and his adjutants choose to launch another, more powerful trade war.

The likelihood of a new round of mercantilist measures only increased after Trump picked as his running mate JD Vance, a far-right US senator who has bluntly proclaimed, "I don't like China." Sarah Bianchi, chief strategist of international political affairs at Evercore ISI, said her assumption is that tariff increases, and other steps, will come "fast and furious" if Trump defeats President Joe Biden.

Under one scenario, economists at Goldman Sachs calculate a roughly 2 percentage-point hit to China's GDP from a 60% US tariff. Their counterparts at UBS this week tallied a 2.5 percentage-point wallop to growth over a year. (As for the US, Wells Fargo warned that a full-blown tariff war could see a drop in US GDP—along with an inflation bump, as discussed Thursday in Bloomberg's Economics Daily.)

The broader takeaway: a draconian tariff move by Trump "would mean a hard-decoupling" between the US and China, says Da Wei, an expert on Sino-American relations at Beijing's Tsingua University. And that would dramatically accelerate the emerging fragmentation of the world into blocs, as the International Monetary Fund recently warned.

Chinese leader Xi Jinping Photographer: Kevin Frayer/Getty Images

Chinese leader Xi Jinping Photographer: Kevin Frayer/Getty Images

This week in the New Economy

There are a number of reasons why a major tariff hike on China is likely under Trump—and not just campaign-trail bluster by the 78-year-old real estate developer.

Yanmei Xie at Gavekal Research says the perception in Washington is that the first trade war, launched by Trump in 2018, didn't leave the US unduly damaged. While there were plenty of negative warnings at the time, there was no noticeable surge in inflation, nor a hit to employment or financial markets. So "resistance is low" to more action.

Biden's maintenance of existing tariffs after he took office, and the addition of his own targeted measures, only work to incentivize a further, hawkish move from Trump, said Tobin Marcus and Chutong Zhu at Wolfe Research. To appear tougher on China, the Republicans would need to go further.

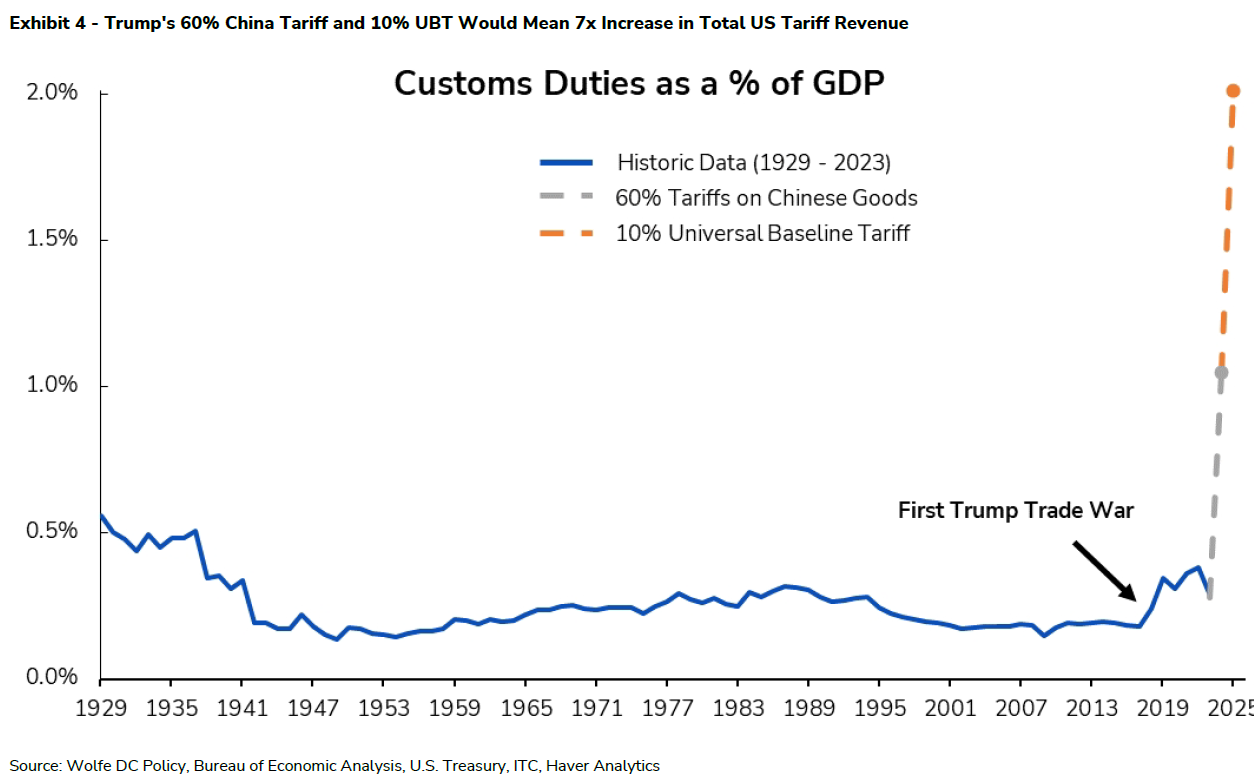

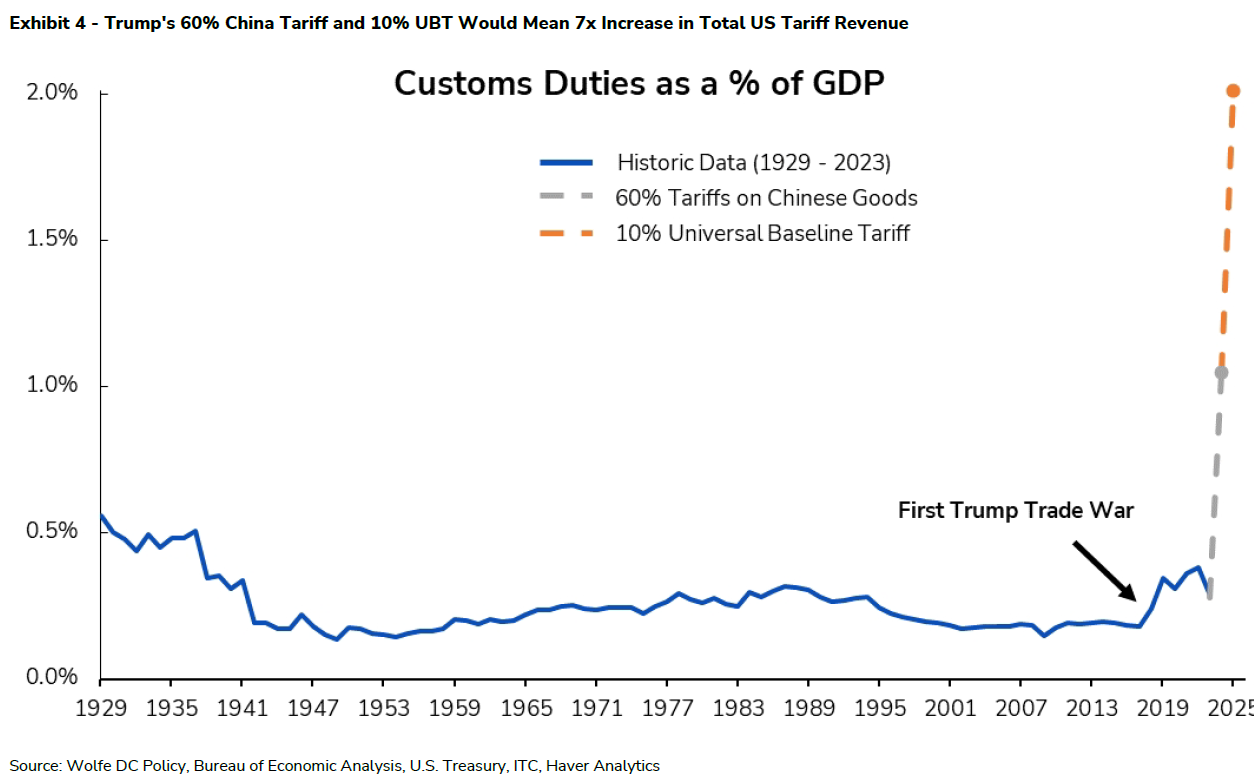

Also, Trump's pledge of further tax cuts would leave Republicans looking for alternative sources of revenue. Tariffs would offer that. Bottom line: "is this a real threat? We think so," Marcus and Zhu wrote in a note to clients last month.

What exactly would Trump impose? Unclear. While he's suggested a 60% tariff rate, he declined to endorse that figure in an interview published this week in Bloomberg Businessweek. "I had it at 50% and I've never heard the 60," he said, in remarks that left analysts puzzled as to what exactly Trump meant.

A full 60% tariff on all Chinese imports, combined with the 10% universal baseline tariff on all other nations that Trump's team also proposed, would leave the US weighted average tariff rate at nearly 17%, the highest since the Smoot-Hawley era of the 1930s, according to Bianchi, who worked at the US Trade Representative's office in the Biden administration.

In the interview, Trump claimed tariffs offer Washington leverage. "Man, is it good for negotiation," he said. Which also raises the potential for some kind of deal, something Trump has claimed to be good at.

Trump decried the cheap exchange rates that China (and Japan) have enjoyed, which he credited for building up their manufacturing competitiveness.

Could some bargain on overhauling exchange rates avert tariff hikes? Some observes don't rule it out. That's what happened in 1985, with the Plaza Accord, when the US, Japan, Germany, France and the UK agreed to a coordinated effort to drive down the dollar against its major counterparts at the time. Today, China (and Japan) have already been intervening in various ways to prop up their currencies and in effect stem dollar gains.

Still, there are a raft of operational challenges to such an agreement, as Goldman strategists including Isabella Rosenberg detailed in a July 12 report. Also, "because the US is a large, relatively insulated economy that trades almost exclusively in its own currency," a cheaper dollar exchange rate wouldn't be a whole lot of help, they wrote.

Trump, in his Republican National Convention speech Thursday, separately indicated he had little problem if Chinese companies set up operations in the US. "The way they will sell their product in America is to build it in America, very simple," he said. "Build it in America and only in America."

The floor of a Fuyao Glass America production facility in Moraine, Ohio Photographer: Ty Wright

In the 1990s, Japan avoided big tariff hikes from the Clinton administration by having its automakers move substantial production to the US. A possible template? Don't count on it—in part because, again, Republicans will have the incentive to hunt for revenues to offset tax cuts, cuts which the Biden administration has warned will yet again benefit only the rich and corporations.

If even 30% tariffs ended up getting levied on China, it would be deeply damaging, Da, the director of Tsinghua's Center for International Security and Strategy, said in an interview earlier this year.

"China-US relations would free-fall again," he said, adding that bilateral trade could collapse to $100 billion or less. Last year, the two nations logged $575 billion of direct trade between each other. Freefall, indeed. —Chris Anstey

The likelihood of a new round of mercantilist measures only increased after Trump picked as his running mate JD Vance, a far-right US senator who has bluntly proclaimed, "I don't like China." Sarah Bianchi, chief strategist of international political affairs at Evercore ISI, said her assumption is that tariff increases, and other steps, will come "fast and furious" if Trump defeats President Joe Biden.

Under one scenario, economists at Goldman Sachs calculate a roughly 2 percentage-point hit to China's GDP from a 60% US tariff. Their counterparts at UBS this week tallied a 2.5 percentage-point wallop to growth over a year. (As for the US, Wells Fargo warned that a full-blown tariff war could see a drop in US GDP—along with an inflation bump, as discussed Thursday in Bloomberg's Economics Daily.)

The broader takeaway: a draconian tariff move by Trump "would mean a hard-decoupling" between the US and China, says Da Wei, an expert on Sino-American relations at Beijing's Tsingua University. And that would dramatically accelerate the emerging fragmentation of the world into blocs, as the International Monetary Fund recently warned.

This week in the New Economy

There are a number of reasons why a major tariff hike on China is likely under Trump—and not just campaign-trail bluster by the 78-year-old real estate developer.

Yanmei Xie at Gavekal Research says the perception in Washington is that the first trade war, launched by Trump in 2018, didn't leave the US unduly damaged. While there were plenty of negative warnings at the time, there was no noticeable surge in inflation, nor a hit to employment or financial markets. So "resistance is low" to more action.

Biden's maintenance of existing tariffs after he took office, and the addition of his own targeted measures, only work to incentivize a further, hawkish move from Trump, said Tobin Marcus and Chutong Zhu at Wolfe Research. To appear tougher on China, the Republicans would need to go further.

Also, Trump's pledge of further tax cuts would leave Republicans looking for alternative sources of revenue. Tariffs would offer that. Bottom line: "is this a real threat? We think so," Marcus and Zhu wrote in a note to clients last month.

What exactly would Trump impose? Unclear. While he's suggested a 60% tariff rate, he declined to endorse that figure in an interview published this week in Bloomberg Businessweek. "I had it at 50% and I've never heard the 60," he said, in remarks that left analysts puzzled as to what exactly Trump meant.

A full 60% tariff on all Chinese imports, combined with the 10% universal baseline tariff on all other nations that Trump's team also proposed, would leave the US weighted average tariff rate at nearly 17%, the highest since the Smoot-Hawley era of the 1930s, according to Bianchi, who worked at the US Trade Representative's office in the Biden administration.

In the interview, Trump claimed tariffs offer Washington leverage. "Man, is it good for negotiation," he said. Which also raises the potential for some kind of deal, something Trump has claimed to be good at.

Trump decried the cheap exchange rates that China (and Japan) have enjoyed, which he credited for building up their manufacturing competitiveness.

Could some bargain on overhauling exchange rates avert tariff hikes? Some observes don't rule it out. That's what happened in 1985, with the Plaza Accord, when the US, Japan, Germany, France and the UK agreed to a coordinated effort to drive down the dollar against its major counterparts at the time. Today, China (and Japan) have already been intervening in various ways to prop up their currencies and in effect stem dollar gains.

Still, there are a raft of operational challenges to such an agreement, as Goldman strategists including Isabella Rosenberg detailed in a July 12 report. Also, "because the US is a large, relatively insulated economy that trades almost exclusively in its own currency," a cheaper dollar exchange rate wouldn't be a whole lot of help, they wrote.

Trump, in his Republican National Convention speech Thursday, separately indicated he had little problem if Chinese companies set up operations in the US. "The way they will sell their product in America is to build it in America, very simple," he said. "Build it in America and only in America."

The floor of a Fuyao Glass America production facility in Moraine, Ohio Photographer: Ty Wright

In the 1990s, Japan avoided big tariff hikes from the Clinton administration by having its automakers move substantial production to the US. A possible template? Don't count on it—in part because, again, Republicans will have the incentive to hunt for revenues to offset tax cuts, cuts which the Biden administration has warned will yet again benefit only the rich and corporations.

If even 30% tariffs ended up getting levied on China, it would be deeply damaging, Da, the director of Tsinghua's Center for International Security and Strategy, said in an interview earlier this year.

"China-US relations would free-fall again," he said, adding that bilateral trade could collapse to $100 billion or less. Last year, the two nations logged $575 billion of direct trade between each other. Freefall, indeed. —Chris Anstey

No comments